Financial inclusion

Financial inclusion

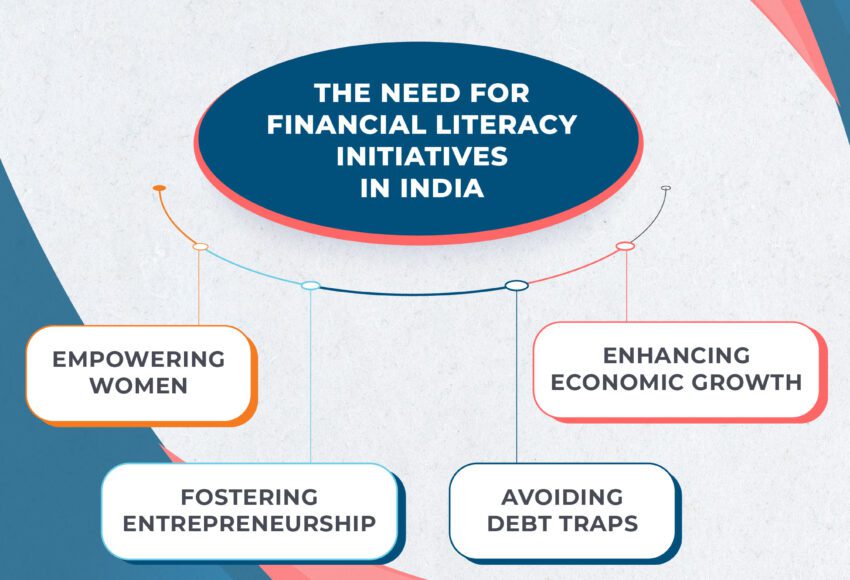

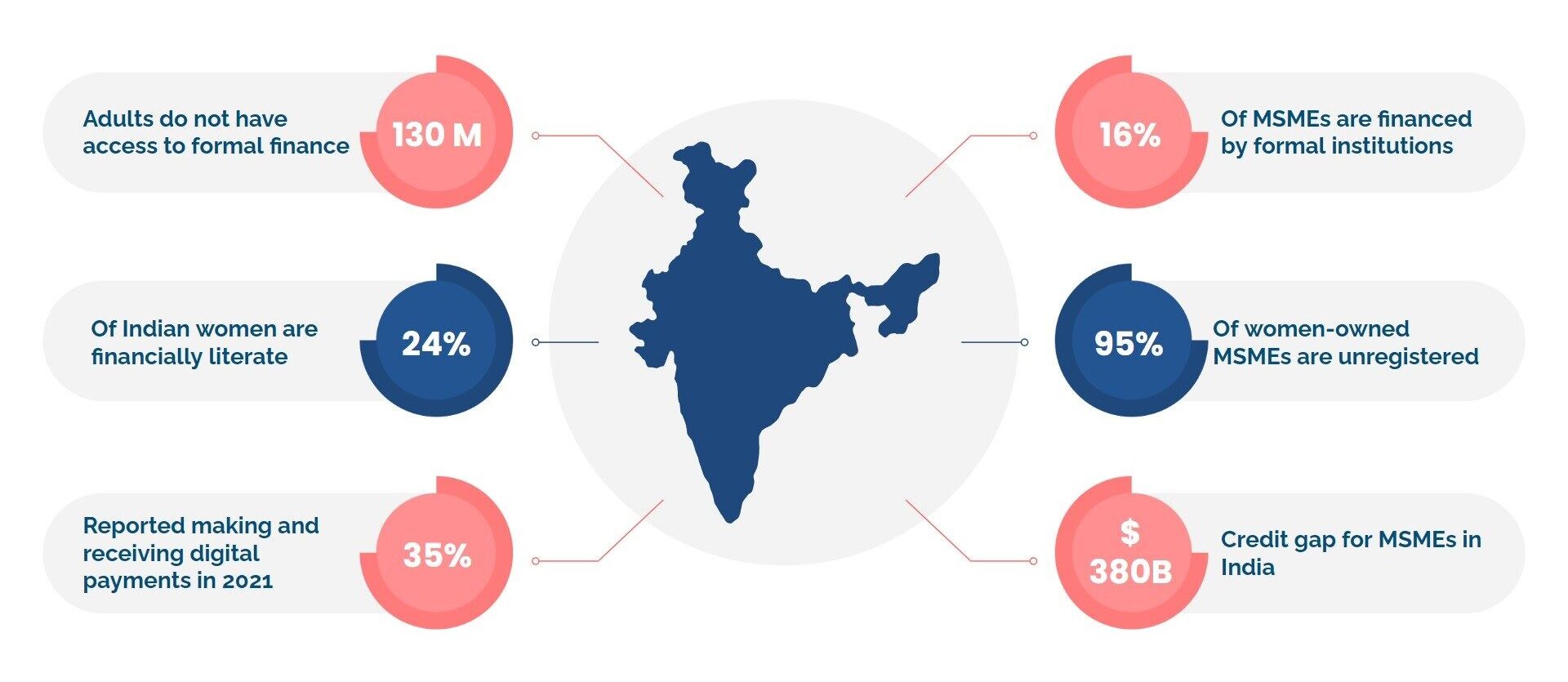

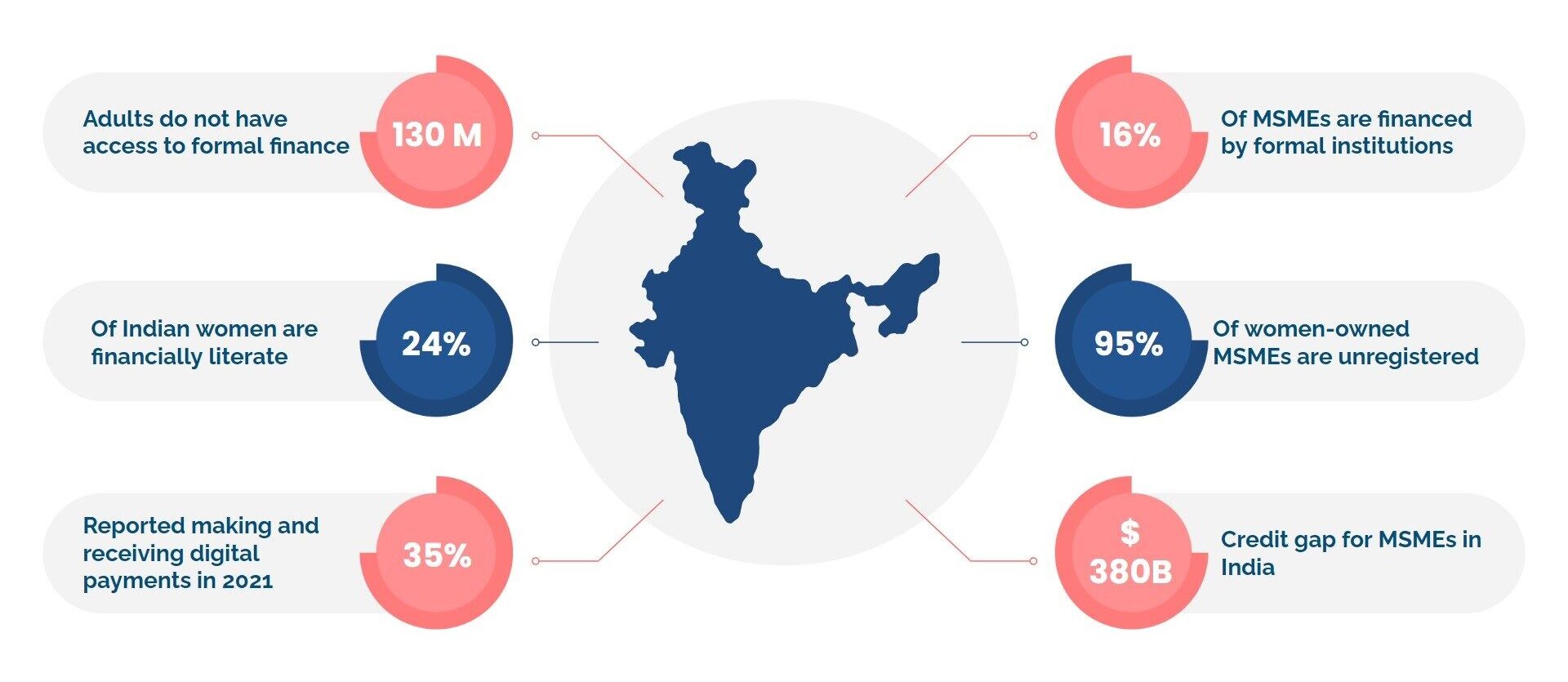

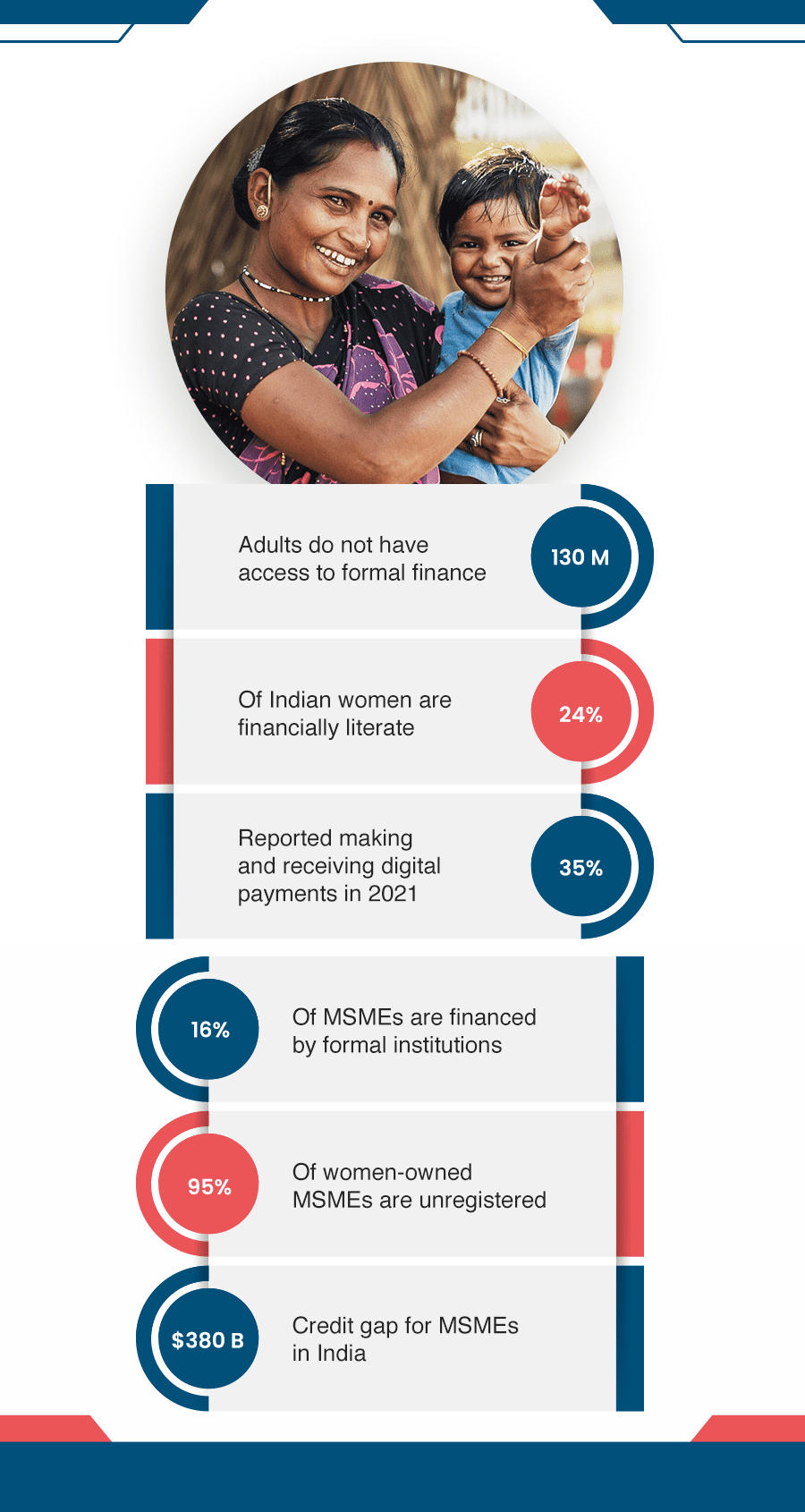

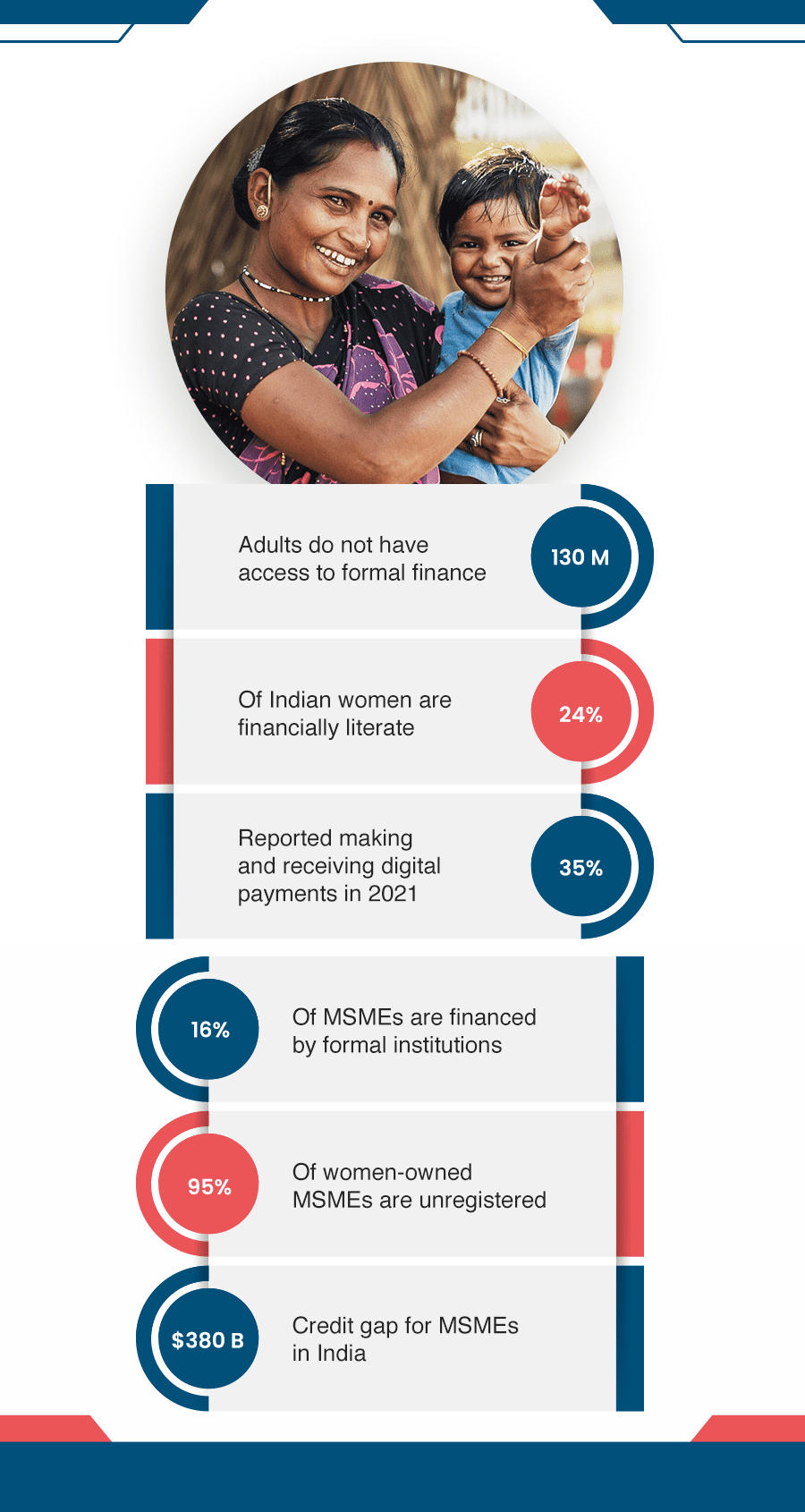

Need for financial inclusion in India

