India’s informal sector makes up a significant portion of the country’s workforce ~43% and provides employment opportunities for millions, especially those from the marginalized communities.�

However, despite its huge contribution to the economy, the informal sector operates without formal recognition. Currently only ~16% of all MSMEs have access to formal credit, creating a huge credit demand for working capital and capacity building support. This gap is further exacerbated for women, with 92.1% of women-owned MSMEs being unregistered / informal, and are therefore unable to access formal finance.�

As majority of the micro enterprises are either New to Credit (NTC) or New to Income(NTI), they are not deemed to be creditworthy, and are considered �high-risk customers� by formal lending institutions (LIs).�

This lack of support leaves individuals vulnerable to economic shocks, hindering their growth and preventing them from realizing their full potential.

Informal workers, including micro-entrepreneurs, have a huge potential to contribute to India’s economic growth, social progress, inclusive growth, and reduced poverty.

The REVIVE Alliance: A Catalyst for Change

Over 80% of solo, nano and micro entrepreneurs are either NTI, NTC, or New to Formal Credit (NTFC), have not completed basic KYC, GST, and other formalization activities, and do not have access to diverse markets.�

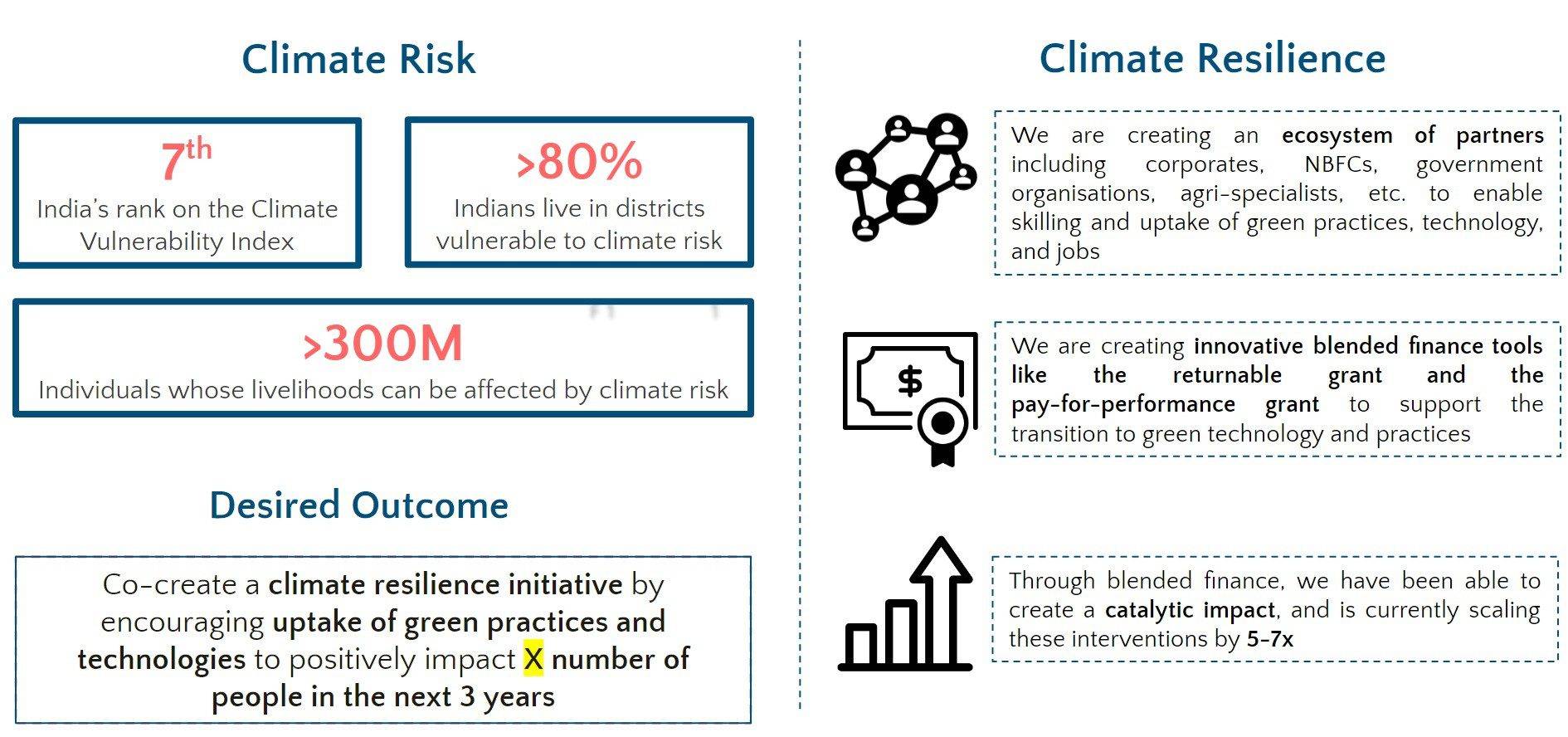

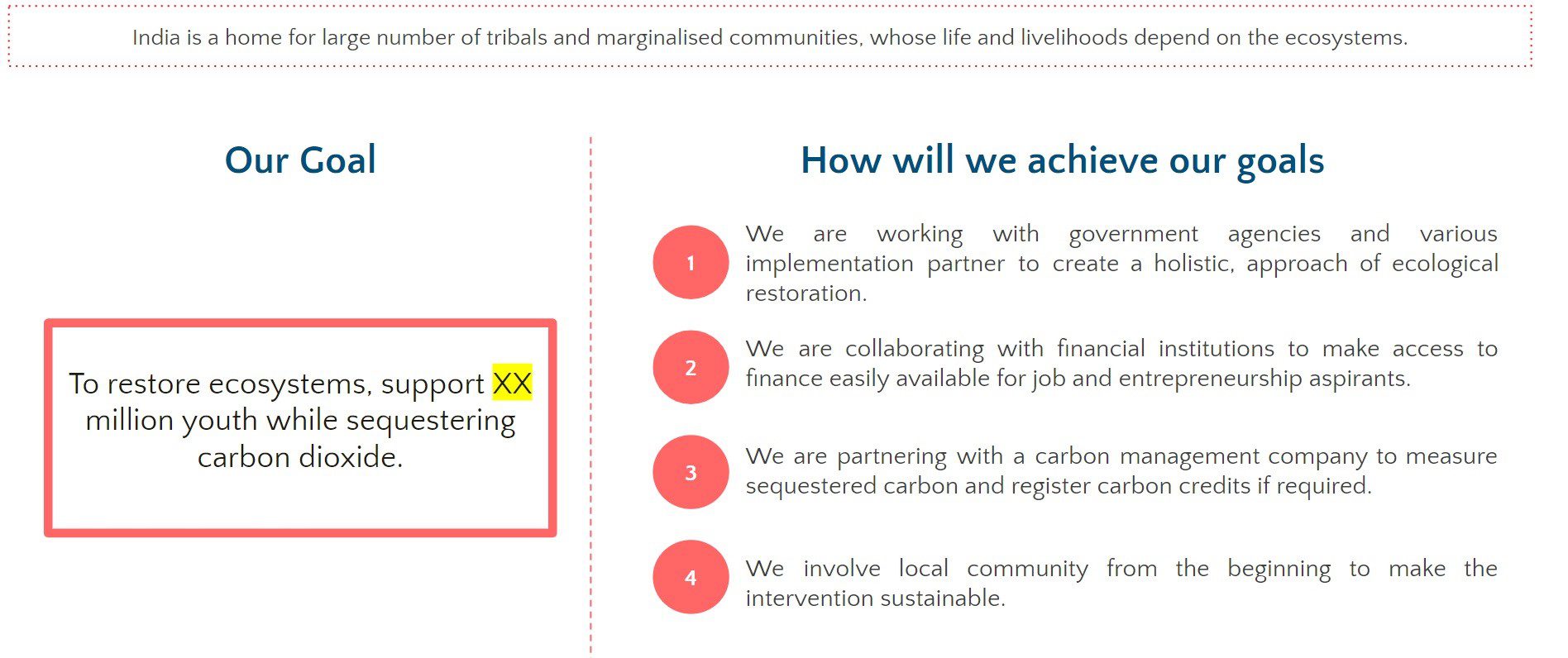

This shows the dire need for support from the private, philanthropic, financial and public sectors to band together to bridge this credit gap, and enable the rapid formalization and growth of these entrepreneurs.�

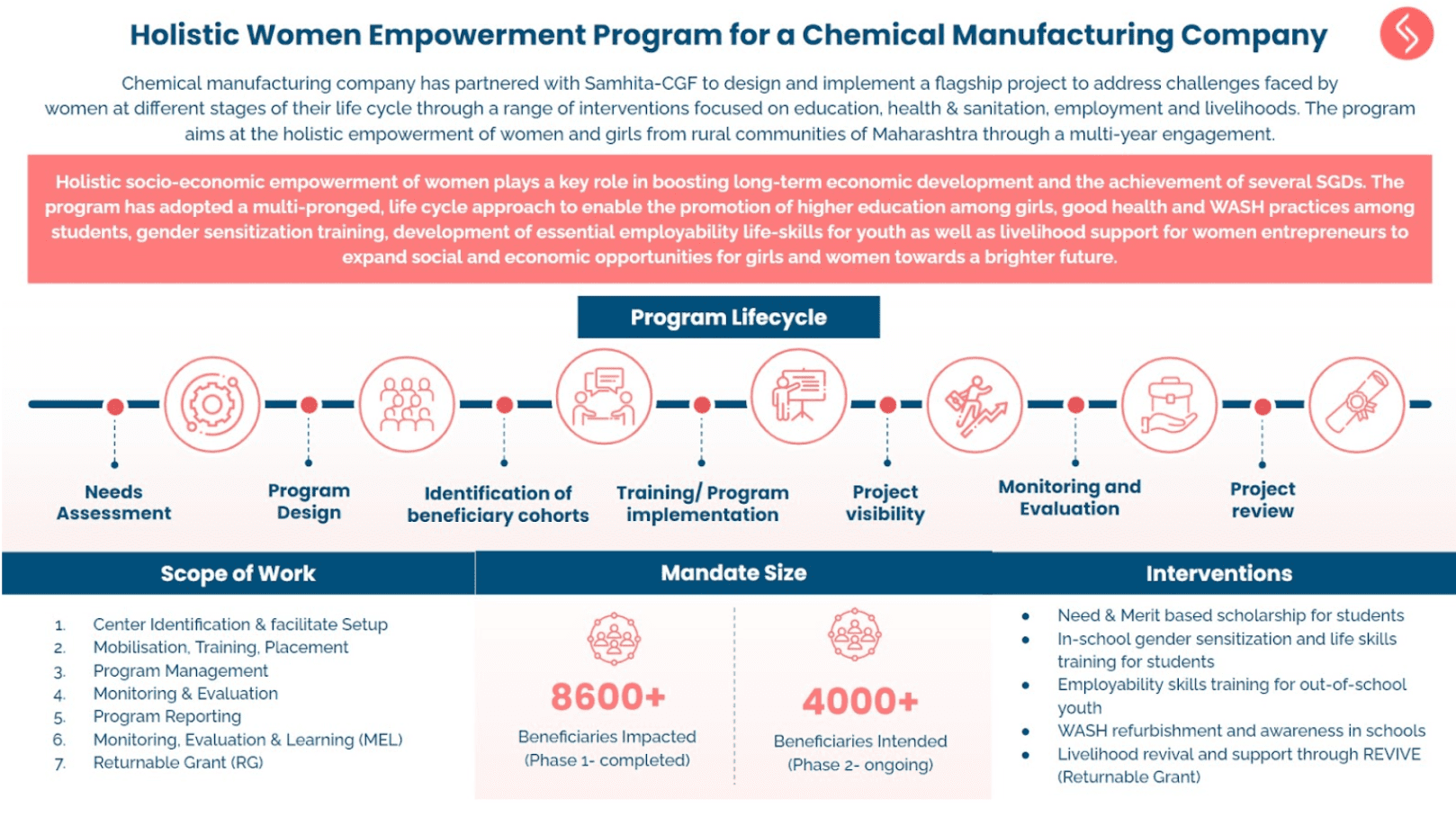

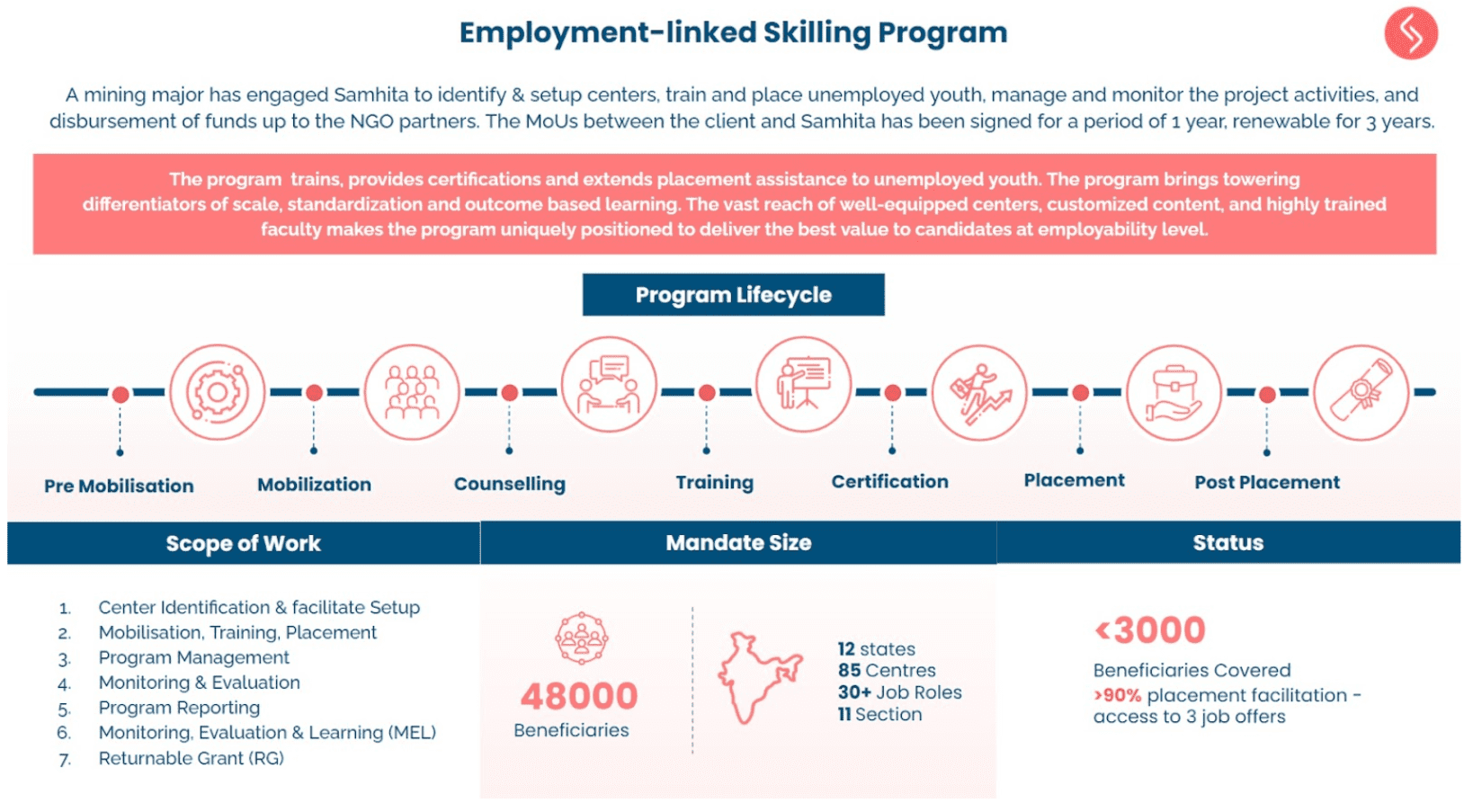

To support these efforts, Samhita-CGF founded the REVIVE Alliance, a collaborative platform that aims to increase incomes, improve livelihood opportunities, and enable the formalization of micro-entrepreneurs, making them more resilient to potential future shocks.

Through a multi-year, multi-intervention approach, REVIVE addresses critical challenges faced by informal workers, providing them with comprehensive support across 5 key interventions.

