Tech underpins a new wave of Indian corporate social responsibility

Priya Naik, Founder and Managing Director of Samhita Social Ventures emphasizes on financial inclusion as the key to economic and social development in an article in CSR Mandate.

In India RBI describes financial inclusion as the process of ensuring access to appropriate financial products and services needed by vulnerable groups such as weaker sections and low-income groups at an affordable in a fair and transparent manner by mainstream institutional players.

Financial inclusion is a fundamental cornerstone of economic and social development. The mandatory CSR spending, as stipulated by the Companies Bill 2012, can help foster partnerships and help achieve a joint approach to promoting financial inclusion in a way that is mutually beneficial to all stakeholders. In order to realize the goal of universal financial inclusion, each stakeholder has to play its part and more importantly, collaborate with each other to harness the benefits and synergies of shared efforts.

The Better India featured Samhita

“Whether to safeguard their workers or help strengthen the country

“India no longer has the luxury of continuing to wait and watch as millions of its tribal peoples suffer and die from preventable causes.”

There is a much higher incidence of maternal and under-five mortality, stuntedness, tuberculosis, and cardiovascular diseases among India’s 104 million tribals compared with the larger population.

Piramal Swasthya and The Bridgespan Group map out the reasons for the lack of reduction of health challenges in tribal areas based on their field studies.

They outline factors such as barriers in access to healthcare and information, insufficient number of public health facilities, and lack of data.

They stress that for scalable and population-wide impact to be achieved, especially to meet India’s national aspirations of Sustainable Development goals of health and well being- a focused and collaborative approach between all stakeholders of society is the only way forward.

“Employees are agitating for decisions and behaviours that they can be proud to stand behind and gravitating toward companies that have a clear, unequivocal, and positive impact on the world. Organizations turning a blind eye will face inevitable blowback”.

Read McKinsey & Company’s insightful article ‘Purpose: Shifting from how to why

Ragini Menon, Consultant and Anushree Parekh, Advisor at Samhita Social Ventures ask,

“Beyond CSR, we believe in companies integrating social responsibility into their business practices. We have developed the Responsible Corporate Citizenship Continuum (RCCC) to articulate the role of the private sector in society and to provide companies with a framework to conceive human rights and social and environmental responsibility in their business practices as well as CSR.”

