Driving Her Happiness

“It’s almost like this rickshaw is currently our caretaker. It’s the sole reason we’re able to survive.”

When the pandemic hit, Usha ben was making sense of the losses she had incurred by setting up a roadside chow mien stall. With the lockdown in place, she had to stall her business. Her only resort was to make her rickshaw run. But with everything going downhill, the rickshaw, too, couldn’t support her much. In the middle of the lockdown, its battery drained. As there was no money even to get basic food on the table, repairing the vehicle was out of the question.

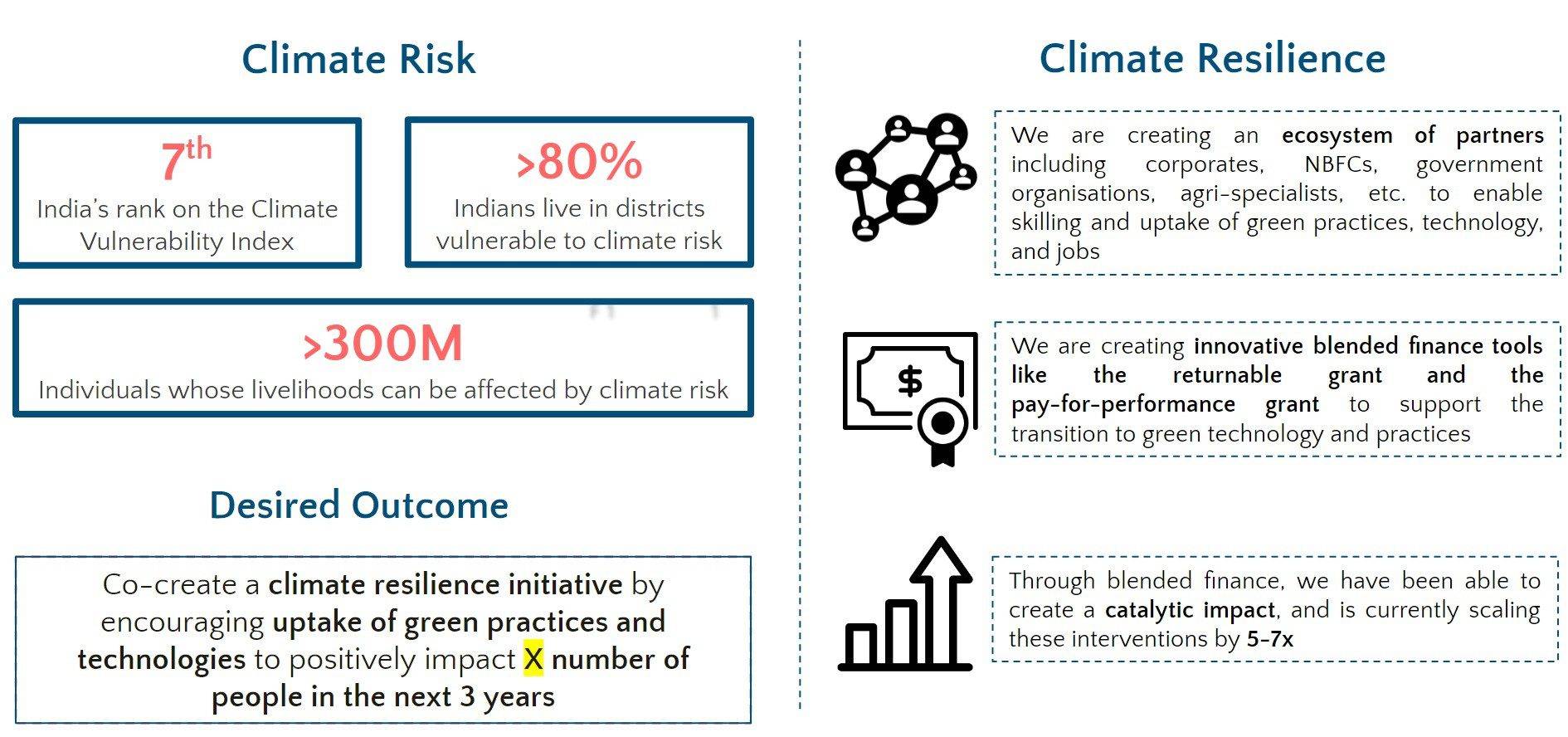

“It was one of the most painful times of my life,” recalls Usha ben. However, a ray of hope showed up when she got in touch with SEWA Bharat and understood that the returnable grant of INR 20,000 could help her get the rickshaw’s battery repaired to enter the market once again. She first came to the SEWA Bharat centre to get her younger daughter’s ‘janampatri’ made, and that’s how she continued to remain in touch with the centre. After three-four years, she applied for an account in the bank with the help of SEWA and that’s when their journey began.

