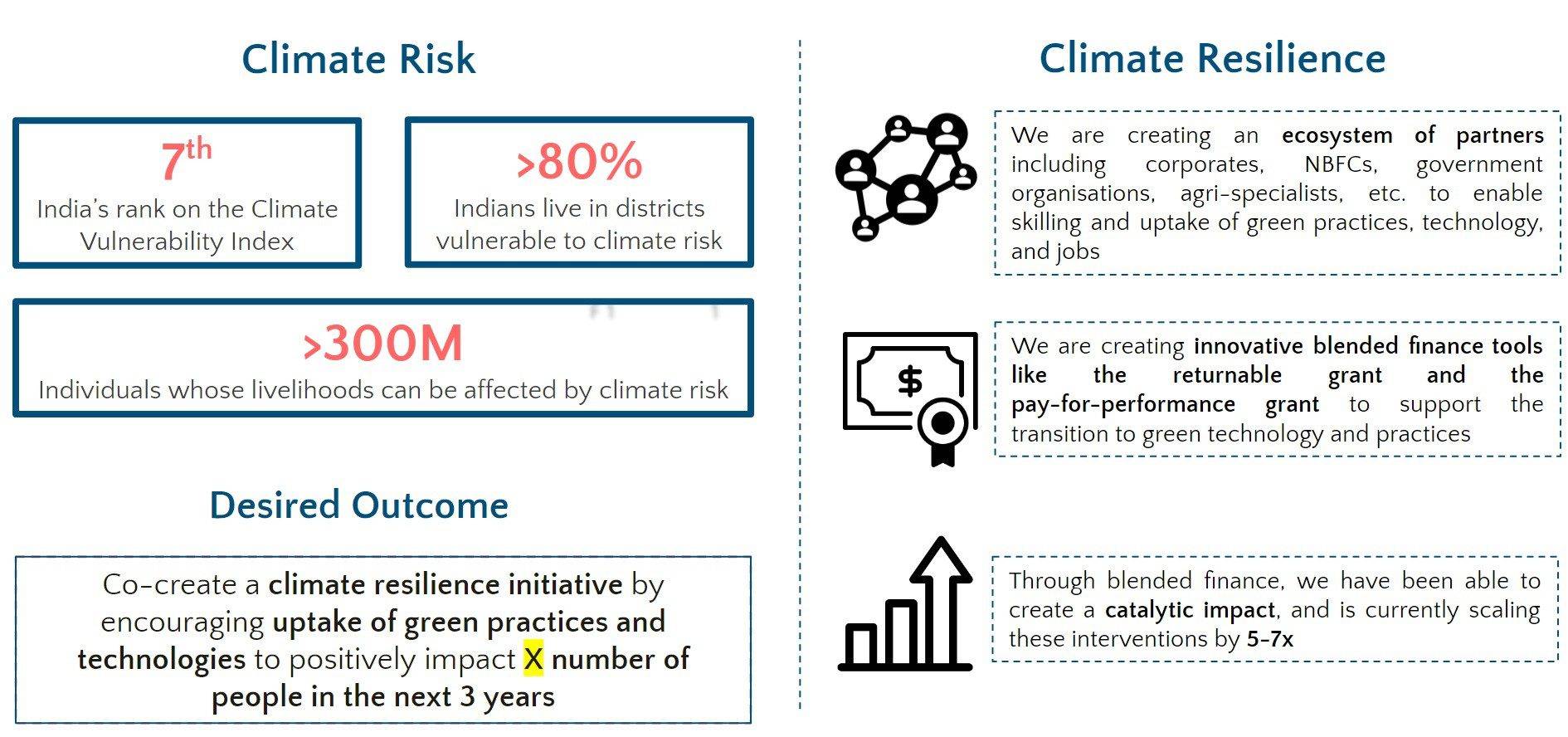

Fostering Financial Inclusion: CIIE.CO and 360One Foundation’s Collaborative Impact