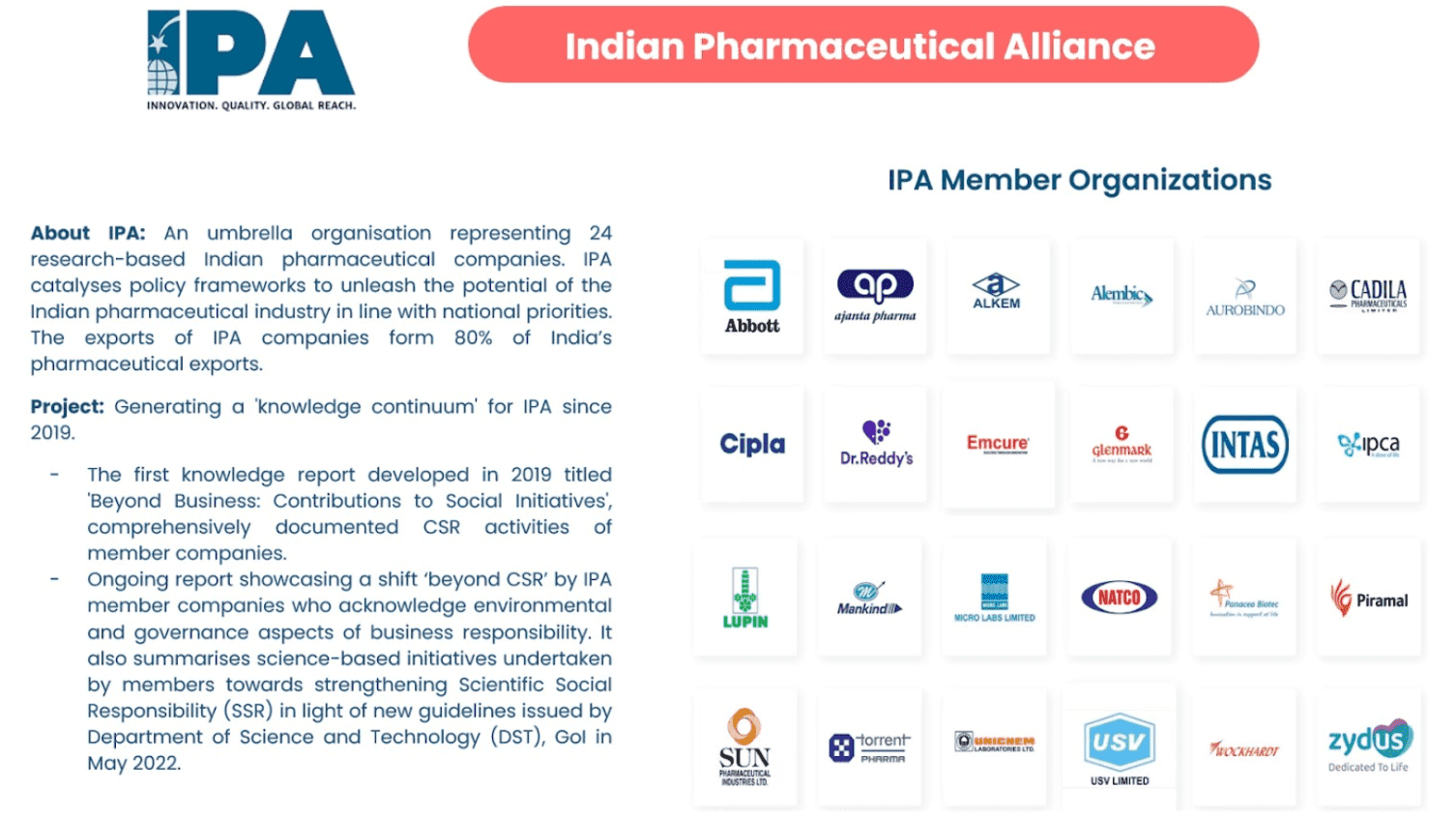

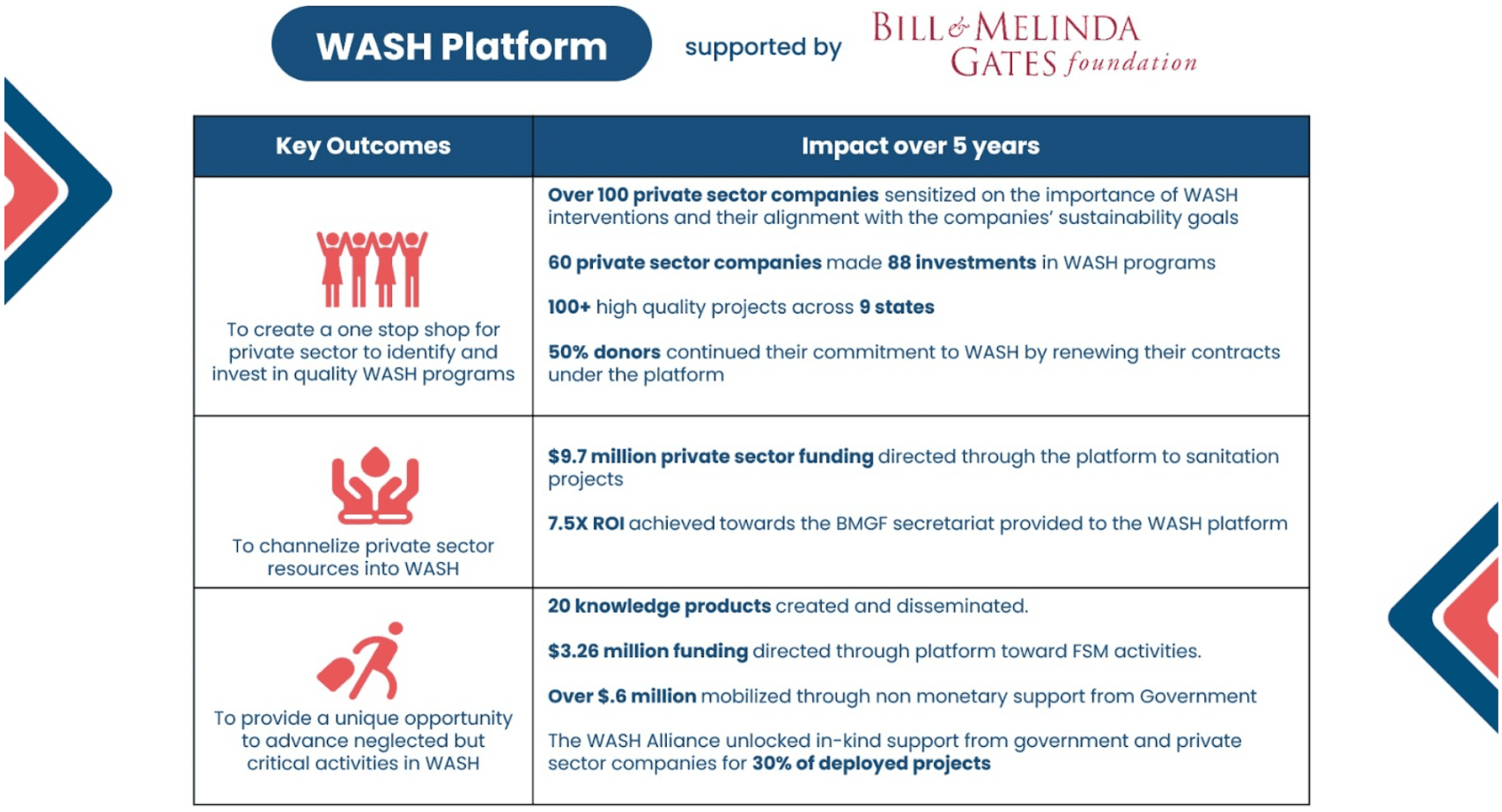

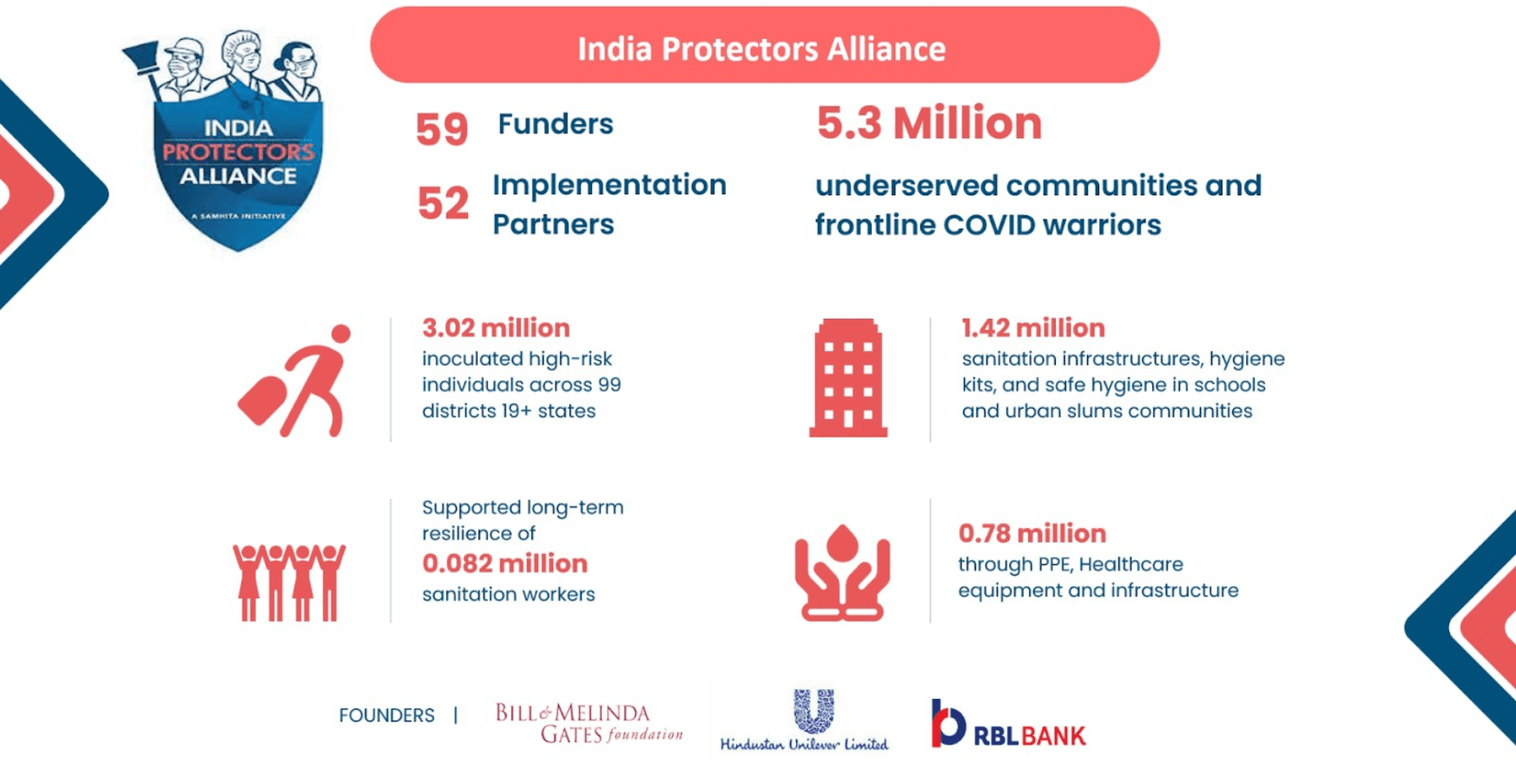

Priya Naik, Founder and CEO, Samhita Social Ventures is interviewed by CSR Mandate where she shares Samhita’s strategies and learnings over the last 10 years while collaborating with a variety of stakeholder such as companies, social enterprises, NGOs, governments, multilaterals and donors. Samhita has curated a number of collaborative platforms to address challenges such as gender inequality, water and sanitation and sustainable livelihoods, with each contributing stakeholder honing their core competencies to collectively create significant impact. In response to COVID, Samhita set up the India Protectors Alliance (IPA) to provide support and equipment to India’s frontline health care and sanitation workers, and REVIVE to pave the path for sustainable recovery of jobs and livelihoods by providing financial and technical assistance.

Covid-19 was an eye-opener for many businesses in that it revealed the importance of migrant and informal workers in a business’s supply chains. Undoubtedly, the corporate sector holds the potential and responsibility to change the dynamics within which workers operate. It is therefore in their own enlightened self-interest that businesses should understand migrant workers

Abhishek Gupta Associate Director

Abhishek Gupta Associate DirectorProfessional Experience:

He is a financial inclusion consultant. He has worked on projects related to digital payments, MSME finance, microfinance, business correspondents, creative industries, financial literacy, digital upskilling, and gender equity in financial services. His clients included the World Bank & IFC, USAID, Bill and Melinda Gates Foundation, Michael and Susan Dell Foundation, Better Than Cash Alliance (BTCA), DAI, Accion and Villgro. His focus is on using mixed-method research and design thinking to ensure customer centricity in financial services for low-income households. He has previously worked with LEAD at Krea University (IFMR), Intellecap and MicroSave Consulting (MSC). He has authored multiple publications, including bylines in Mint, Business Line, Inc42, CNBC TV18 and NextBillion.

Educational Background:

Abhishek holds a B.E. in Mechanical Engineering from Delhi College of Engineering (DCE), Delhi University and an MBA from Institute of Rural Management, Anand (IRMA).

Personal Interests and Hobbies:

Some of his hobbies include high-altitude trekking, playing chess and reading the history of economic thought.

Laxmi Grover Assistant Manager

Laxmi Grover Assistant ManagerProfessional Experience:

She comes with a blend of foundation in software engineering and a grasp of social impact, as she has transitioned from a technical background to a development-focused career. She has worked with Mitrata Inclusive Financial Services, Gov of Odisha (ORMAS), Greenpeace, TCS, and L&T Infotech in the past across domains like financial inclusion, sustainable livelihoods, M&E, and end-to-end project management.

Educational Background:

Laxmi is a B Tech graduate in Computer Science & Engineering from NIT Jalandhar and holds Masters in Social Sciences from Tata Institute of Social Sciences.

Personal Interests and Hobbies:

Some of her hobbies include

Swagata Gan Manager

Swagata Gan ManagerProfessional Experience:

She has worked in organisations like CINI (Child in Need Institute), IHAT (Indian Health Action Trust), PATH and ARMMAN and has been involved

Kaustubh Mishra Associate

Kaustubh Mishra AssociateProfessional Experience:

He has done internships with Education Department of the Government of Uttar Pradesh, Breakthrough Trust, Centre for Budget & Governance Accountability, and Niti Tantra. He brings strong skills in data analysis and proficiency in statistical tools including Excel, R, and Stata.

Educational Background:

Kaustubh holds a Bachelor’s degree in Public Administration from the University of Lucknow and a Master’s degree in Development Studies from the Tata Institute of Social Sciences.

Personal Interests and Hobbies:

Some of his hobbies include playing cricket, gardening, and reading books.

Vaibhavi Iyer Senior Manager – Marcom

Vaibhavi Iyer Senior Manager – MarcomProfessional Experience:

Vaibhavi has spent most of her career working with D2C businesses and brands. She started off her career as the first product manager at CRED, followed by building an ed-tech business at the peak of the pandemic at Openhouse and eventually transitioning to a skin-in-the-game consulting and venture-capital firm called Spring Marketing Capital. Over the course of her career, her main focus has been Strategy (with a focus on consumer insights) and Brand Building.

Educational Background:

Vaibhavi holds a B.A. Economics Honors Degree from St. Xavier

Shahzad Shaikh System Administrator

Shahzad Shaikh System AdministratorProfessional Experience:

He holds experience in maintaining, upgrading and managing the applications, software, hardware and networks. His last assignment was with Oasis Capital – Manama, Bahrain . Previously he as also worked with organizations like Ramee Group, Wipro InfoTech and Trimax Computer Ltd.

Educational Background:

Shahzad holds Bachelor

Rachana AgarwalManager – Flagship

Rachana AgarwalManager – FlagshipProfessional Experience:

Rachana is a experienced instructional designer with over 20 years of experience in the industry, analyzing learning needs and developing customized content for extensive mandates for the government, social sector and corporates.

Educational Background:

Rachana is a graduate in English Literature from Women

Mohit Sharma Manager – ONDC

Mohit Sharma Manager – ONDCProfessional Experience:

He holds experience in Brand Sourcing, Market Research, and successful Merchandising across business to business (B2B) and business to customer (B2C)models. His last assignment was with Metaverse Blockchain Solutions Pvt Ltd. where he was spearheading the merchandising strategy for the e-commerce & reward platform, optimizing, product assortment and placement to maximize sales and customer engagement, brand on-boarding and brand closures. Previously he has also worked with organizations like Shopclues.com, Killer & Lawman Pg3, Pepperfry , Fashionandyou and Shoplik.com.