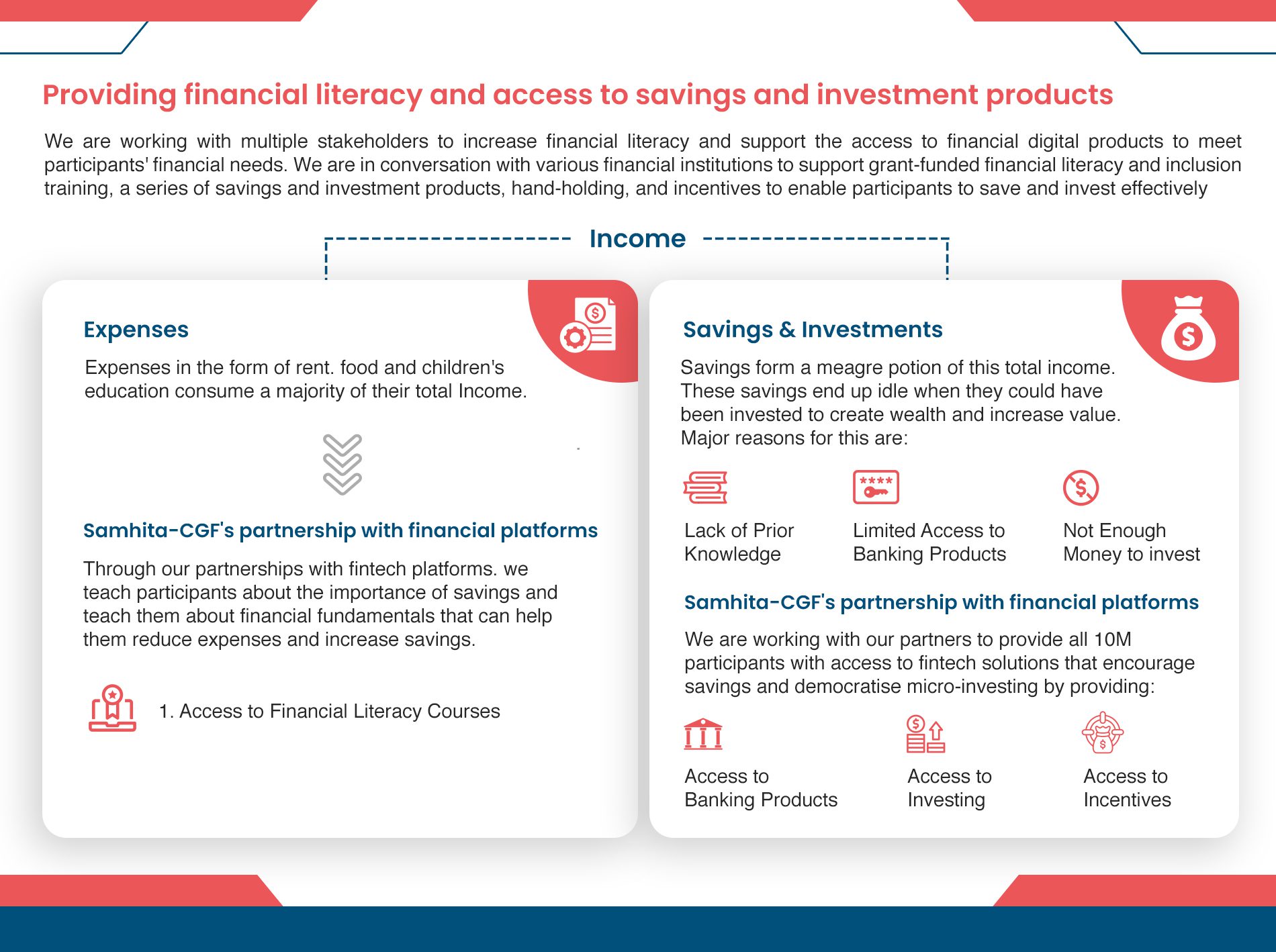

Since 1999, the SEWA Delhi microfinance program has enabled women to be financially included and independent. The aim is to ensure that members have access to savings and loans, particularly for working capital, and are prevented from exploitation by moneylenders.

“I was very disappointed as my work had stopped. I was facing severe issues, my income dropped and our ration was finishing. I approached Dolly didi from SEWA Bharat and she guided me through the process of procuring an interest-free loan. It helped me get the rickshaw battery changed and I was back on the road,” adds Usha ben.

Usha used to make electrical seals at her home before working as an e-rickshaw driver. For 1000 pieces she would get Rs 50 and in a day she could only make 220-250 seals in spite of working for more than 12 hours. Therefore, her elder brother suggested that she should drive an e-rickshaw. Usha has fond memories attached to the vehicle. Her elder brother not only went along with her for the purchase but also taught her how to drive.

