Sanitation Workers

Sanitation Workers

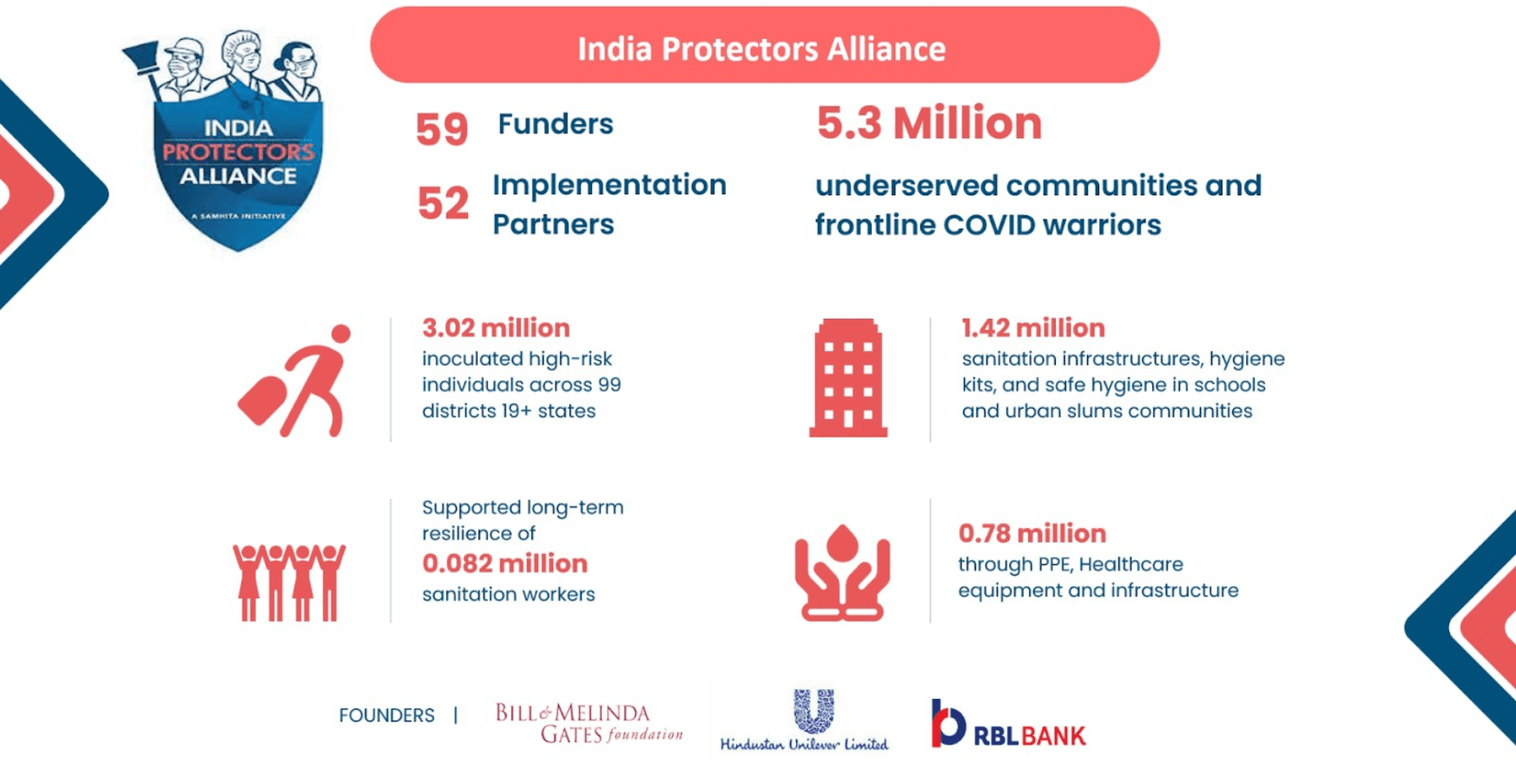

There are more than five million full-time sanitation workers of which two million are directly engaged in high-risk tasks such as emptying septic tanks, maintaining sewer lines, and drains at the cost of their health, dignity, and safety. Irrespective of their contributions, they are not recognized as essential public service providers, instead are overlooked, made invisible, stigmatized, and ostracized by society at large. Moreover, the Covid-19 pandemic has exposed the vulnerability of sanitation workers and their families to many challenges. They face various challenges at the workplace, such as compromised health and safety, limited or no awareness about social security schemes, and limited skills and livelihood options.

Therefore, the REVIVE Alliance aims to uplift sanitation workers by improving their overall quality of life while addressing critical socio-economic challenges faced by sanitation workers through focused interventions that cater to their immediate, medium- and long-term needs. In doing so, the project not only impacted the workers but also their family members resulting in 4x overall impact.

The project has 3 components:

- Provision of PPE kits to sanitation workers,

- Providing upskilling and entrepreneurship support

- Linking sanitation workers with relevant social security schemes.

The program is implemented by Kam Foundation and Haqdarshak Empowerment Solutions Private Limited in Pune and Mumbai, Maharashtra. So far, PPE kits have been distributed to 1000 sanitation workers and have undergone covid-19 prevention training. 499 sanitation workers have received benefits from the social security schemes, and 792 sanitation workers have undergone upskilling and entrepreneurship training. The project envisages improving the health of sanitation workers by preventing them to catch the infection, increasing usage of PPE kits, access to government entitlements, and enhanced skills and technical know-how for increased income generation potential.