Returnable Grants

Returnable Grants

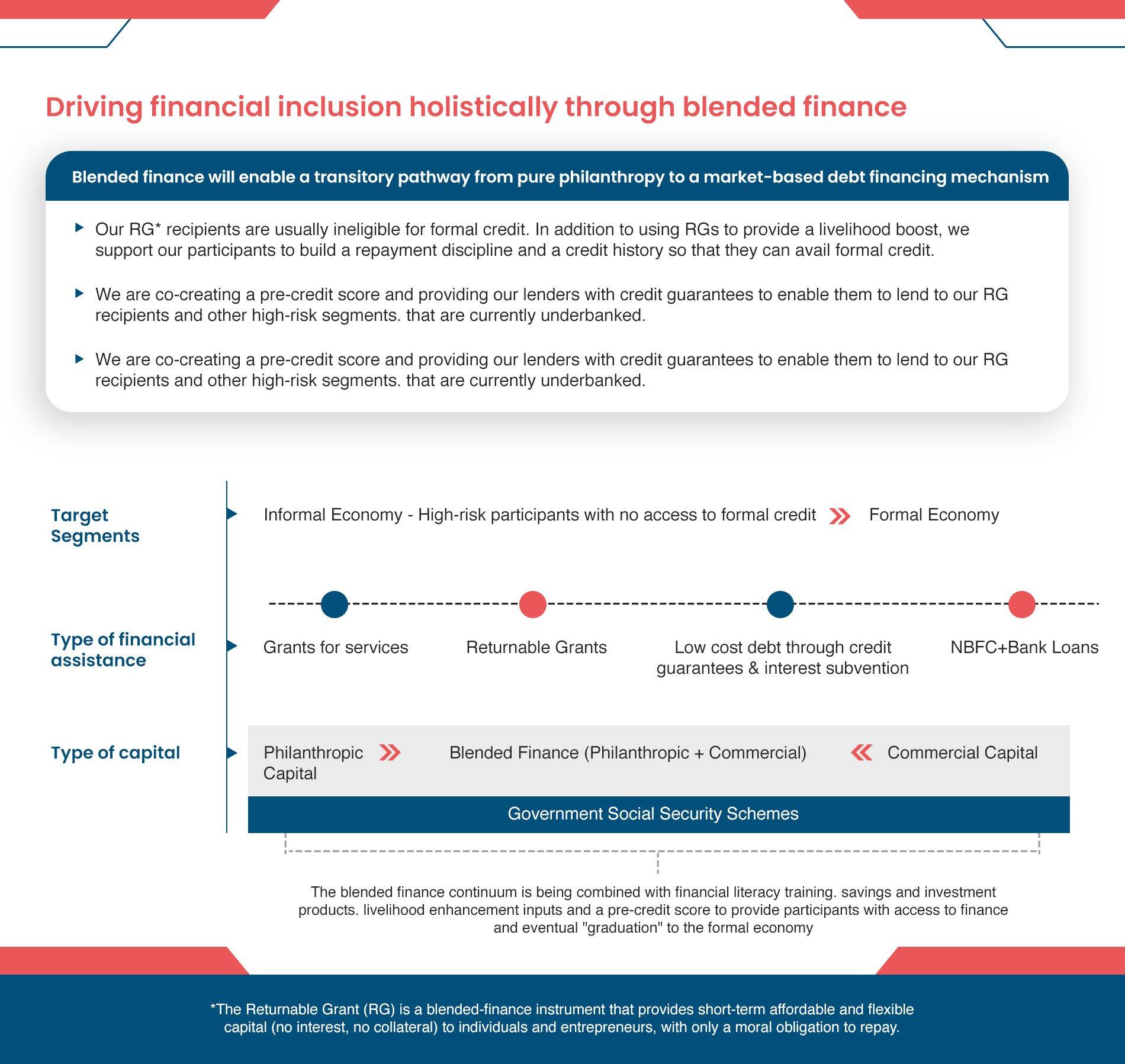

Returnable Grants (RGs) have revolutionized the landscape of financing and social impact, providing leverage from a funding perspective while creating a multiplier effect for participants that drives positive change.

Principles of Returnable Grant

Ethical Financing

Zero interest, zero collateral loan like CSR and FCRA compliant financial instrument

Gifted Grants

No legal obligation on grantee to repay grant

Smooth Credit Evolution

Repayment aids to transitioning to a more formal credit guarantee

Repaying with Ease

Easy & flexible terms to repay grant money

Ethical Financing

Zero interest, zero collateral loan like CSR and FCRA compliant financial instrument

Gifted Grants

No legal obligation on grantee to repay grant

Smooth Credit Evolution

Repayment aids to transitioning to a more formal credit guarantee

Repaying with Ease

Easy & flexible terms to repay grant money

The Solution to Financial Challenges Facing MSMEs

- Lack of collateral to access formal bank loan

- Inability to raise capital or scale business

- Shortage of capital

- Threat of high interest rate from private moneylenders

- Allows money to be directly credited into the participants’ accounts or given out as cash equivalents such as vouchers

- Enables MSMEs to operate for longer periods to scale, and/or adopt new techniques and products

- Levies individuals with a moral (and not legal) obligation to repay

- Potential ability of selected participants to repay as a cohort

- Access to financial literacy training and a pre-credit score that can put them on a pathway to access formal credit

The Solution to Financial Challenges Facing MSMEs

- Lack of collateral to access formal bank loan

- Inability to raise capital or scale business

- Shortage of capital

- Threat of high interest rate from private moneylenders

- Allows money to be directly credited into the participants’ accounts or given out as cash equivalents such as vouchers

- Enables MSMEs to operate for longer periods to scale, and/or adopt new techniques and products

- Levies individuals with a moral (and not legal) obligation to repay

- Potential ability of selected participants to repay as a cohort

- Access to financial literacy training and a pre-credit score that can put them on a pathway to access formal credit

Journey so far…

Journey so far…

Creating evidence on good financial & digital behavior for the vulnerable locked out of the formal economy

Creating evidence on good financial & digital behavior for the vulnerable locked out of the formal economy

5-7x

multiplier effect & transformative long-term change

97%

repayment rate despite no legal obligation on grantee

33,000

participants impacted

till date

Journey so far…

Creating evidence on good financial & digital behavior for the vulnerable locked out of the formal economy

5-7x

multiplier effect & transformative long-term change

97%

repayment rate despite no legal obligation on grantee

33,000

participants impacted

till date