“At the beginning, I was quite scared of how to drive the rickshaw and was so nervous thinking what if I hit someone or something. My brother sat beside me and taught me how to drive. I am very happy every time when the people of the centre are my passengers,” she tells.

Today, she earns anywhere between INR 700-800 per day and can provide for the education of her two young girls. “I take care of this rickshaw more than anything else in my life right now. I make sure it is always in good shape, I make sure I don’t park it randomly and so the chances of theft reduce, basically I make sure it is up and working -because this is the whole and sole of our lives right now,” she further adds.

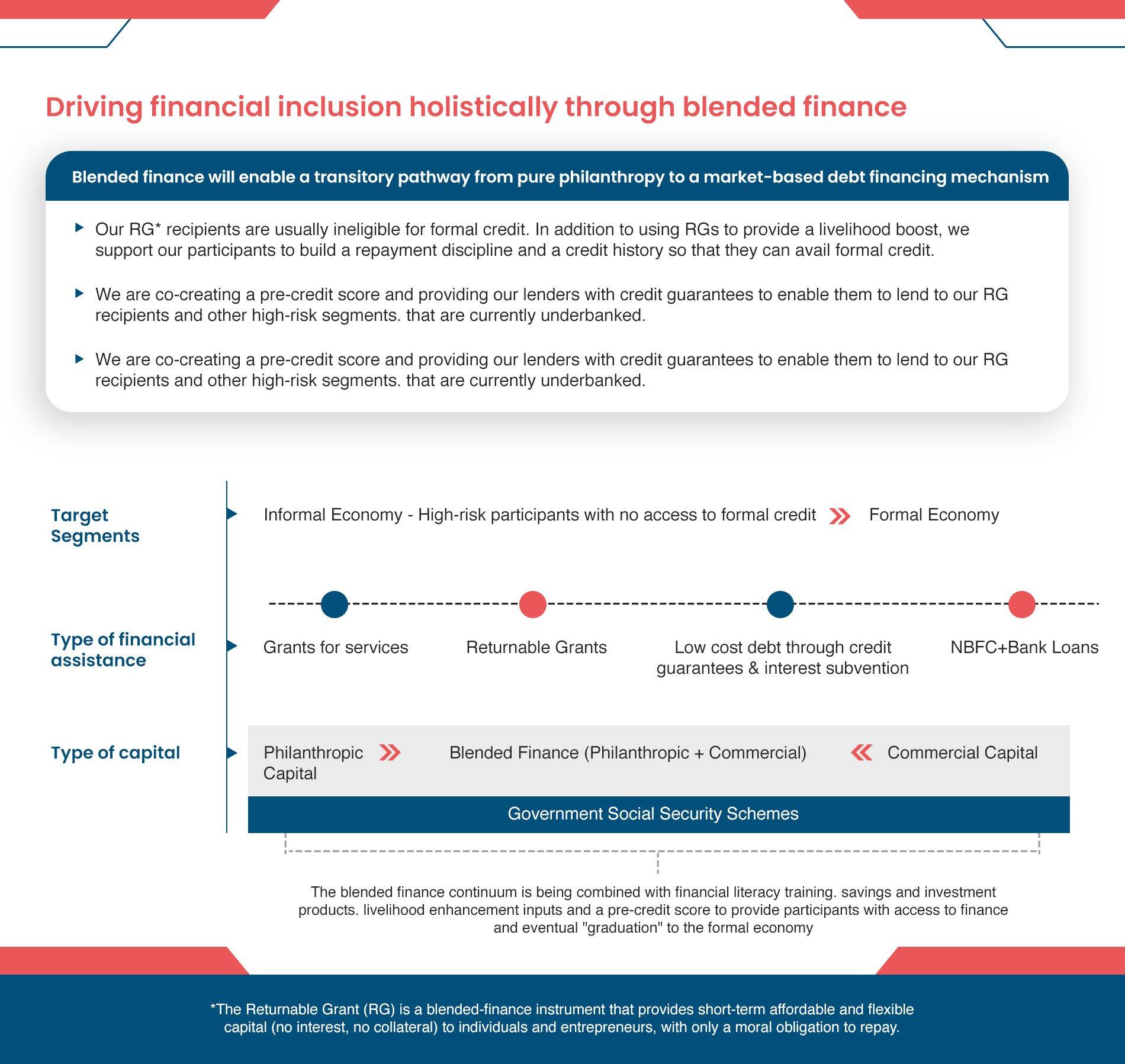

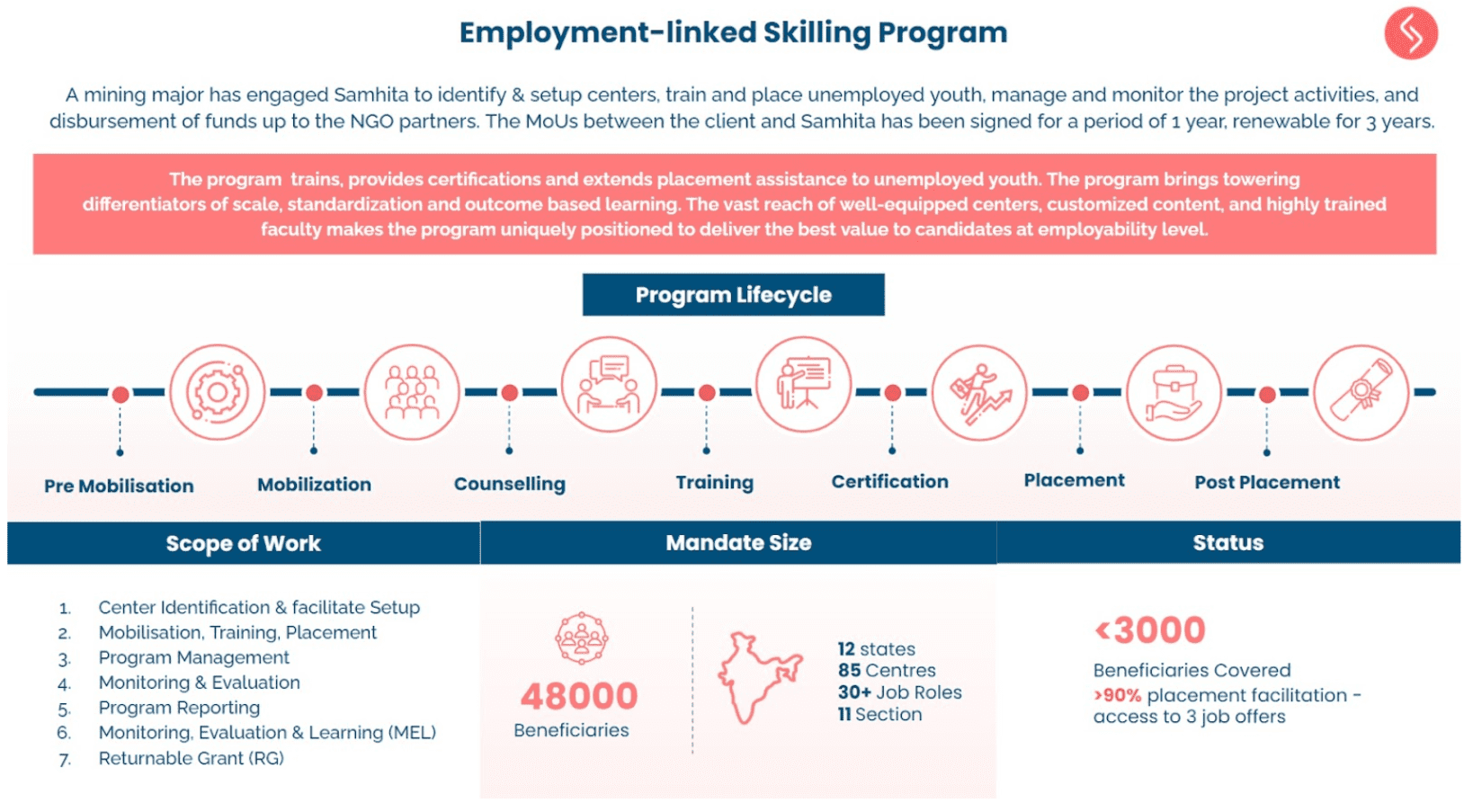

In the Returnable grant program by Samhita, 202 women micro-entrepreneurs were aimed to be supported in Delhi. They are from Jahagirpuri, Sundarnagri, Gokulpuri, New Ashok Nagar and Raghubir Nagar areas of Delhi and are associated with SEWA Delhi Trust and Delhi credit cooperative. These women are from the backward communities and informal sector who have lost their livelihood during COVID-19. Mostly women micro-entrepreneurs involved in some trades i.e Home Based worker, Vendor, Domestic Worker, Self Employed. Like Usha ben, most of them have set up their small business such as selling garments, jewellery or tie&dye dupattas. The Grant has helped them scale their reach and led to a consistent source of income.

Usha ben received the Returnable Grant in the first cycle, September 2021. With the help of her rickshaw business, she will complete the repayment of the loan (INR 6000) by July 2022.

“After all being your own boss is the best, isn’t it? I can drive this rickshaw as much on as many days as I feel. When I’m sick, I can just let it park. No one’s going to ask me questions on that, no? It’s a great feeling,” she concludes.

This story was editorialised by Avantika Seth