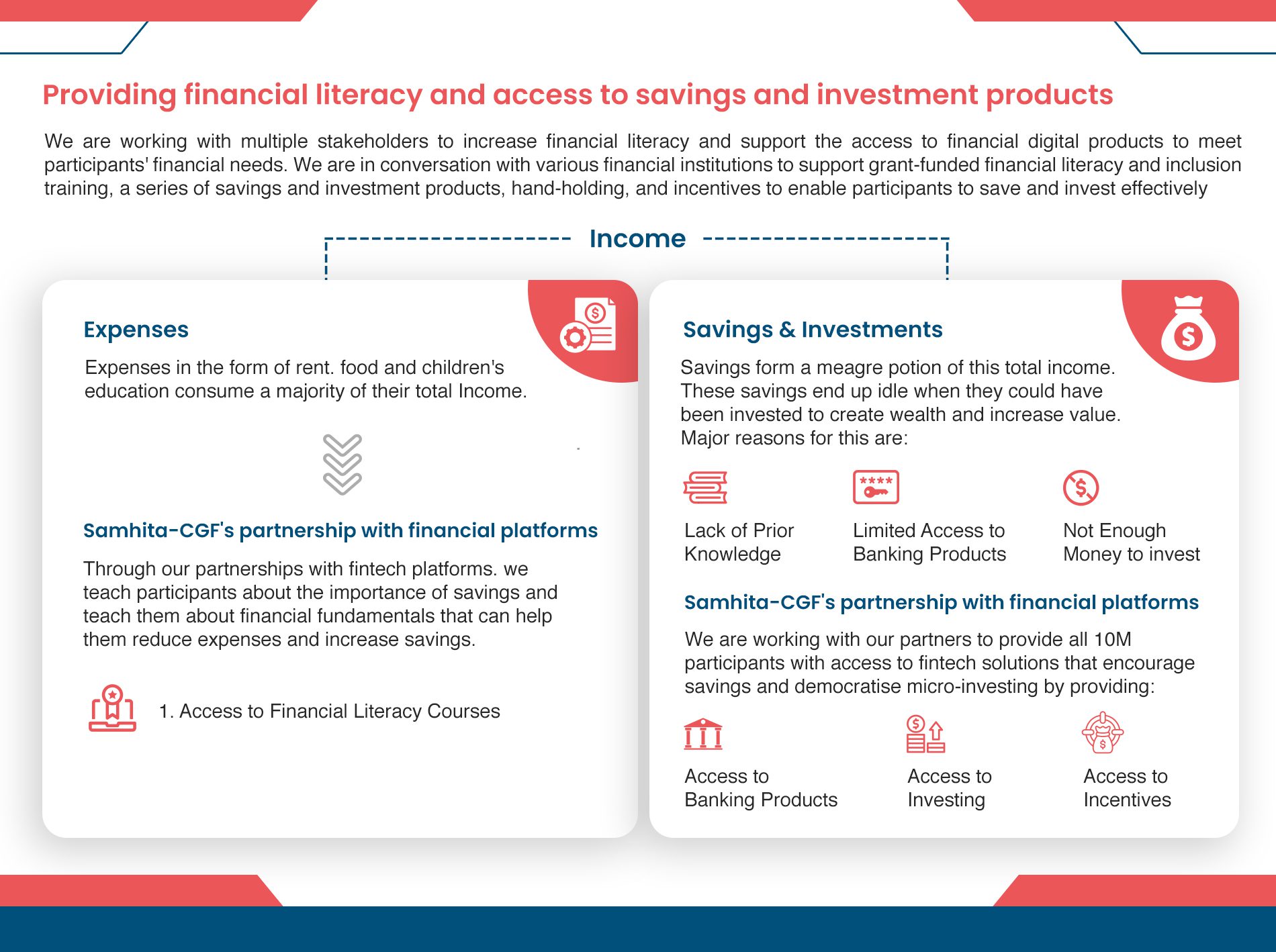

� � �1 . Financial Literacy and Inclusion

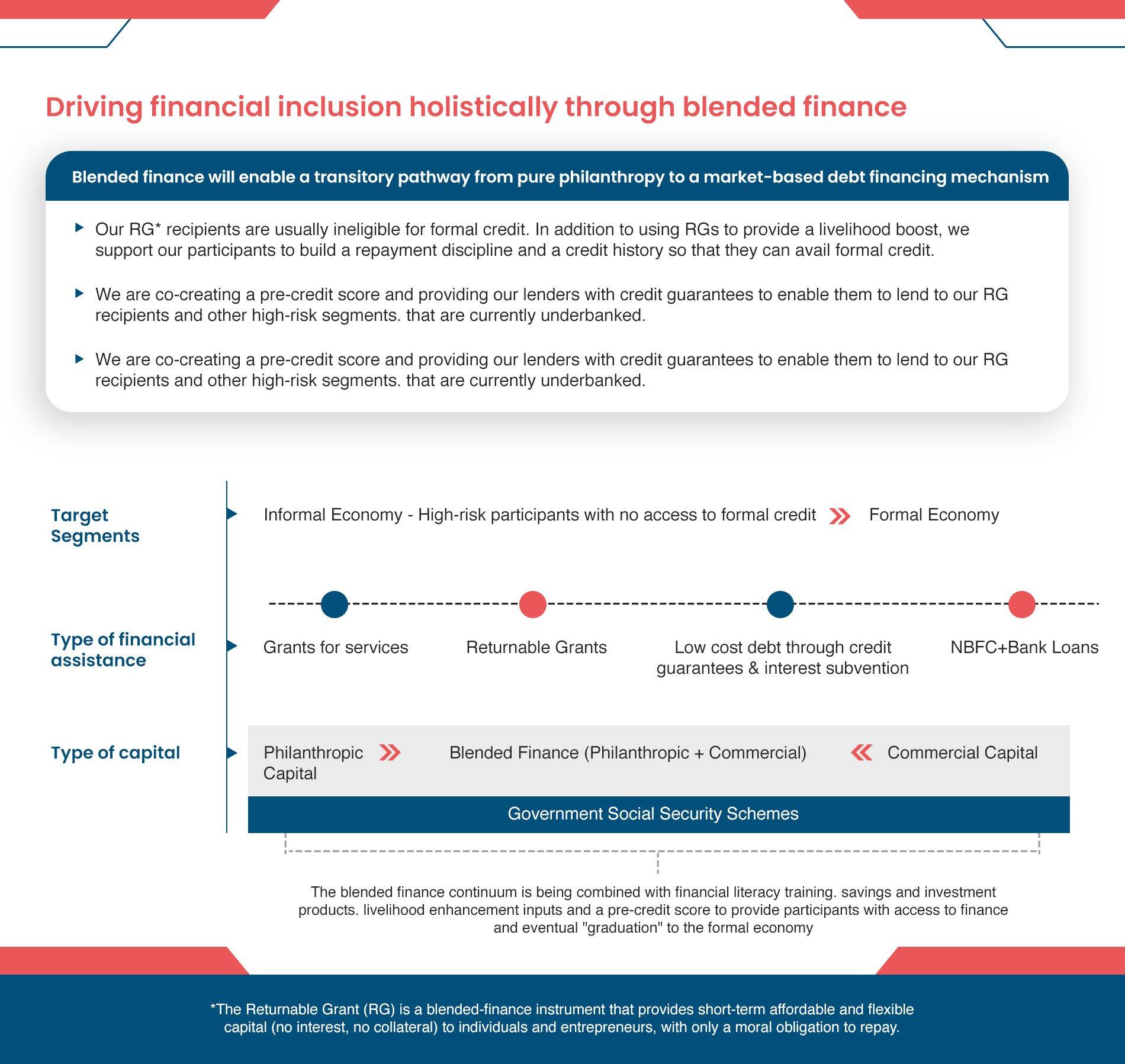

REVIVE focuses on enhancing financial literacy, facilitating access to formal credit through the Returnable Grant, as well as offering savings and investment support.�

Training programs and workshops are conducted to enhance financial literacy and promote savings habits. Additionally, REVIVE collaborates with financial institutions to facilitate access to formal credit and capital, catalyzed by the Returnable Grant that facilitates a graduation model.�

By enabling participants to navigate the financial landscape, REVIVE paves the way for financial inclusion and improved financial stability.�

� � �2. Skills Development and Job Progression

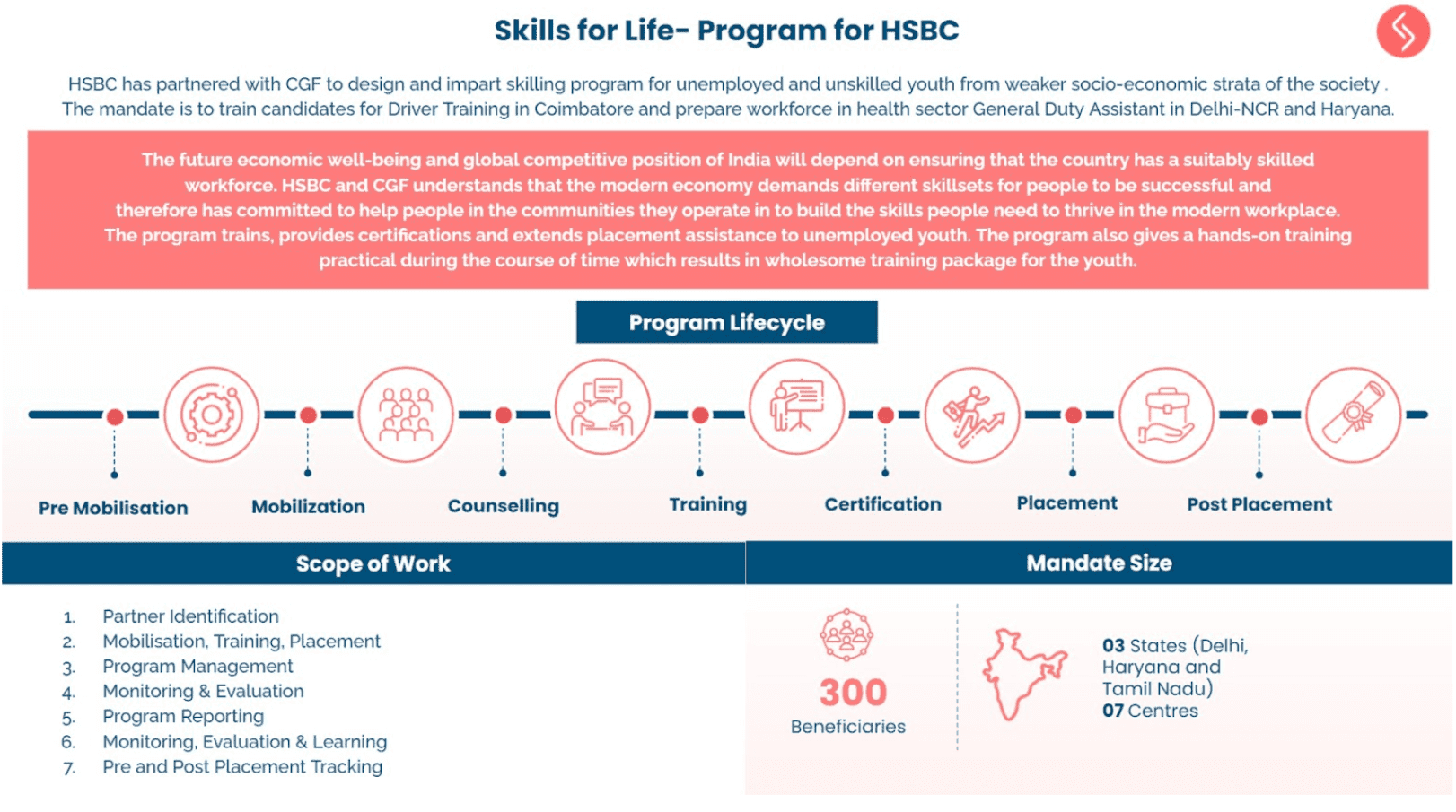

Limited skills and job opportunities often result in low wages for informal sector workers. REVIVE addresses this challenge by offering skill development programs that upskill / reskill job seekers and entrepreneurs.�

By partnering with training institutions, sector skills councils, and industry experts, REVIVE is able to deliver skilling programs to enhance technical and management skills, as well as entrepreneurial capabilities.

� � �

3. Enterprise Strengthening and Market Linkages

REVIVE aims to bridge this gap by providing enterprise development support and facilitating market linkages, so as to bridge the network gap and equip micro-entrepreneurs with the resources they need to thrive.�

Through these connections, micro-entrepreneurs are able to scale their businesses and expand their customer base.

� � �

� � �4. Digital Empowerment

REVIVE bridges the digital-divide through digital literacy and empowering participants with the necessary digital skills, covering topics like digital safety, financial tools as well as platforms that can help them with employment opportunities.��

� � �5. Social Protection

REVIVE unlocks government schemes and facilitates access to affordable healthcare, insurance, pension schemes, trade-specific benefits and other social security benefits that provide a safety net for informal sector workers for income security and protection against unforeseen risks.

Fostering an Enabling Environment

