From Opportunity to Success: Microsoft’s Holistic Approach to Supporting Women Entrepreneurs

From Opportunity to Success: Microsoft’s Holistic Approach to Supporting Women Entrepreneurs

When it comes to keeping up with the digital age, women in India face several challenges, which have a significant influence on the growing digital gap in the country. Microsoft, through its CSR Program, has supported a total of 10,000 women entrepreneurs, with the last 5,000 beneficiaries benefiting from a comprehensive approach that includes digital and financial literacy, bookkeeping, mentoring, advanced training for participants, and access to government schemes, all of which are aligned with the theme of sustainable entrepreneurship.

Weaving Entrepreneurial Dreams, One Stitch at a Time: Manisha from Nuh, Haryana

“After the program, I felt that in order to grow the business, I need to be educated further.”

Manisha, is a determined young entrepreneur, from Bichhor village in Nuh district, Haryana. At the age of 19, she found herself in a challenging situation where she had to drop out of school to support her family financially. The conservative environment in Nu district further exacerbated the impact on Manisha’s life as her family opposed her desire to pursue education. As a result, she was confined to her home, without any opportunities for formal learning.

Despite facing these challenges, Manisha’s determination led her to seek guidance from her sister, who was skilled in tailoring. She quickly learned from her and began taking orders directly from home. However, the income from her limited customer base within the village was insufficient.

A major turning point for her was when she became a part of the REVIVE program, spearheaded by Microsoft. This program taught her how to utilise digital tools and effectively manage her cash flow, enabling her to expand the business and reach a larger customer base. Moreover, it made her realise the untapped potential of her own phone for conducting various business related activities beyond mere communication.

Additionally, the program’s impact extended well beyond the realm of business, positively influencing the overall wellbeing of the community. Nu district, known for its persistent problem of financial fraud and crime, had long been a burden on its residents. However, with the implementation of the REVIVE program, individuals like Manisha gained valuable skills to safeguard themselves from such incidents, fostering a newfound sense of resilience and empowerment that surpassed societal gender constraints.

Encouraged by such transformative effects and positive changes within the community, Manisha’s parents had a change of heart and agreed to support her in pursuing higher education. This marked the beginning of a promising chapter in her life, where she could simultaneously nurture her business and embrace the educational opportunities she had longed for.

Manisha’s case study exemplifies the impact of Microsoft’s holistic approach in supporting women entrepreneurs. By providing digital and financial literacy, access to tools and resources and mentoring, Microsoft has empowered women like her to overcome challenges, achieve business growth, and pursue their dreams.

UNDERSTANDING THE CHALLENGES

Entrepreneurship among women is a vital component of the overall solution. However, women-owned enterprises in India face a number of challenges, including:

- Inadequate access to skilling: Women entrepreneurs often lack the skills and training necessary to run a successful business. This might make it harder for them to compete with more established businesses.

- Lack of market linkages: This may be attributed to a lack of knowledge of their products and services, as well as social and cultural barriers that restrict women from accessing the market.

- Limited access to finance: Women frequently experience difficulties acquiring loans or other sources of funding. This might make it difficult for them to establish or grow their businesses.

- Socio-cultural barriers: Constraints such as inadequate access to skilling, lack of market linkages, limited financial access, and societal biases represent substantial hurdles for women entrepreneurs. These barriers impede their long-term viability and ability to innovate.

Moreover, the digital divide exacerbates these challenges, making it difficult for them to leverage technology for business growth and success. Therefore, addressing these challenges is essential to unlocking the full potential of women entrepreneurs.