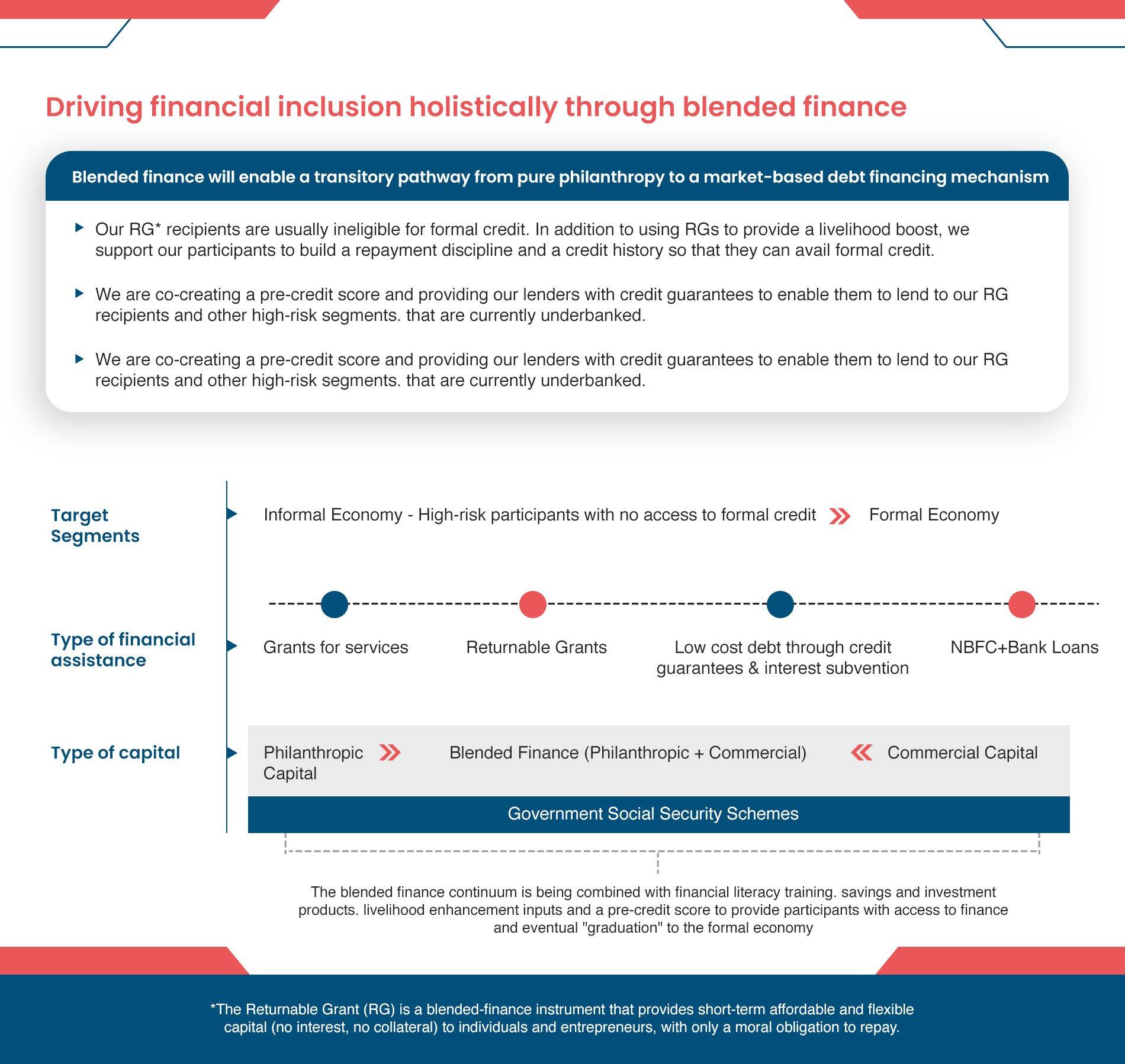

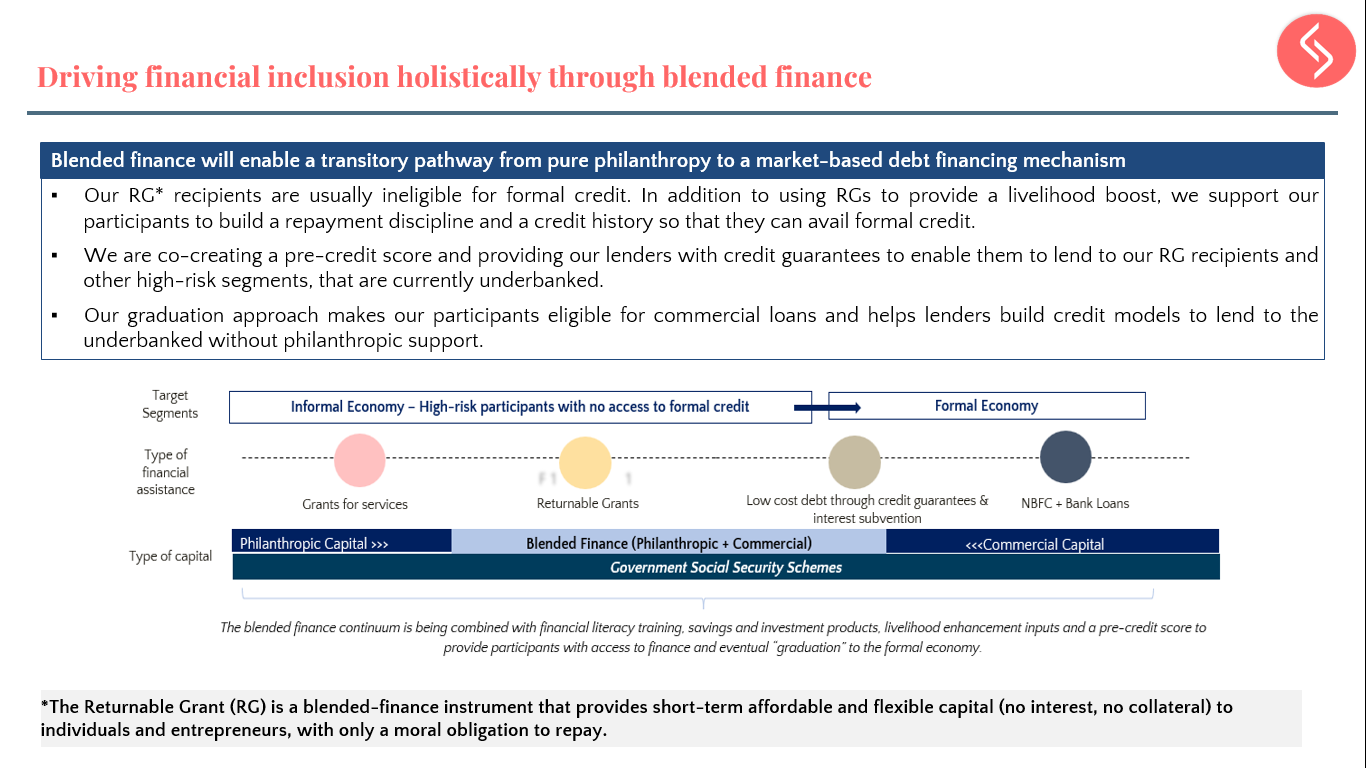

CIIE.CO, the Innovation Continuum at IIM Ahmedabad, has partnered with 360 One Foundation to address the critical issue of limited access to quality credit for the Bharat Segment, encompassing Indian households earning less than $10 a day. With 360 One Foundation’s invaluable support, CIIE.CO has empowered three inclusive lending start-ups with catalytic funding, designated as First Loss Default Guarantee (FLDG) capital. Additionally, one start-up received funding for validating its business case.

This catalytic funding has been a game-changer, enabling these start-ups to unlock over 10 times the initial capital from formal credit sources. This, in turn, helps them validate their business models, extend financial inclusion, and broaden access to credit for the Bharat Segment.

Throughout the project, CIIE.CO also provided critical technical assistance and ongoing support to these selected start-ups over an 8-month period.

Key Project Components:

Blended Finance Instrument: First Loss Default Guarantee (FLDG)

Project Location: Pan India (Start-ups based at IIM-Ahmedabad)

Total Start-ups Supported: 4

Total Unique Incremental Borrowers from the Bharat Segment Impacted: 5,750+

Additional Funds Unlocked: Approximately INR 14,15,00,000

Support to Start-ups: Diagnostic Panels, Mentoring Clinics, Portfolio Engagement Hours

This partnership drives financial inclusion and empowers the Bharat Segment by fostering innovation and expanding access to credit opportunities.