Why Financial Inclusion Matters

Empowering Entrepreneurs

Enhancing Livelihoods

Resilience and Security

Barriers to Financial Inclusion

- Privacy concerns and data security issue

- Technology limitations in rural areas

- Low financial literacy and awareness

- Insufficient infrastructure in rural areas

- Lack of proper authentication mechanism

- Poor last mile connectivity in rural areas

Barriers to Financial Inclusion

- Privacy concerns and data security issue

- Technology limitations in rural areas

- Low financial literacy and awareness

- Insufficient infrastructure in rural areas

- Lack of proper authentication mechanism

- Poor last mile connectivity in rural areas

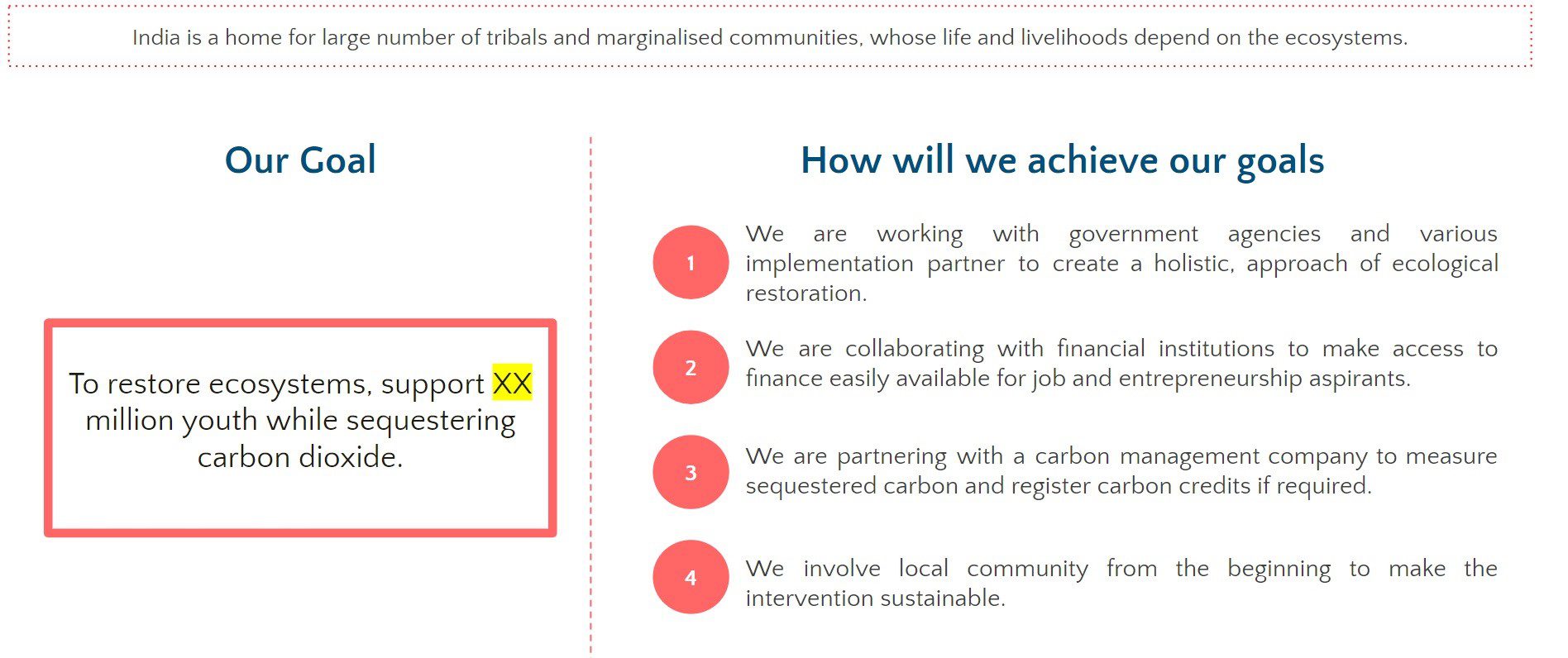

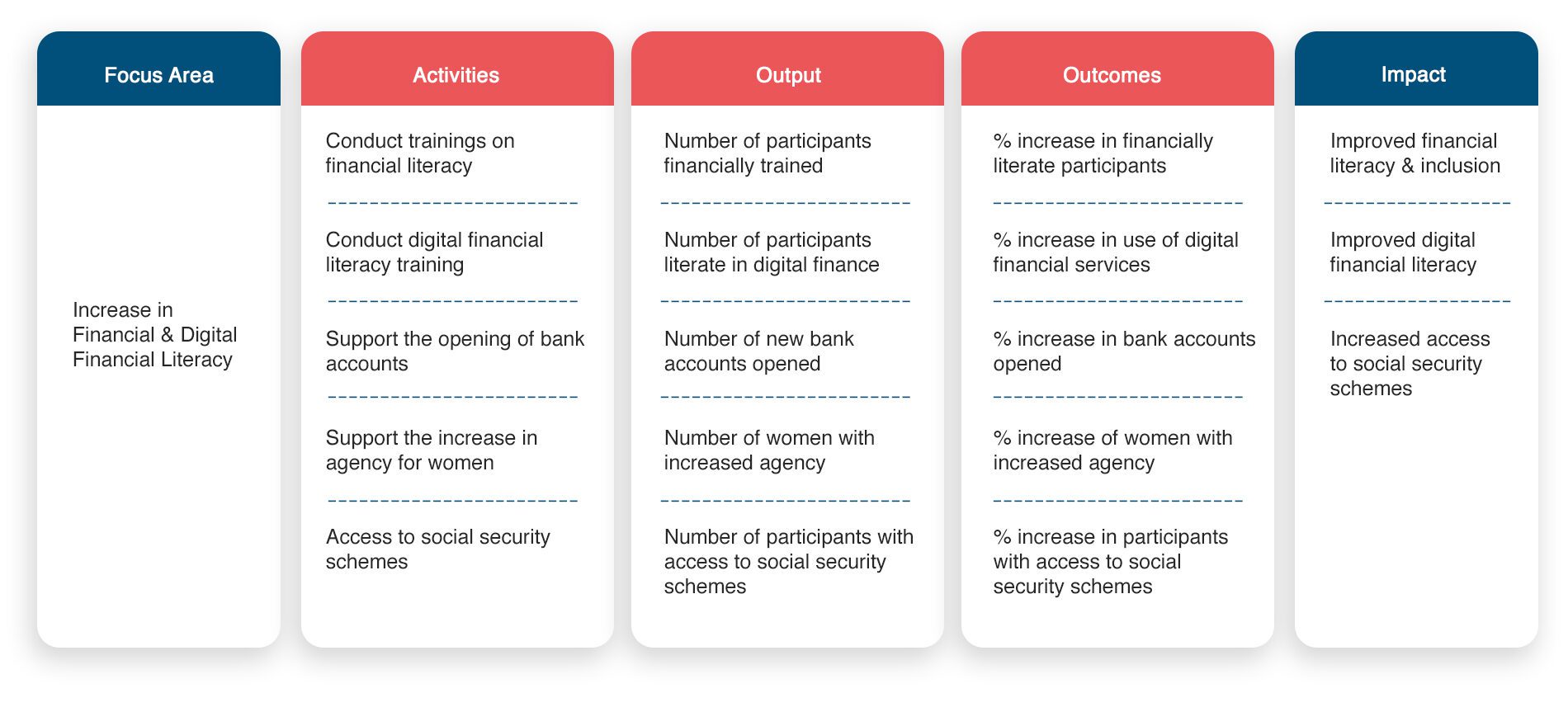

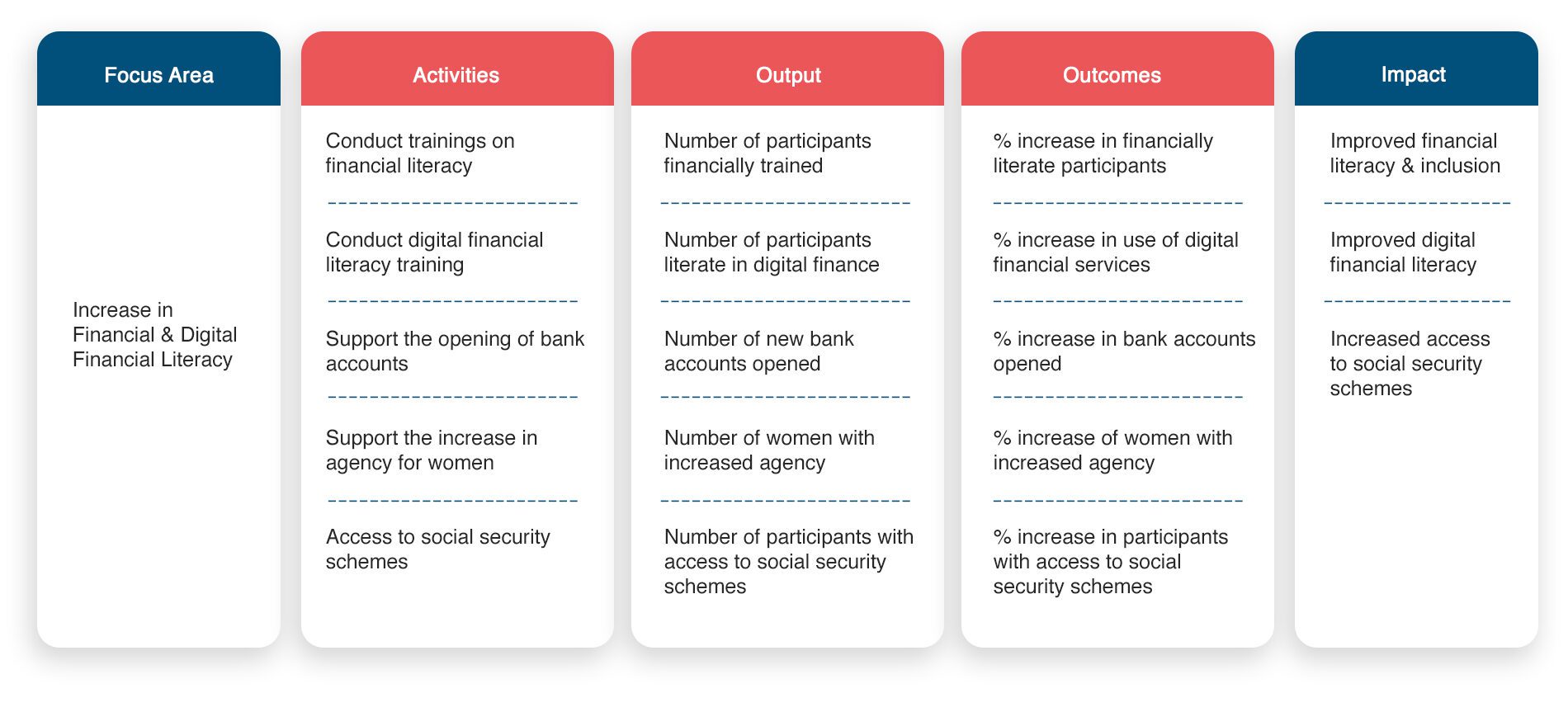

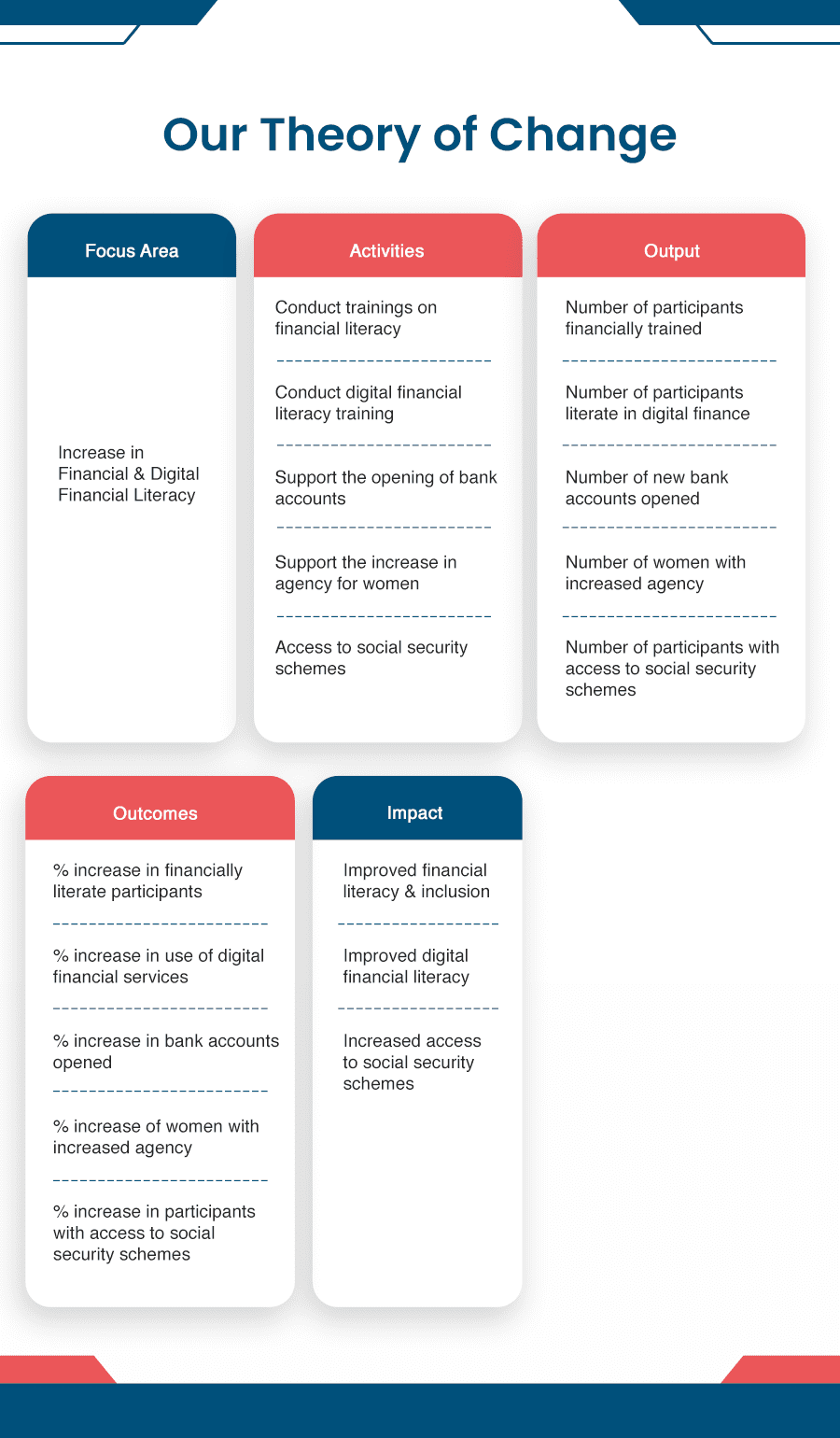

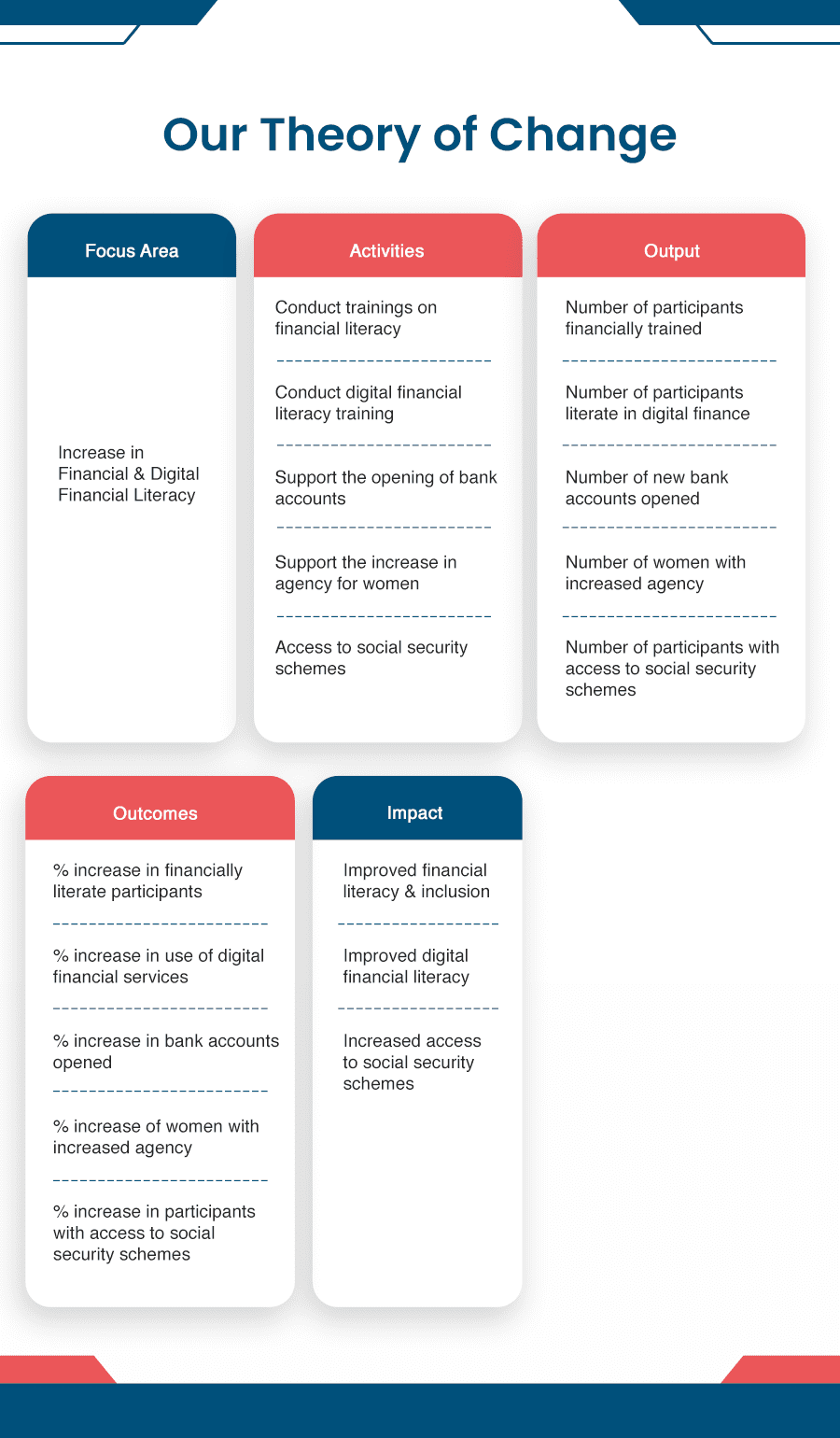