REVIVE brings together a whole ecosystem of players – the government, corporates,, foundations, financial institutions, nonprofits, and other such stakeholders to create an enabling environment.�

Blended finance tools, such as the Returnable Grant, play a crucial role in providing NTC and NTI workers with access to capital on favorable terms, allowing them to invest in their businesses, scale their operations, skilling, get formal loans, etc.�

Through the co-creation of public goods, such as a pre-credit score, REVIVE aims to enable micro-entrepreneurs to access formal finance easily. The pre-credit score, backed by a credit guarantee, can be used by financial institutions to offer credit to first time borrowers, acting as a proxy for credit ratings and proof of ability to repay.

Impact and Potential for Scale

The REVIVE Alliance has the potential to create a transformative impact on the lives of millions of informal workers. By enhancing their livelihoods through improving access to finance, and enabling skills development, REVIVE aims to uplift micro-entrepreneurs and drive socio-economic progress.�

The ripple effect it can create extends beyond the immediate participants, positively impacting their families and communities.

With an initial target of impacting 10 million individuals, the REVIVE Alliance aims to scale its interventions and reach an even larger segment of the informal sector in the coming years.

By empowering informal workers through financial literacy, skills development, enterprise strengthening, and digital empowerment, REVIVE aims to build a thriving future where every individual has the opportunity to succeed and reach their full potential.