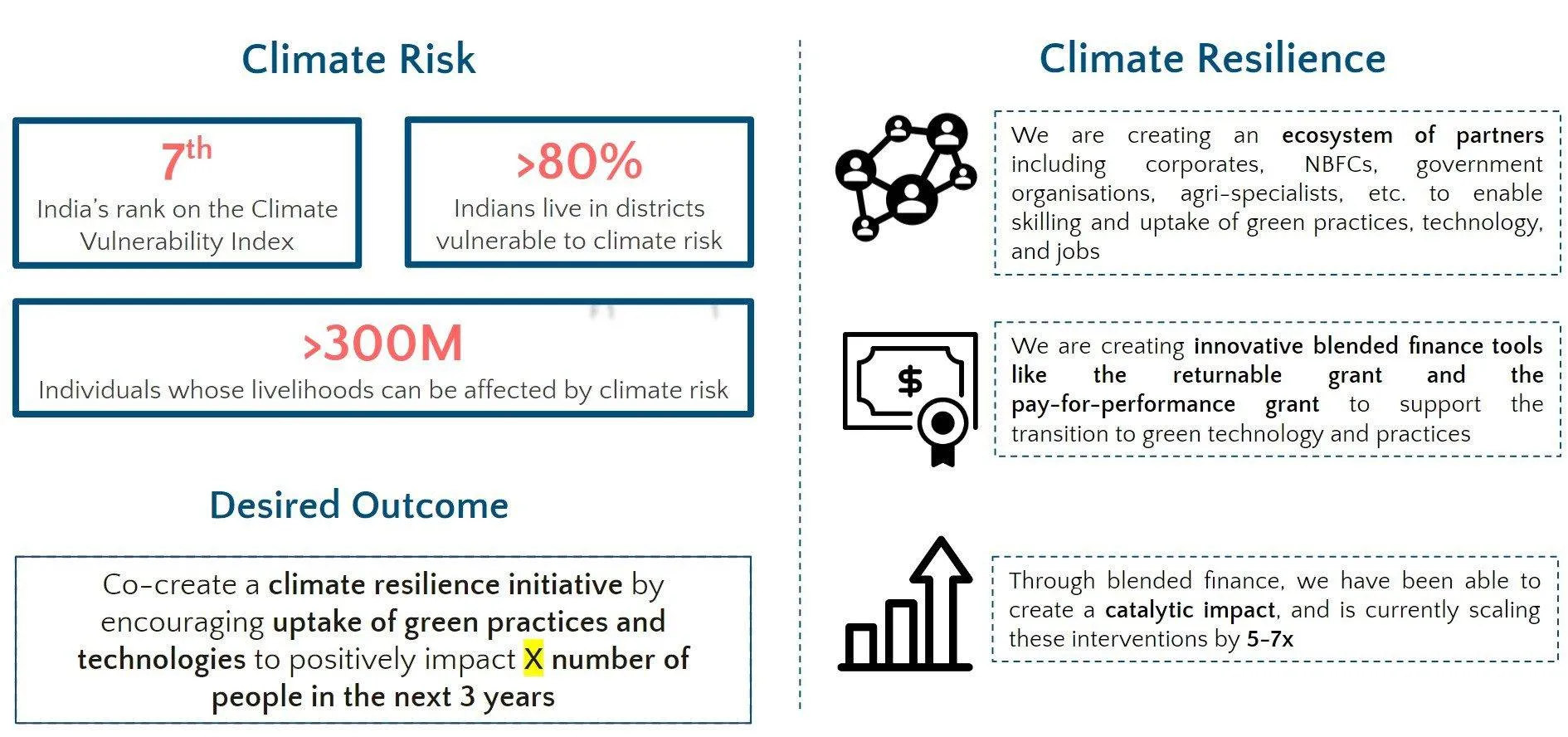

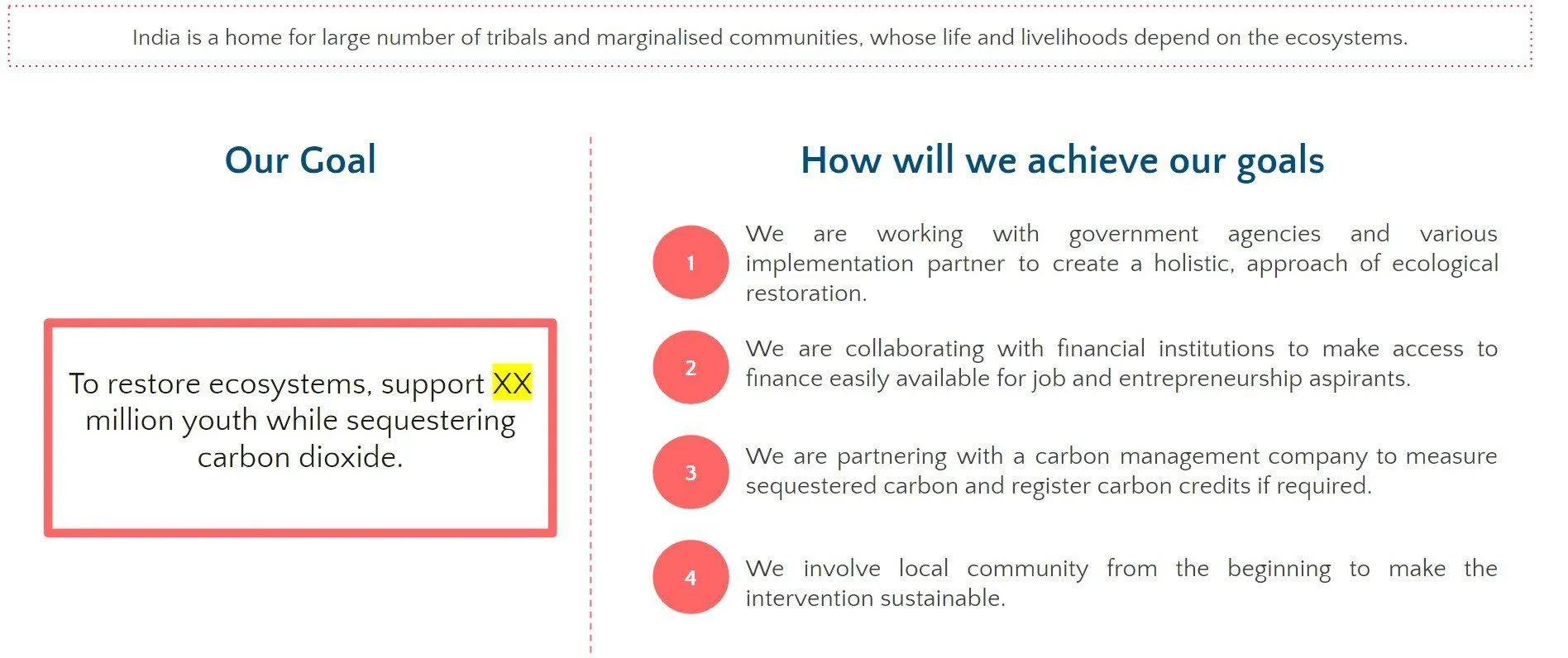

MICROSOFT’S PROGRAM INTERVENTION

Microsoft’s CSR Program stands as a shining example of a holistic approach to bridge the digital divide and support women entrepreneurs in India. Recognising the significance of digital tools as a leapfrog intervention in economic empowerment. Microsoft aims to support women micro-entrepreneurs by providing them with the necessary tools and resources to thrive in the digital age.

Initiated as a pilot program targeting 5,000 women entrepreneurs in rural India, with the goal of providing them with digital and financial literacy skills as well as the capacity to effectively operate, manage, and develop their enterprises.

HOLISTIC SUPPORT FOR WOMEN ENTREPRENEURS

Using a blended support model, Samhita’s partnership with Microsoft has aimed to address barriers and strengthen the women’s entrepreneurship ecosystem across 10 states by focusing on the following key areas:

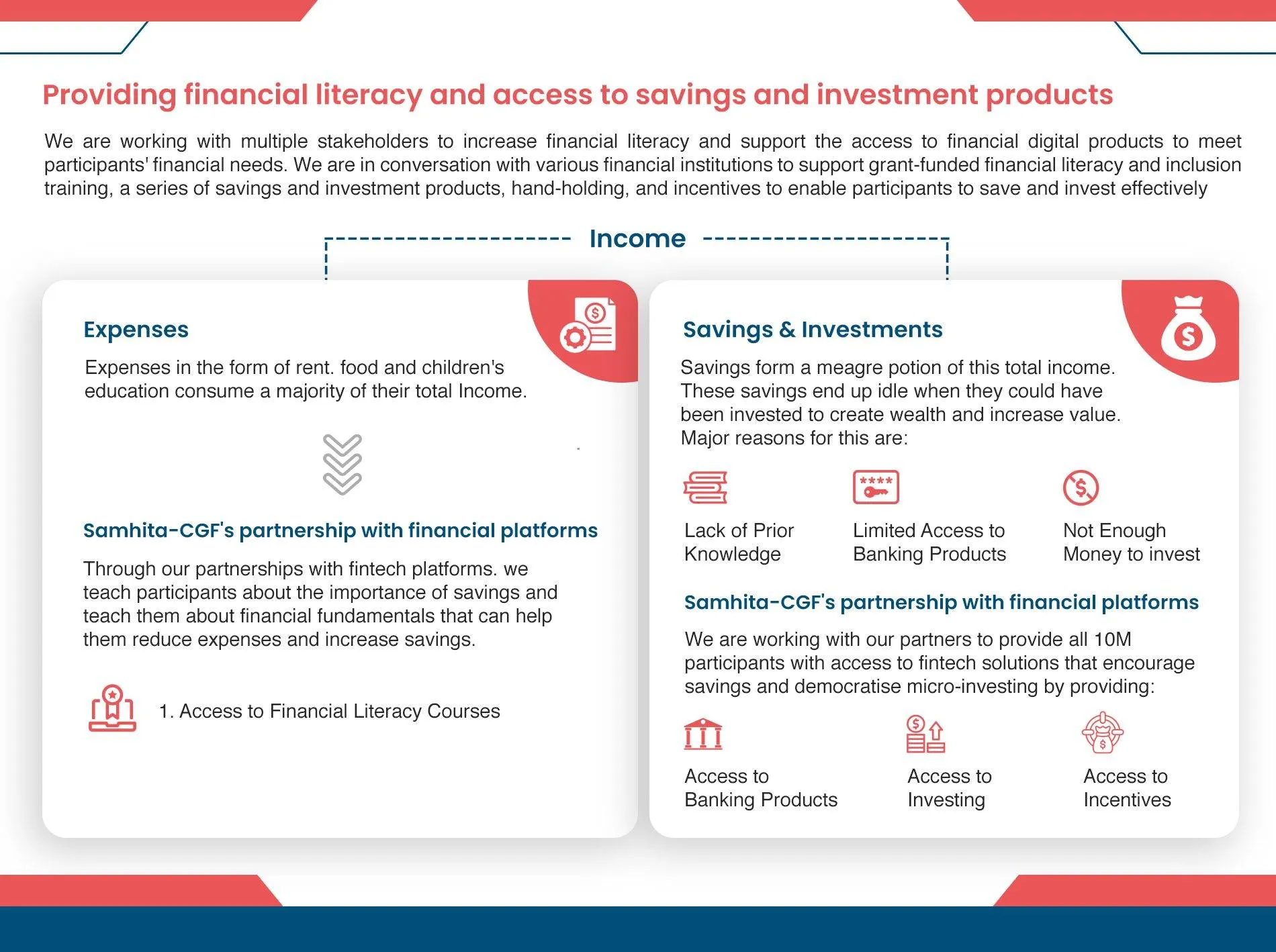

- Digital and Financial Literacy (DFL): Capacity Building Sessions were conducted to enhance women entrepreneurs’ digital and financial literacy. These sessions covered topics such as concepts of banking, insurance, and using digital tools such as mobile devices, internet, social media, email, and awareness of e-security and safety.

- Digital Bookkeeping Tools: Women micro-entrepreneurs were introduced to user-friendly digital bookkeeping tools that streamlined their financial processes. By using the tools, they were able to improve accuracy, enhance cash flow visibility, and make informed decisions based on real-time data. These tools, built on Microsoft Azure, provide flexibility so that they can be used both online and offline, ensuring accessibility even in areas with limited internet connectivity.