Educational Background:

Mohit holds a Master degree from IMT Ghaziabad.

Personal Interests and Hobbies:

Some of his hobbies include

Kunal Dhooper Associate Director – ONDC

Kunal Dhooper Associate Director – ONDCProfessional Experience:

He holds expertise in visualizing the e-commerce business value chain in Indian and Global context. He has been leading multiple projects and teams to drive online growth, GTM strategy for startups and digital partnerships. In his last assigbment he was the Co-Founder of the URBCLAN(Clothing accessories) brand. Previously he has worked with organisations like Zigly, Gadgets360, NewU (Subsidiary of Dabur India Ltd), Snapdeal and Flipkart.

Educational Background:

Kunal Dhooper holds a Bachelors degree in Commerce from University of Delhi Masters Degree in Marketing from IP University.

Personal Interests and Hobbies:

Some of his hobbies include – playing badminton and playing percussion instruments.

Vikas Kantu Director – ONDC

Vikas Kantu Director – ONDCProfessional Experience:

Johny holds expertise in strategic planning, process design, and implementation, proficient in cross-functional project execution and delivery, with a deep understanding of tech platforms and marketplace systems. He has proficiency in setting up Processes, Transitions, Governance & SLAs, directing business transformation initiatives & establishing processes for delivering high-quality solutions. His last assignment was with Flipkart Internet Pvt. Ltd. Where he was leading the Central Supply Analytics, Seller Marketing, Monetization charter, and Tier 2 Account management for sellers. Previously he has also worked with organizations like Cure.Fit, Canara Paper Mills and GMJ Paper & Boards.

Educational Background:

Johny holds a B.E. Mechatronics Engineering degree from Anna University, Chennai and MBA in Operations Management from SIBM, Bengaluru.

Vikas Kantu Head – Marcomm

Vikas Kantu Head – MarcommProfessional Experience:

He holds expertise in defining brand vision, guidelines, strategy, positioning and creating impactful Communication & Media strategies. Collaborated with the top agencies, celebrities, script-writers, directors to craft 25+ remarkable ad films. His last assignment was with Spartan Poker as Head

Akash RoyTechnology Product Lead

Akash RoyTechnology Product LeadProfessional Experience:

Akash Roy joins us as a Technology Product Lead. He is based out of Mumbai, and will be working closely with Priya Naik. He has 17 years of total experience, with 8 years in Technical Project Planning.

Educational Background:

Akash holds a Bachelors and Masters Degree in Business Administration and is a certified Project Manager and Product Manager.

Personal Interests and Hobbies:

He is someone who likes to research on a wide range of topics like, History, Space and Tech as a hobby. He also loves to trek.

Noshir Dadrawala

Noshir DadrawalaAbout Noshir:

Mr. Noshir H. Dadrawala is the Chief Executive of the Centre for Advancement of Philanthropy. He has been with the Centre since its inception in 1987. Currently, he serves on international boards as; Member, Asia Pacific Philanthropy Network which is a part of Give2Asia based in San Francisco, member of the Coordinating Committee of Brazil based Worldwide Initiatives & Network of Grant-makers (WINGS), Fellow of the Centre for Study of Philanthropy (New York) which is affiliated to the Graduate School & University Center of the City University of New York, member of the Advisory Council of the U.S. based International Centre for Not-for-profit Law. He is also a trustee of; Resource Alliance (India), India Sponsorship Committee, Make A Wish Foundation

Our collaboration with

CIIE.CO, the Innovation Continuum at IIM Ahmedabad, has partnered with 360 One Foundation to address the critical issue of limited access to quality credit for the Bharat Segment, encompassing Indian households earning less than $10 a day. With 360 One Foundation’s invaluable support, CIIE.CO has empowered three inclusive lending start-ups with catalytic funding, designated as First Loss Default Guarantee (FLDG) capital. Additionally, one start-up received funding for validating its business case.

This catalytic funding has been a game-changer, enabling these start-ups to unlock over 10 times the initial capital from formal credit sources. This, in turn, helps them validate their business models, extend financial inclusion, and broaden access to credit for the Bharat Segment.

Throughout the project, CIIE.CO also provided critical technical assistance and ongoing support to these selected start-ups over an 8-month period.

Key Project Components:

Blended Finance Instrument: First Loss Default Guarantee (FLDG)

Project Location: Pan India (Start-ups based at IIM-Ahmedabad)

Total Start-ups Supported: 4

Total Unique Incremental Borrowers from the Bharat Segment Impacted: 5,750+

Additional Funds Unlocked: Approximately INR 14,15,00,000

Support to Start-ups: Diagnostic Panels, Mentoring Clinics, Portfolio Engagement Hours

This partnership drives financial inclusion and empowers the Bharat Segment by fostering innovation and expanding access to credit opportunities.

IIT Delhi’s SAMRIDH Hosting entity, in collaboration with the National Skill Development Corporation (NSDC) and the 360 One Foundation, has initiated an innovative financing solution to empower vulnerable communities through skill development and job placement. This project aims to generate livelihoods for beneficiaries from underserved backgrounds.

Phase 1 – Training: The project utilizes a grant of INR 1.3 Crores from the 360 One Foundation to leverage an additional working capital loan of INR 4 Crores from NSDC, offering an affordable interest rate of 6% per annum. This financing mechanism includes a 30% partial risk guarantee. With this support, a remarkable 2,420 beneficiaries receive training and job placement opportunities, significantly exceeding the impact of traditional grant-based training programs. The guarantee is renewable for two years, and any unutilized portion can further enable working capital loans, extending support to additional beneficiaries.

Phase 2 – Placement & Retention: Upon successful job retention for three months post-placement, a portion of the 360 One Foundation’s grant (INR 26.7 lakhs) transforms into a Social Success Note, linked to beneficiary placement and retention. This innovative approach reduces borrowing costs for the implementing entity and incentivizes NSDC for improved performance outcomes.

This project aligns with CSR regulations under clause (ix)(b) of Schedule VII of the Companies Act, 2013. It contributes to public-funded universities like IITs, facilitating research aimed at promoting Sustainable Development Goals (SDGs). To ensure CSR compliance, IIT Delhi disburses the grant to NSDC, provides evidence of utilization, monitors and reports the training and placement of marginalized beneficiaries, and tracks the grant for two years to provide further support as needed.