Samhita-CGF’s Theory of Change

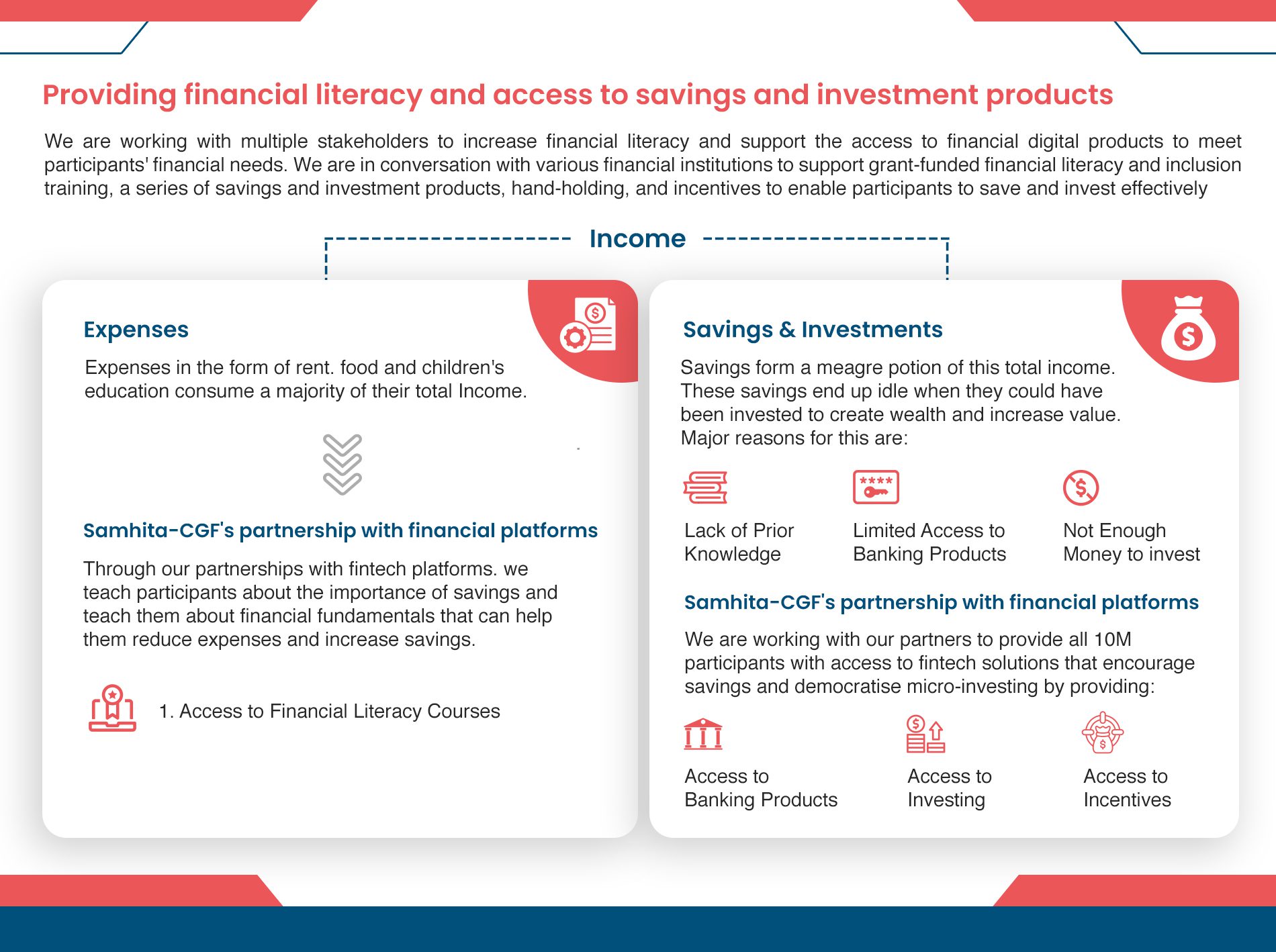

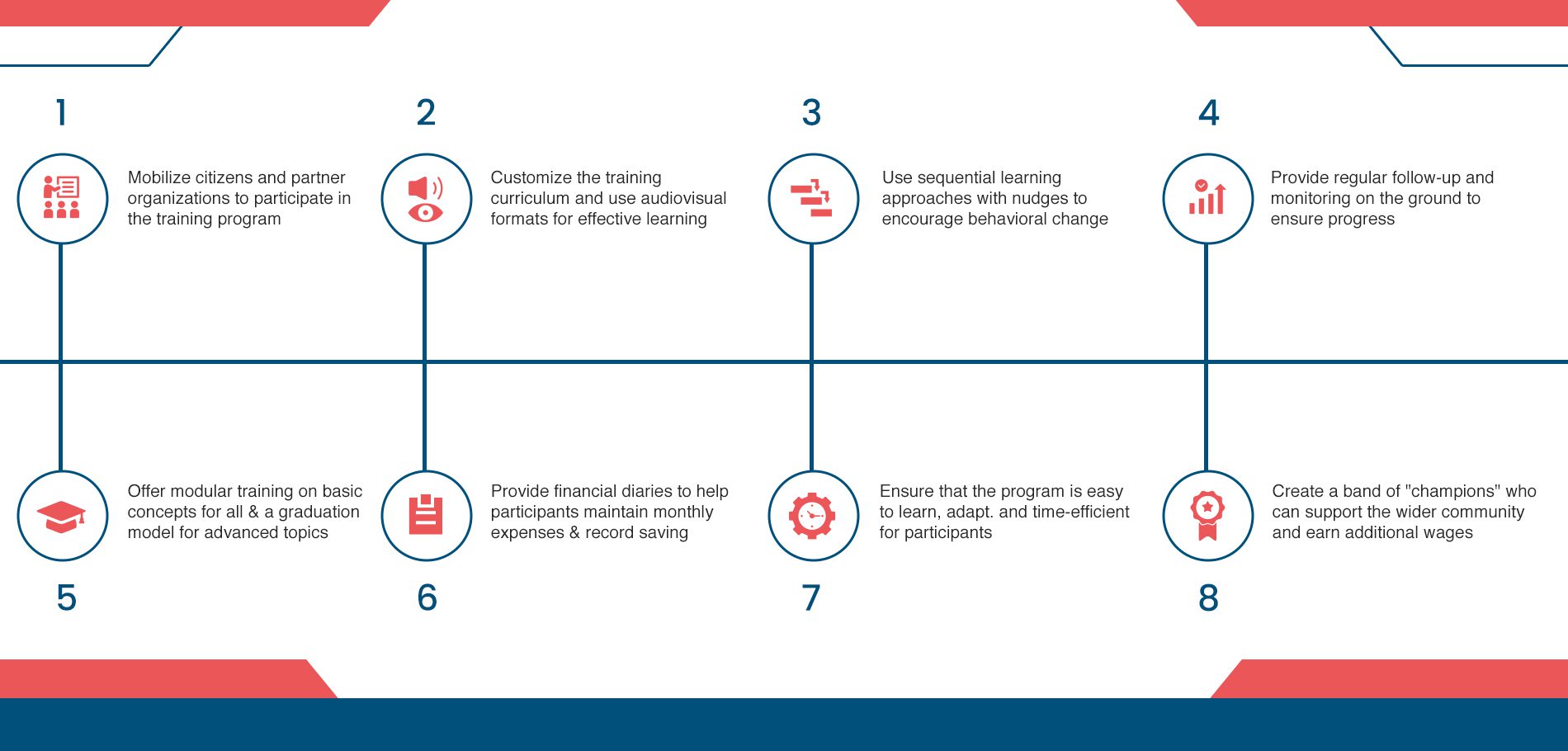

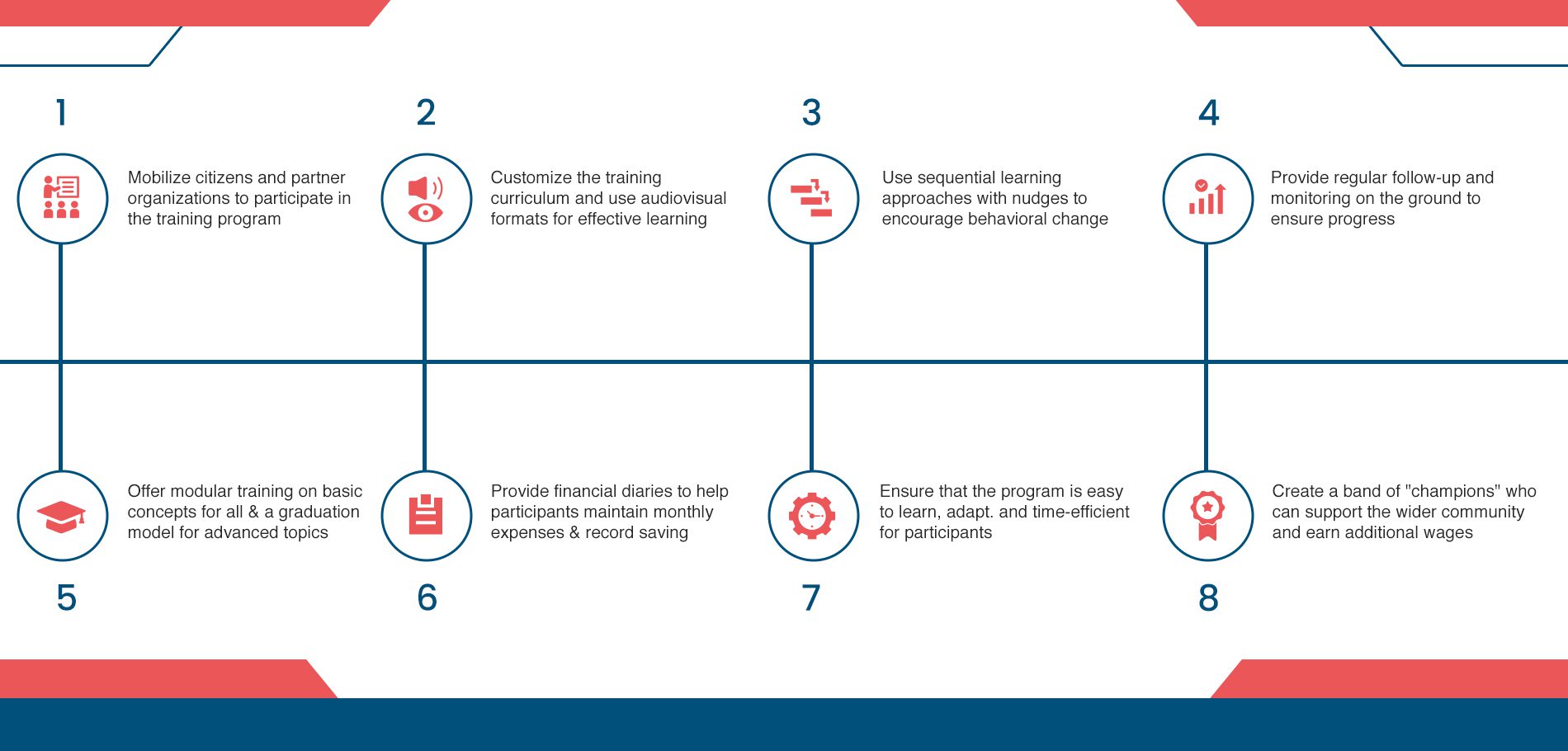

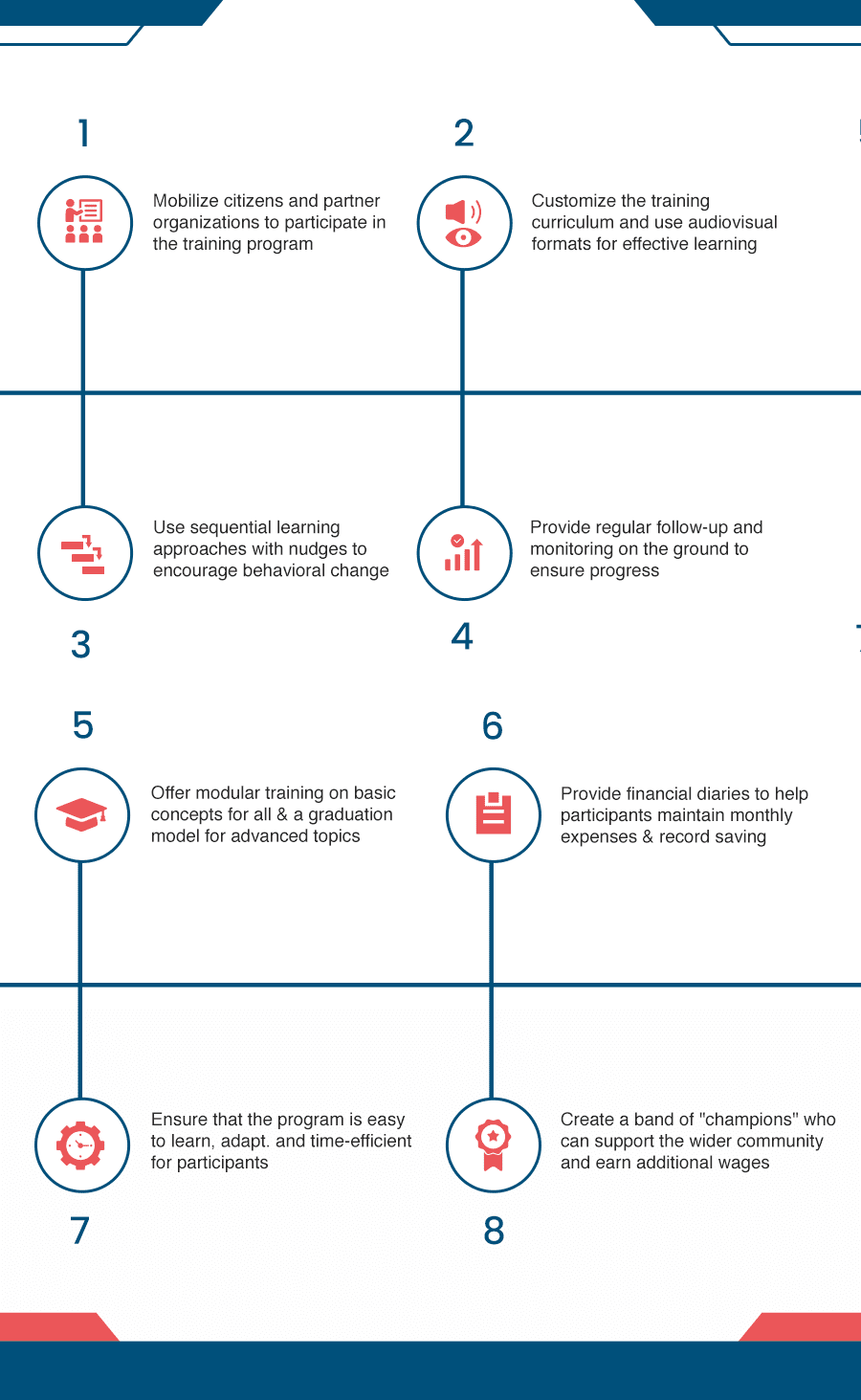

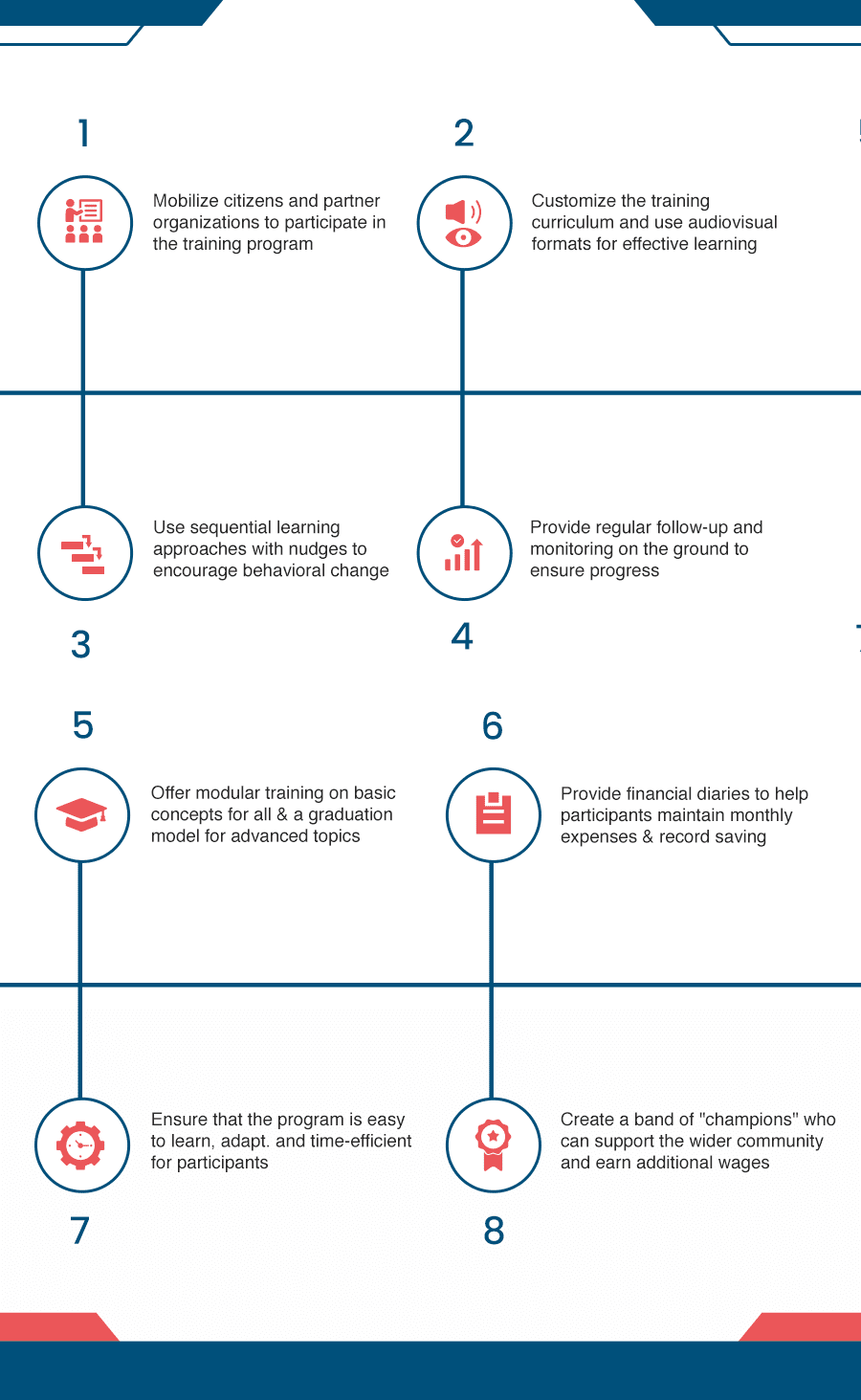

Samhita-CGF’s Financial Literacy Process

Samhita-CGF’s holistic approach to Financial Inclusion

The Samhita-CGF Advantage

Catalytic impact

Funders

Market making

NBFCs

Sourcing participants

NBFCs

Technology enablement and robust MEL tracking

all

We are creating indices to gauge the effectiveness of our interventions, including the Income Index, Resiliency Index, and the Women’s Empowerment Index.

Supporting long term, holistic impact

Participants

We therefore support participants by providing additional intervention support (digital / financial literacy, skilling, enterprise development, etc.) to build their capabilities and bridge this gap.

