The Power of Painting

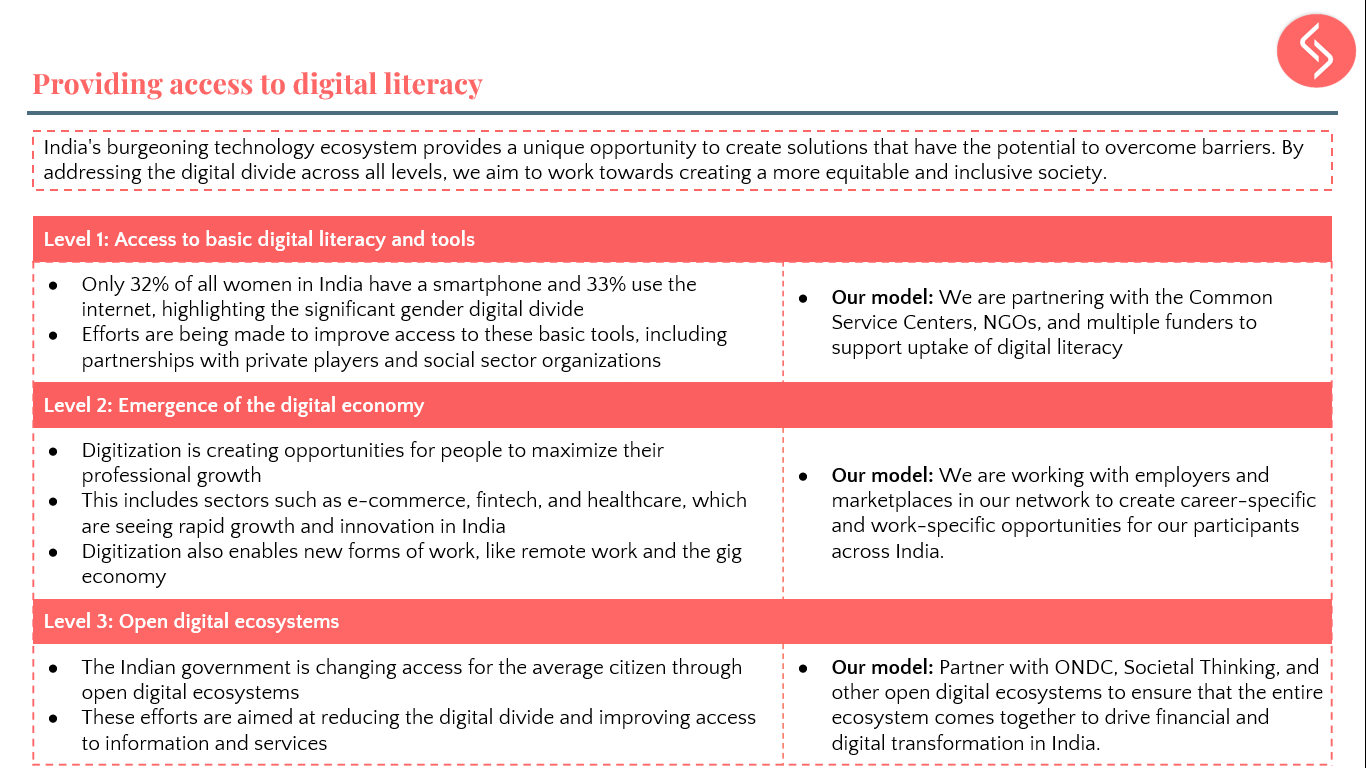

Through an artisanal upskilling program facilitated by the REVIVE Alliance, one resolute woman has found a way to turn her passion for painting into a means of income that can facilitate her children’s education.