This innovative financing solution enables the implementing entity to offer short-term training and placement services to beneficiaries, whether through fee-based or government-sponsored models. Overall, this initiative has the potential to exponentially impact the lives of vulnerable communities by providing them with valuable skills and access to sustainable livelihoods.

This project in collaboration with SEWA aims to offer financial access for business growth and economic stability to 2,500 unbanked women micro-entrepreneurs including vendors, home-based workers, and agriculture. Our pre-credit score system and credit guarantee mechanism will enable them

Jagdish Acharya

Jagdish AcharyaAbout Jagdish:

Mr.Acharya brings over 44 years of executive leadership experience, and is passionate about driving skill development, quality improvement, and innovation in the paint and coatings sector. As the CEO of PAINTS & COATINGS SKILL COUNCIL, he leads a dynamic team of professionals who work with industry stakeholders, government agencies, and training partners to create and implement competency-based standards, curricula, and assessments for the industry. In his current role, he has successfully launched several strategic initiatives, such as the National Apprenticeship Program, the Recognition of Prior Learning, and the Paints and Coatings Academy for the Paints and Coatings Industry. These initiatives have enabled thousands of workers and students to acquire industry-relevant skills, certifications, and career opportunities. He has also established strong partnerships with leading paint manufacturers, associations, and educational institutions to promote the adoption and recognition of the NCVET standards and programs. Additionally, he has represented the industry at various national and international forums and events, showcasing the best practices and achievements of the Indian paint and coatings industry

Subho Moulik

Subho MoulikAbout Subho:

He is a Chartered Accountant and an MBA from London Business School.

He brings over 18 years of experience in technology sales, marketing, product development, innovation and strategy. He was associated with companies like Wayfair, Arthur Andersen, Ernst & Young, the Citi Group, Mckinsey & Company, Whirlpool Corporation, and Adani Group, amongst others.

Subho is a pro-bono advisor for the overall strategy and technology development for Samhita-CGF.

Sudip Basu

Sudip BasuAbout Sudip:

Sudip is a Bachelor of Technology graduate from IIT Kharagpur, and holds a post graduate diploma in marketing & finance from IIM, Bangalore.

He brings 3 decades of rich experience in risk management, lending to retail, SMEs, large corporates, cash flow lending, etc. He was the MD, Risk Management, Citi Private Bank, Mumbai and is currently the Group Risk Head at the Hinduja Group.

Ajay Satish SoniFull-stack Developer

Ajay Satish SoniFull-stack DeveloperProfessional Experience:

Ajay has 1 year experience in Full-stack development. Completed 15 project and reached up to 1 million leads. Builded e-commerce ,Food Franchise and Traveller Franchise, Waterpark

Sudhir NaikCFO

Sudhir NaikCFOProfessional Experience:

A qualified finance professional (ACA, AICWA, ACS), Sudhir has served articles with A F Ferguson & Co and served MNCs

Diviniti KothariAnalyst-Strategic Partnerships

Diviniti KothariAnalyst-Strategic PartnershipsProfessional Experience:

She has gained expertise in research, policy-making, and legislative affairs through her collaboration with various political figures. She has completed her internships

Akriti TiwariAssociate – Marcomm

Akriti TiwariAssociate – MarcommProfessional Experience:

Akriti’s last assignment was with Pokerbaazi

Shreya KuruvillaManager – Implementation

Shreya KuruvillaManager – ImplementationProfessional Experience:

She is a Social Impact Professional with over 8 years of experience working in multiple domains. She holds expertise in managing end to end projects implementation across various thematic areas. Her last assignment was with America India Foundation. She has previously also worked with organizations like Capgemini, TechnoServe and HCL Foundation.

Educational Background:

She holds a B.A Hons. in History from St. Stephen

Juhi AnandSr. Associate – Implementation

Juhi AnandSr. Associate – ImplementationProfessional Experience:

Juhi

Aarchita SharmaAssociate – Revive

Aarchita SharmaAssociate – ReviveProfessional Experience:

Aarchita has worked as a Young Professional at the Rajasthan Grameen Aajeevika Vikas Parishad (RGAVP), Ministry of Rural Development, Government of Rajasthan. She then joined as an Academic Associate at the Kautilya School of Public Policy in Hyderabad.

Educational Background:

Aarchita holds a BA in Social Sciences from the Tata Institute of Social Sciences and a MA in Development Studies from the Indian Institute of Technology Guwahati.

Personal Interests and Hobbies:

Some of her hobbies include

Ramakrishna MSr. Associate – Skilling

Ramakrishna MSr. Associate – SkillingProfessional Experience:

Ramakrishna

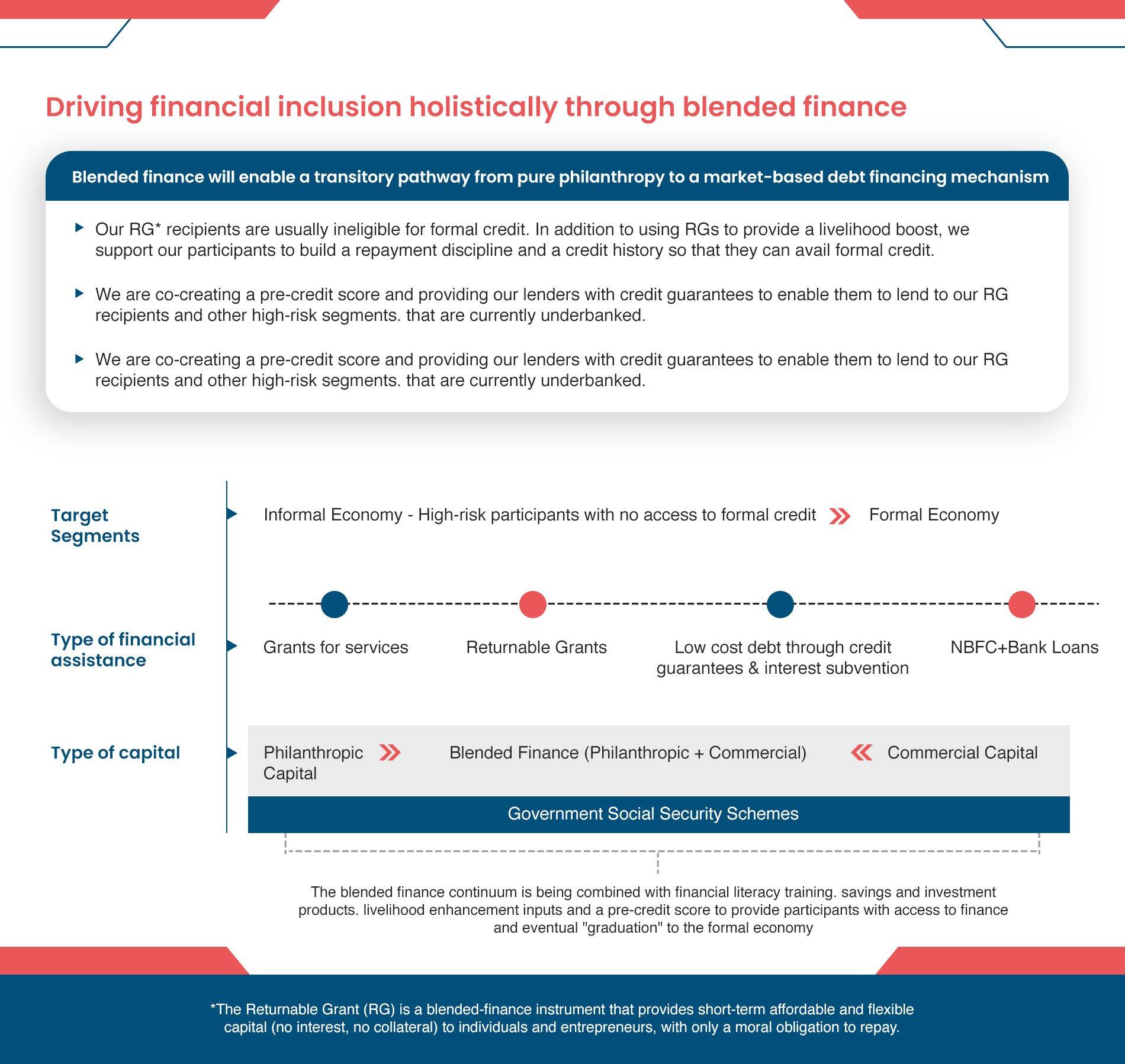

The need for blended finance in India:

Blended finance (BF) is the strategic use of development finance from public and philanthropic sources to mobilise additional capital from the private sector towards greater, sustainable impact. Typically, grant funding is blended with other sources of capital such as debt or equity to maximize funding and social impact capacity.

Blended finance provides opportunities for transformation of the social impact space by working at the intersection of sarkaar, bazaar and samaaj. It uses a network mindset, bringing with it a set of partners, protocols and governance rules, to design interventions and amplify impact at-scale.

Muli DeviMicroentrepreneur, Gokalpuri

Muli DeviMicroentrepreneur, GokalpuriMicro-entrepreneurs – Reviving Muli Devi

VarshaBeautypreneur, Ghaziabad

VarshaBeautypreneur, GhaziabadBeautypreneurs – Varsha went from Helper to Owner

For Varsha, being a beautician was of an interest right from her 12th class. She picked up this skill in Meerut post which she received a formal training with Empower Pragati. A freelancer before (for 2.5 years) who also used to work at an E-aggregator platform for beauty services, Varsha now owns a salon just on the front porch of her house. Varsha has employed one helper at her salon. She received a grant of ?20,000 and she has been able to purchase a ring light, a curling machine and other makeup products. She currently sees 4 to 5 customers in a day and is earning an income of up to ?12,000. She created a savings account in the name of her children and now wishes to grow her business and look for a better place to shift her business.

Mansi SuhasBamboo artisan, Chandrapur, Maharashtra

Mansi SuhasBamboo artisan, Chandrapur, MaharashtraArtisans – Doubling Mansi

In a country as diverse as India, access to credit can be a challenge, particularly for those without established credit histories. CGs play a vital role in enhancing financial inclusion by encouraging lenders to extend credit to a broader range of borrowers, thereby fostering entrepreneurship and economic development.

Credit Guarantees step in to provide that extra layer of assurance, boosting confidence among lenders to extend loans to a wider range of borrowers who otherwise may not be eligible for such support. This not only supports economic growth but also empowers individuals and businesses to seize new opportunities.

We are creating a INR 500Cr credit guarantee facility with CGTMSE, called

Credit Guarantee is a financial mechanism where a third party (often a government agency or a financial institution) promises to repay a loan, or a part of the loan, on behalf of a borrower if the borrower is unable to do so. In other words, it

Kotak and USAID are creating a $200M pari-passu credit guarantee facility to support lending to NTC and NTB entrepreneurs, with a focus on women. Through this facility, USAID will provide a pari-passu guarantee to Kotak to support on-lending to NBFCs. Kotak will in-turn provide loans at subsidized rates to NBFCs to facilitate and promote lending to higher-risk segments.

Entrepreneurs availing of this facility will also receive additional intervention support like financial and digital literacy, skilling, and enterprise development to bolster their capabilities to repay the loans on time and reduce risk for NBFCs.

Praveen BVManager – Skilling

Praveen BVManager – SkillingProfessional Experience:

He has previously worked with organizations like Digital Academy 360, Rooman Technologies Pvt. Ltd., Agastya EdTech Pvt. Ltd. and Direct Dialogue Recruiter. He holds expertise in project planning, execution, client acquisition, account management and strategic planning.

Educational Background:

Praveen holds a BBM Degree in Marketing from Dayananda Sagar Junior Business School, and Masters Degree in MBA from Sikkim Manipal University.

Personal Interests and Hobbies:

Some of his hobbies include – playing cricket and reading novels.

SupriyaManager – Skilling

SupriyaManager – SkillingProfessional Experience:

She is a development professional with nine years of experience with organizations like Bihar Rural Livelihoods Promotion Society in Bihar and Bharat Rural Livelihoods Foundation in Delhi. She holds expertise in handling project management in skilling & livelihoods space at the local and national levels, managing budgets, government relations, prospect researching and

partnerships.

Educational Background:

Supriya holds B.Com degree from Patna University and Masters Degree in Development Management from Indian Institute of Forest Management, Bhopal.

Personal Interests and Hobbies:

Some of her hobbies include reading and cooking.