- Performance-linked incentives: To encourage and motivate digitization in the first phase, high-performing women entrepreneurs or those with progressive engagement were rewarded with incentives.

- Handholding support: To promote sustained use of digital tools, and follow-ups for additional resources or support.

THE PROGRAM’S OVERALL IMPACT

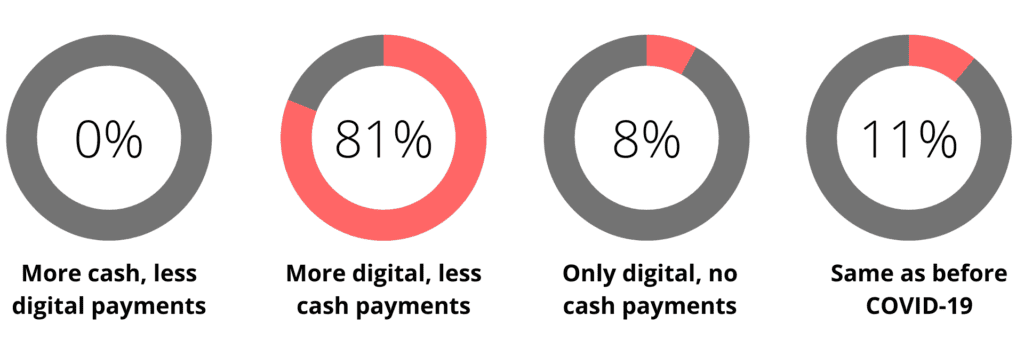

The first phase of the program successfully trained 5000 women entrepreneurs in digital and financial literacy, and provided them with access to user-friendly digital bookkeeping tools. These efforts yielded the following achievements:

- 44.1% of participants continue to actively maintain digital account books for their businesses.

- 62% of women began tracking their borrowing and lending by the end of the program as compared to only 27% at the start of the program.

- The number of women tracking inventory, banking operation, and payments increased by 10%, 14%, and 19%, respectively.

A significant proportion of women entrepreneurs were able to digitize their bookkeeping practices, and were also able to obtain small formal bank loans because of these efforts. These included women entrepreneurs from various cohorts such as artisans, street vendors, dairy farmers and tailors.

SCALING UP AND ADDRESSING ADDITIONAL NEEDS

In the second phase, the program has been scaled up to support an additional 5,000 women entrepreneurs and it includes multiple interventions, in addition to digital literacy:

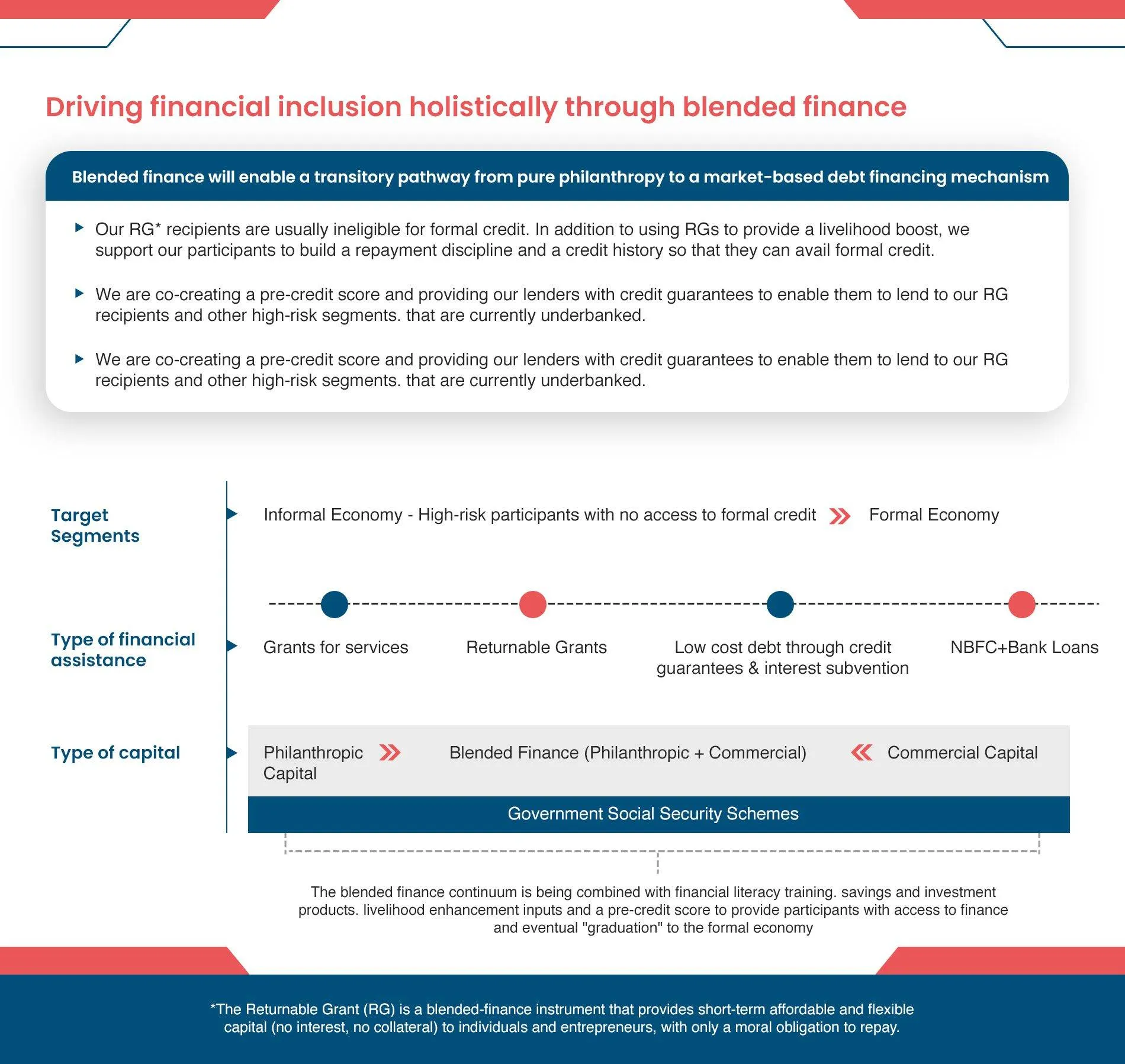

- Access to Finance: Access to formal financial resources remains a significant challenge for women entrepreneurs, which was addressed by facilitating access to credit and connecting women with financial institutions. By building relationships with banks and fostering partnerships, the program enabled the participants to secure financial resources. This support empowered them to invest in their business, expand their operations, and achieve sustainable growth.

- Social Protection: By unlocking relevant government schemes and services, women entrepreneurs were able to leverage them to access funding, business development resources, and market opportunities. This strategic approach propelled their enterprises forward by providing them with the necessary support and resources to overcome barriers.

- Mentoring and Peer Support: Through mentorship, these women entrepreneurs received valuable guidance, industry insights, and access to networks, enabling them to make informed decisions and seize new opportunities. Additionally, the program created peer support networks that fostered a sense of community, allowing women to share experiences and learn from one another.

KEY LESSONS FOR DRIVING IMPACT

Microsoft’s program has provided valuable lessons for scaling up and replicating holistic support models for women’s entrepreneurship. There are two key lessons that have emerged from this program:

- Customisation: It is essential to address the specific needs and contexts of women entrepreneurs. By tailoring interventions, organisations can effectively address the specific requirements of women entrepreneurs, increasing their chances of success.

- Partnerships: Collaborations with financial institutions, government agencies, and community organisations create a comprehensive ecosystem of support that helps in offering assistance and guidance to women entrepreneurs in their businesses.

These lessons serve as valuable guidelines for organisations aiming to develop impactful programs for women entrepreneurs, and Microsoft’s Program stands as a testament to the effectiveness of such an approach. Ultimately, when organisations combine tailored approaches with strategic partnerships, they can create an environment for women entrepreneurs to thrive.

This article was editorialised by Ayushi Bhatnagar and Evans Rebello.