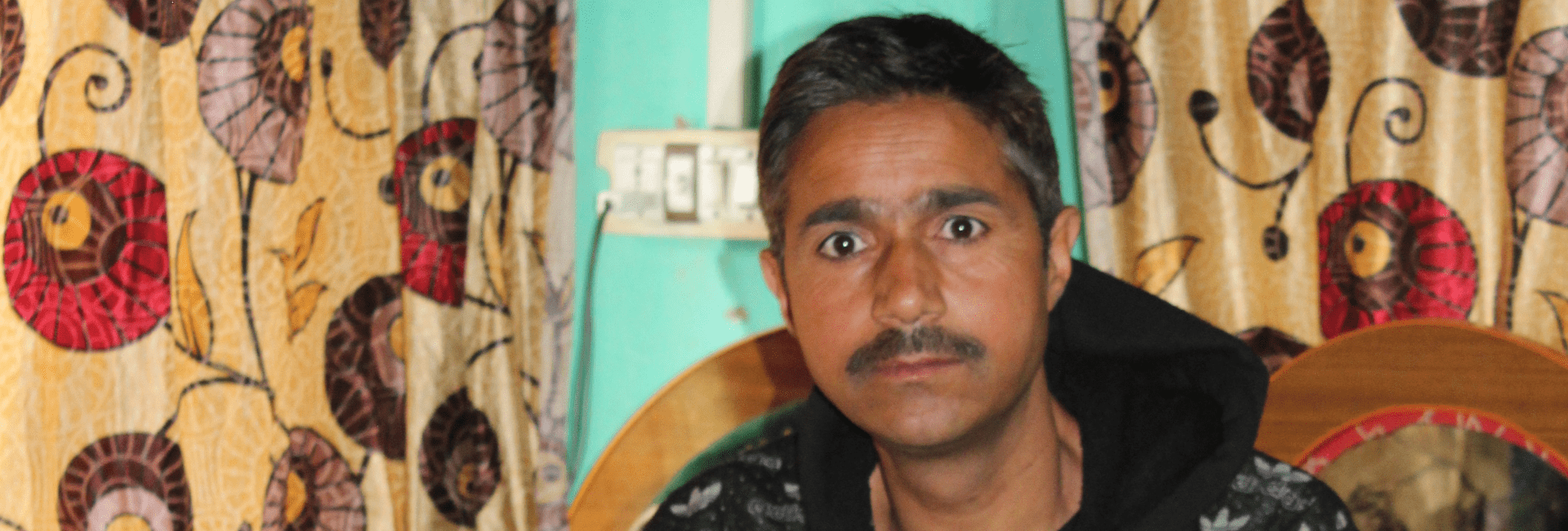

Gayatri Ganesh Gaikar, 38 years old, lives in a joint family which includes six other members. When two of them contracted COVID-19, the entire family had to quarantine themselves for 2 weeks, which not only increased their healthcare worries, but also their livelihood concerns. Gayatri, a mother of two children, shoulders all the domestic responsibilities in the household. Her husband, who works as a driver, lost his job due to COVID-19. “During the pandemic, his previous company shut down. He only gets little work now and only leaves the house for work on some days. Apart from him, in this household, I paint. Since we’ve had to stay at home and not go out to look for work, I’ve only been painting,” said Gayatri, who identifies herself proudly as a financial contributor to the family.

Gayatri’s household income has reduced by more than 50% due to COVID-19 related issues. Determined to supplement her family income, Gayatri turned her passion for painting into an income source after she heard about the TISSER skilling program, a part of the REVIVE Alliance, in her neighbourhood. “Earlier, I used to do some tailoring work like stitching bags along with other women in my bachat ghat (Self Help Group). In 2020, one of my neighbours told me about a TISSER training program and since I was interested in painting, I went to check it out,” said Gayatri.

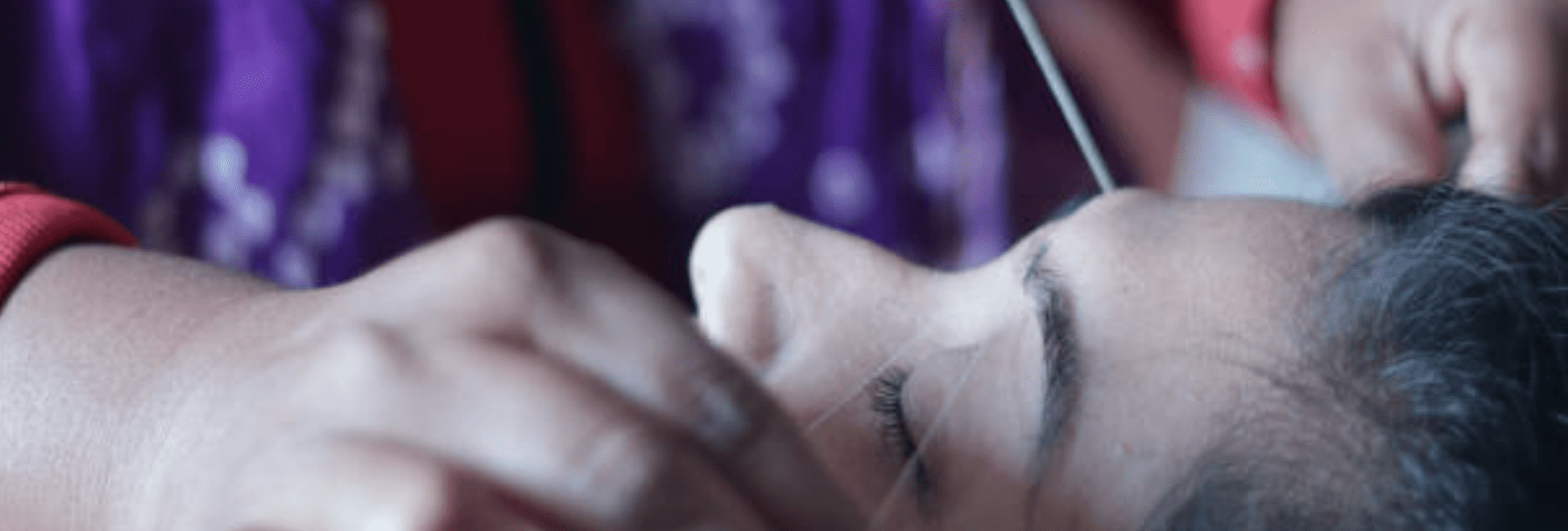

Through the TISSER program, Gayatri has already completed 1 year of professional training in Warli painting, and her second year is ongoing. “TISSER gives us raw materials, and we just do the artistic work and give the product — like odhani, kurta, dress — back to them; they sell it. We work in a group, but if there are too many people it gets scary because of Covid. I work in a group with 2-3 women from my village, so that we don’t have to travel much. I like working with them because I can work on the parts I enjoy — like designing. They are also very encouraging about my work,” said Gayatri.