Participants receiving holistic support will be more capable to repay loans

HOLISTIC IMPACT

ROBUST MEL TRACKING

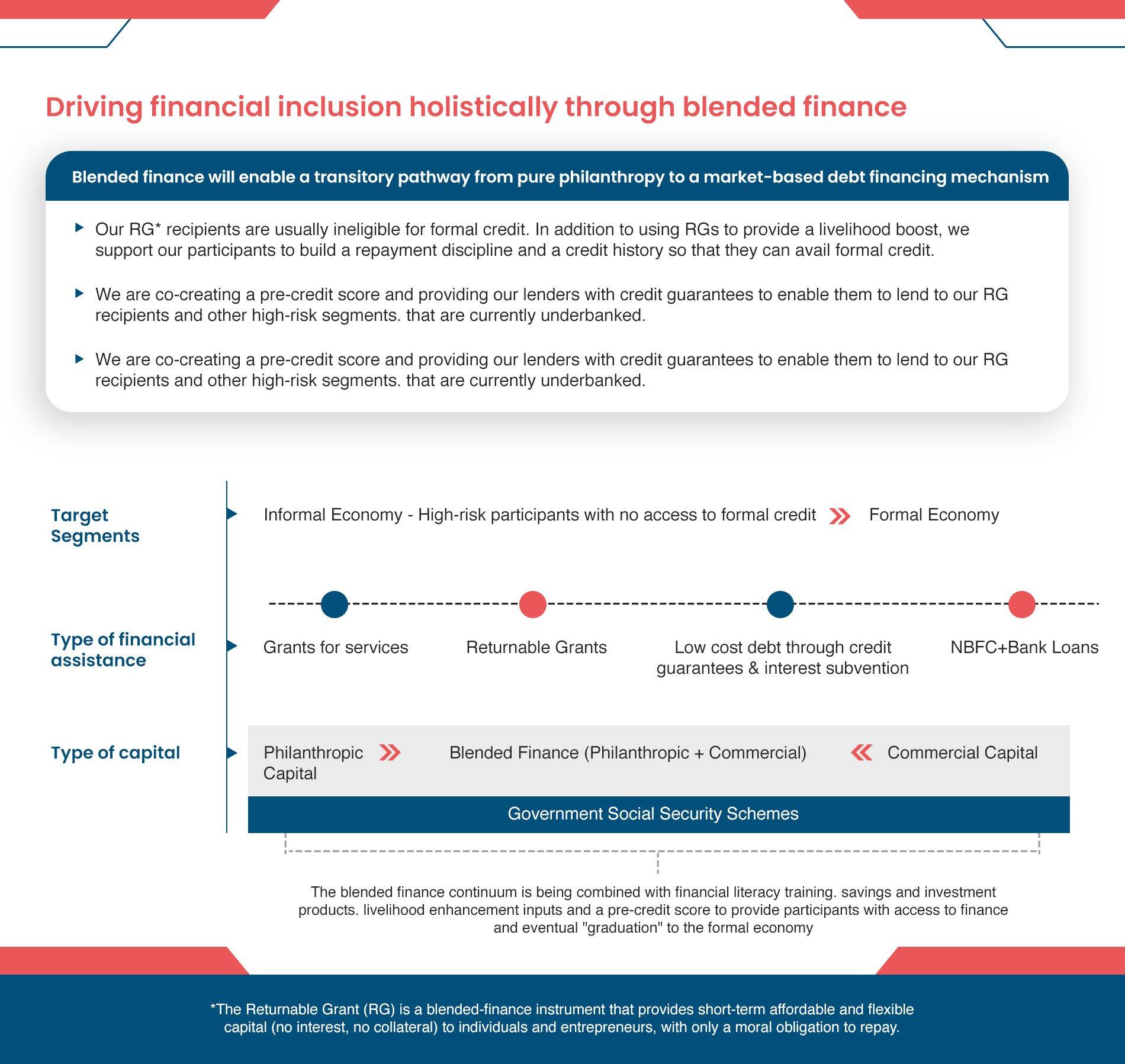

Our blended finance instruments have been developed to be sustainable in terms of both leverage and in naturally facilitating the graduation of participants towards formal credit

Our facility is the first of its kind that focuses on supporting NTC and NTI segments, who otherwise remain unbanked, and aim to facilitate their graduation by supporting our RG participants who demonstrate good repayment behaviour.

- We will support NBFCs in sourcing participants through our strong network on NGOs, implementation, and training partners with pan-India reach.

- We will support NBFCs in sourcing participants through our strong network on NGOs, implementation, and training partners with pan-India reach.

- Our participants often face a knowledge and/or skills gap which access to finance alone cannot bridge.

- We therefore support participants by providing additional intervention support (digital / financial literacy, skilling, enterprise development, etc.) to build their capabilities and bridge this gap.

- Participants receiving holistic support will be more capable to repay loans

- We are working with Societal Thinking to develop our technology platform for scale where we will onboard and monitor REVIVE participants, not only through the course of the program but after completion as well.

- We are creating indices to gauge the effectiveness of our interventions, including the Income Index, Resiliency Index, and the Women’s Empowerment Index.

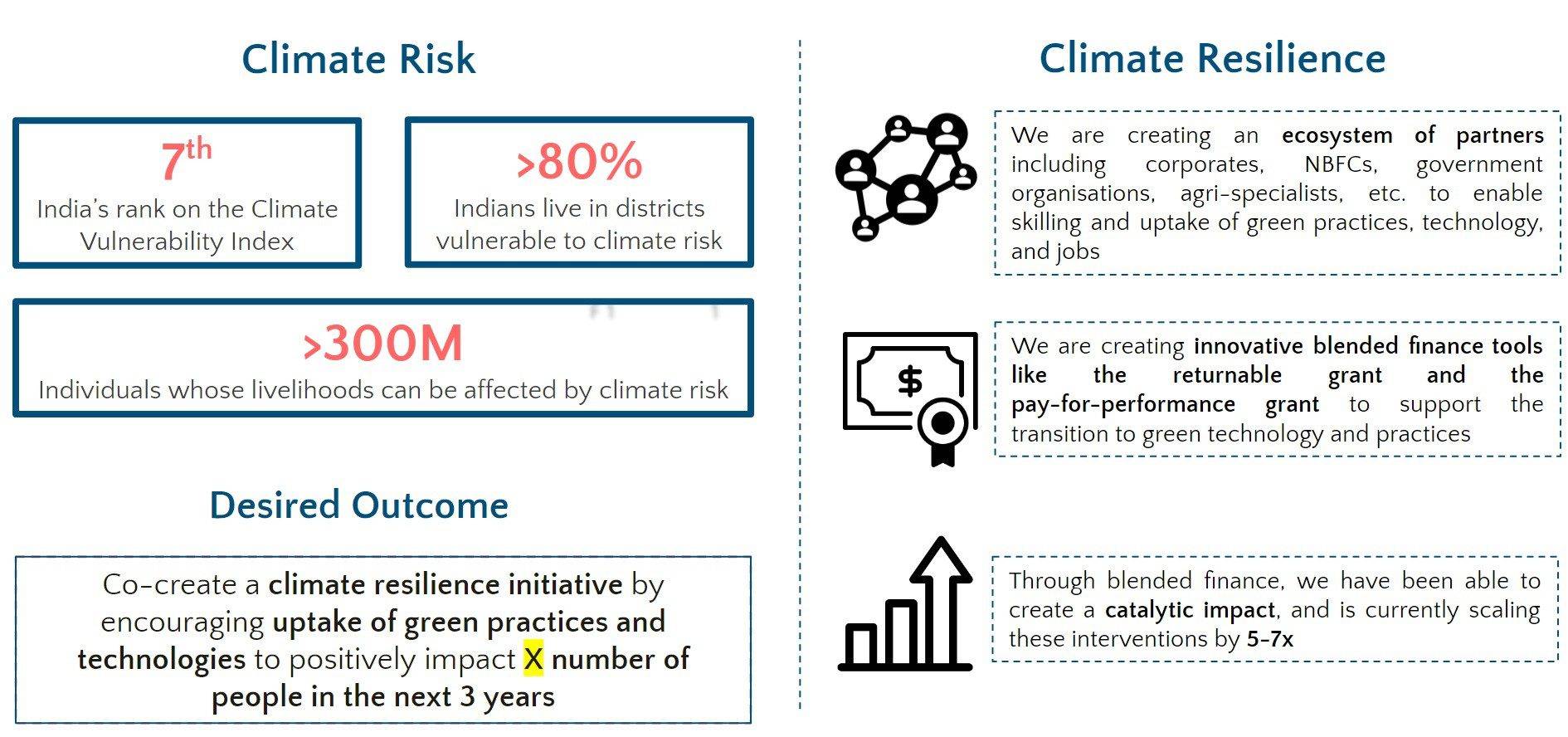

Challenges to generating livelihoods

welfare schemes

Participation Rate (FLFPR)

There is a massive credit gap of $530 billion in the MSME sector in India. Out of more than 64 million MSMEs, only 14% have access to credit.

47% of the debt demand is unaddressable as it comes from "enterprises which are not financially viable or prefer financing from informal sources.”

Only 6% of all MSMEs actively sell on e-commerce platforms. Owing to the informal nature of businesses, entering and navigating the market can be a daunting task. Limited market knowledge and resources exacerbate the challenges.

The Indian government spends over 7% of its GDP on welfare services. But there’s still a huge gap in the demand and supply, resulting in unspent funds.

India’s FLFPR is abysmally low at 23%, as compared to other emerging economies like Vietnam (~70%). while more women have a bank a/c now, with no gender gap, the number of women aged 15-49 who have money that they can decide how to use has grown very tepidly, from 44.6% to 51.2% between NFHS-3 IN 2005-06 and NFHS-5 IN 2019-21.

Latest News

- November 2, 2023

- November 2, 2023

- November 2, 2023

- November 2, 2023

- October 16, 2023

In a world striving for new innovations in pursuing holistic financial inclusion, Samhita-CGF takes a bold step forward with its

- September 20, 2023

Financial literacy has long been recognized as a key driver of economic growth and prosperity. This blog delves into the

- July 11, 2023

India’s informal sector makes up a significant portion of the country’s workforce ~43% and provides employment opportunities for millions,

- March 2, 2022

- February 14, 2022

The COVID – 19 lockdown has adversely impacted the most vulnerable sections of society, such as informal workers, farmers, street

- January 13, 2022

COVID – 19 has disproportionately affected women, owing to the compounded effect of generally earning less, saving less and holding