Priyanka SrivastavaBusiness Analyst

Priyanka SrivastavaBusiness AnalystProfessional Experience:

Her expertise is to closely work with the business teams and understand the

requirements and align the same with the development teams. Her last assignment was with In-solutions Global Pvt Ltd as Functional Business Analyst wherein her major responsibility was to handle the organization’s application which was used to settle NETC (National Electronic Toll Collection ) Toll Transactions for different bank clients. She has also worked with IIT- Delhi as Project Assistant.

Educational Background:

Priyanka holds Business Analyst Certificate (IIBA endorsed) and MCA degree from Annamalai University.

Personal Interests and Hobbies:

Some of her hobbies include reading and cooking.

Sachin ShindeSystem Admistrator

Sachin ShindeSystem AdmistratorProfessional Experience:

Sachin brings with him over 15 years of experience in the IT Infrastructure Management. He holds expertise in handling Technology Operations, Information Security, Service Desk Management, Business Application, network maintenance, Linux, Windows (All versions) & MS- DOS. His last assignment was with IFAST Financial India Pvt Ltd as Lead, IT Infrastructure. Previously he has worked with companies like Sunshine Telesoft Pvt Ltd, Fashion Life Style, Entire Software Exports pvt. Ltd. and Comptrain Center Pvt. ltd.

Educational Background:

He is a Economics graduate and holds a DBA certification and Diploma in Hardware and Networking.

Personal Interests and Hobbies:

Some of his hobbies include – playing Cricket & programming.

content1}

content1}

Amit Garg

Amit GargAbout Amit:

Amit Garg leads the regional program strategy, grants management and partnerships for the Global Fund to End Modern Slavery (GFEMS) in India and Bangladesh. GFEMS is a Washington D.C.-based fund backed by the US, UK and Norwegian governments in addition to private foundations and aims to combat human trafficking in all its forms. This includes labour exploitation, bonded labour & child labour in global supply chains (such as construction and apparel) and commercial sexual exploitation of children. Prior to this, he led the philanthropy portfolio for Credit Suisse (CS) bank aimed at education, financial inclusion and skill development. He also led a similar portfolio for Godrej Properties (part of the larger Godrej Industries Group) prior to CS where the grants were aimed at making rural to urban migration safer. Previously Amit has worked with UNICEF as State Coordinator

Nachiket Mor

Nachiket MorAbout Nachiket:

Nachiket Mor has a PhD in Economics from the University of Pennsylvania. His current work is principally focused on the design of national and regional health systems.

He was a member of the Planning Commission

Irfan Nooruddin

Irfan NooruddinAbout Irfan:

Irfan is the Director of the South Asia Center at the Atlantic Council. He is also a Professor in the School of Foreign Service at Georgetown University. Dr. Nooruddin conducts research in the political economy of development, trade, and investment, and the challenges of democratization in the 21st century.

He is the author of Elections in Hard Times (Cambridge University Press, 2016) and Coalition Politics and Economic Development (Cambridge University Press, 2011) and more than twenty-five scholarly articles and book chapters. In 2012, he was a Fellow at the Woodrow Wilson International Center for Scholars in Washington, DC., and is a Team Member of Lokniti: Programme in Comparative Democracy in New Delhi, India. He has received grants from the Bill & Melinda Gates Foundation and USAID.

Irfan has a PhD in Political Science from the University of Michigan and a BA in Economics and International Studies from Ohio Wesleyan University. He was born and raised in Bombay where he studied at St. Xavier

Arun Maira

Arun MairaAbout Arun:

Arun Maira is a thought leader on social and economic development and transformational change and leadership. He is an author of several books including Shaping the Future: Aspirational Leadership in India and Beyond; Redesigning the Airplane While Flying: Reforming Institutions; and Transforming Capitalism: Improving the World for Everyone. His most recent book is Listening for Well-Being: Conversations with People Not Like Us. He is a frequent speaker at international forums on the reform of institutions.

Mr. Maira is Chairman of the Board of Trustees of HelpAge International and Chairman of the Foundation for MSME Clusters. He was a Member of the Planning Commission of India from 2009 to 2014, and of the National Innovation Council, besides being Chairman of The Boston Consulting Group in India from 2000-2008. Earlier, he worked with the Tata Group for 25 years in senior management and board positions.

Suhas Misra

Suhas MisraAbout Suhas:

Suhas completed his MBA from IIM Calcutta (Class of 2003) and started his professional career with Coca Cola. In 2005 he moved to Nokia as a Regional Sales Training Manager and in 2006, started ChannelPlay- India

Paresh S. Parasnis

Paresh S. ParasnisAbout Paresh:

Paresh Parasnis in his current position as Head of Piramal Foundation is responsible for all the CSR activities of Piramal Enterprises Limited. Paresh is a Fellow of the Institute of Chartered Accountants of India and a graduate of Mumbai University. Paresh started his career with Hindustan Lever Limited. He then moved on to HDFC Limited, where he handled various responsibilities. His last assignment in HDFC Ltd was business development and overseeing the operations in Maharashtra, Gujarat and Madhya Pradesh. In November 2000, Paresh moved to a new venture in the HDFC fold to set up the life insurance company, HDFC Standard Life Insurance (a joint venture with Standard Life plc, UK). In November 2008, Paresh was appointed as a full time member of the Board of Directors of HDFC Standard Life and served as the Executive Director and Chief Operating Officer till July 2012. During his tenure with HDFC Standard Life, he was a Member of Board Committees and Chair / Member of internal management committees. He also has a vast experience in the area of consulting and has been a Project Manager / Financial Analyst in programs funded by multilateral agencies. He brings with him a rich experience of 30 years with major strengths in strategy formulation, project management, time-bound execution and building robust and customer-friendly servicing models.

Krishnan Neelakantan

Krishnan NeelakantanAbout Krishnan:

Krishnan Neelakantan is Senior Director

Amita N. Vyas

Amita N. VyasAbout Amita:

Dr. Amita Vyas is an Assistant Professor & Director of the Maternal & Child Health masters in public health program in the Department of Prevention and Community Health at the George Washington University School of Public Health and Health Services, and holds an adjunct appointment with the Johns Hopkins Bloomberg School of Public Health. Dr. Vyas is a public health scientist whose primary research focuses on reproductive and sexual health. At George Washington University, Dr. Vyas teaches Reproductive Health: US and Global Perspectives, Adolescent Health & Development, Social and Behavioral Determinants of Health, and Management Approaches to Public Health. Dr. Vyas has given lectures and speeches around the country including Capitol Hill and was the Chair for

N.S. Raghavan

N.S. RaghavanAbout N.S. Raghavan:

N.S. Raghavan is a co-founder and former Joint Managing Director of Infosys who took voluntary retirement from Infosys in the year 2000 to promote his vision of entrepreneurship and India-based global companies on a broader scale.