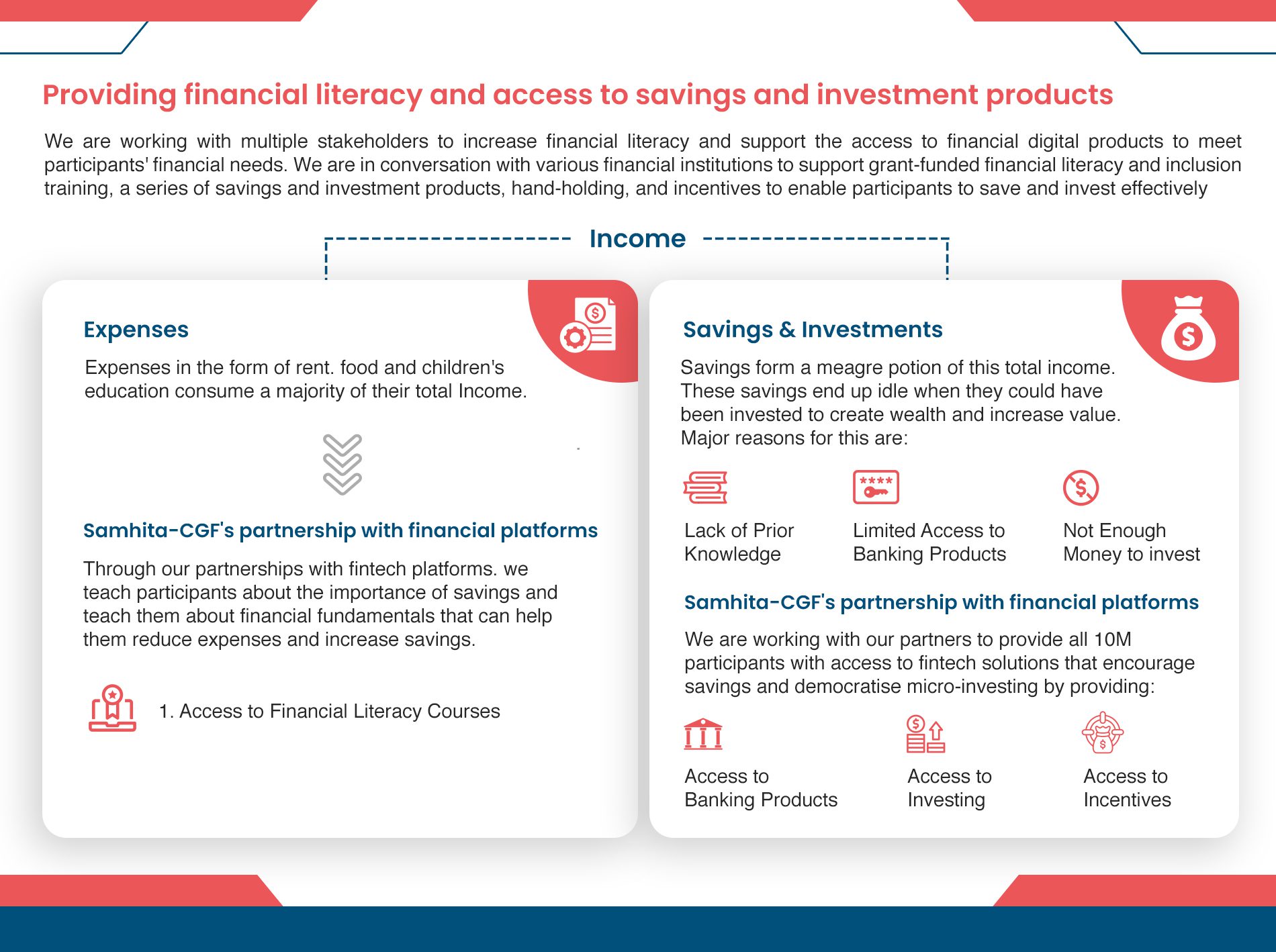

Her contributions to the household income (now around ₹ 8,000-10,000), helps them meet their bare basic needs — including food and children’s education. However, expenditure always threatens to exceed income. The family is worried about their health, their lack of savings and their difficulties in meeting monthly expenses. “I would like it if work increases. Some days we don’t get too much work and because of Covid, I can’t go out and I can only do this. More income would be nice because the kids are also studying now — 10th standard and 4th standard. I have my family’s support to work as well, so I can work well,” said strong-willed Gayatri.