Nadathur Holdings & Investments was incorporated with the aim of nurturing knowledge-based and innovation-driven ventures that either target the Indian market or leverage Indian resources to target the global market.

Similarly to encourage entrepreneurship in the country and help incubate start-ups, he set up the N. S. Raghavan Centre for Entrepreneurial Learning (NSRCEL) at Indian Institute of Management, Bangalore (IIMB) with a contribution of around Rs 12.5 crores.

N S Raghavan was selected by a reputed panel of international judges to receive the Dhirubhai Ambani Award for the year 2004 on the 57th India

Luis Miranda

Luis MirandaAbout Luis:

Luis is the Managing Trustee of the Collective Good Foundation. He is Senior Advisor to Morgan Stanley Infrastructure and Advisor to the Nadathur Group. He has been involved in setting up two successful companies

Priya Naik

Priya NaikAbout Priya:

Samhita Social Ventures evolved from Priya

Suman Srivastava

Suman SrivastavaAbout Suman:

Suman Srivastava is the Founder and Innovation Artist at Marketing Unplugged. He is also the author of Marketing Unplugged: Spotting the elephants in the room.

Suman Srivastava enjoys doing new things. A graduate of Delhi University, IIM Ahmedabad and IMD Lausanne, he is an advertising man, strategist, author, marathon runner, teacher, social worker, sports fan, creative bartender and an entrepreneur.

Suman has been the CEO of Euro RSCG India for 5 years and also Chief Strategy Officer for Euro RSCG Asia Pacific. He was the Chairman of Euro RSCG

Anisha PanigrahiSr. Manager

Anisha PanigrahiSr. Manager

Mukesh Kumar PandeyNetwork Support

Mukesh Kumar PandeyNetwork Support

Anirban SahaAnalyst

Anirban SahaAnalyst

Prachi PatniAssociate

Prachi PatniAssociate

YaminiAssistant Manager, Implementation REVIVE

YaminiAssistant Manager, Implementation REVIVEProfessional Experience:

Yamini is an aspiring entrepreneur with 2+ years of experience in social sector. She has worked in different sector from financial inclusion, education, business accumen, health to mental health. She is a team player and

Vishal DhaleDirector

Vishal DhaleDirector

Dr Rashi SabooSenior Associate, Implementation

Dr Rashi SabooSenior Associate, ImplementationProfessional Experience:

A public health professional at heart, the larger goal is to positively influence the public health landscape globally.

Educational Background:

Personal Interests and Hobbies:

Some of her hobbies include playing board games, listening to indie music bands & watching

Kedar AnnamAssistant Manager

Kedar AnnamAssistant ManagerProfessional Experience:

Kedar is a Development Sector Professional for more than 7 years and have worked in area like sanitation, waste management, WASH, social and financial inclusion, livelihood, health and education.

Educational Background:

He is a Mechanical Engineer and holds a Masters Degree in Business Management from Symbiosis Institute of Business Management.

Personal Interests and Hobbies:

Some of his hobbies include

Dipti BairageeSenior Associate

Dipti BairageeSenior Associate

Sanika MoreAssociate

Sanika MoreAssociate

Narendra KulkarniAssistant Manager

Narendra KulkarniAssistant Manager

Akshay KamtamAssistant Manager

Akshay KamtamAssistant Manager

Toji Easo VargheseBusiness Analyst

Toji Easo VargheseBusiness AnalystProfessional Experience:

Toji

Smriti SangamAssociate

Smriti SangamAssociate

Pratik TrivediAssistant Manager, Implementation

Pratik TrivediAssistant Manager, ImplementationProfessional Experience:

Pratik Trivedi joins us as Assistant Manager Implementation, based out of Mumbai, and will be

Abhishek ChandraSenior Associate

Abhishek ChandraSenior Associate

Aman MatetiSenior Associate

Aman MatetiSenior Associate

Divya AgarwalAssistant Manager

Divya AgarwalAssistant Manager

Ujwala ParabAssistant Manager

Ujwala ParabAssistant Manager

Asha Ashish WellorkarAssistant Manager

Asha Ashish WellorkarAssistant Manager

Nayonika BasuAssistant Manager

Nayonika BasuAssistant Manager

Vishal KonbattulwarManager

Vishal KonbattulwarManager

Shatakshy BhattAssistant Manager

Shatakshy BhattAssistant Manager

Siddhanta BanerjeeManager

Siddhanta BanerjeeManager

Miral GosaliaManager

Miral GosaliaManager

Richa AroraManager

Richa AroraManager

Avantika SethCommunication Specialist

Avantika SethCommunication SpecialistProfessional Experience:

Avantika has a vast experience as a Journalist, Researcher, Oral Historian, Documentary Filmmaker, and Podcaster. She

Shiv Kumar PandeySenior Manager

Shiv Kumar PandeySenior Manager

Dhatri KotakSenior Manager

Dhatri KotakSenior Manager

Dr Vinti K. AgarwalDirector

Dr Vinti K. AgarwalDirector

Sanjoli JainCS Professional

Sanjoli JainCS ProfessionalAbout Sanjoli:

Hello, my name is Sanjoli Jain, and I am excited to join this company as a CS professional. I have worked for two years in a CS firm, where I gained experience in dealing with contracts, wills, company law, and various other laws. In addition to my professional background, I am also visually impaired, which has given me a unique perspective on the challenges faced by persons with disabilities. As a result, I have a strong desire to work in the development sector and help empower underprivileged communities. I am committed to promoting the rights of persons with disabilities and other marginalized groups, and I look forward to contributing my skills and experience to create positive change.

HemlataManager

HemlataManager

Aswathy SAssociate

Aswathy SAssociate

Nirmala MathewSenior Manager

Nirmala MathewSenior Manager

Swastika BhuyanAssociate

Swastika BhuyanAssociate

Nora AlexySenior Associate

Nora AlexySenior Associate

Vishakshi RajAssociate

Vishakshi RajAssociate

IpsitaAssociate

IpsitaAssociate

Biswanath SenapatiManager

Biswanath SenapatiManager

Shivani TripathiAssociate

Shivani TripathiAssociate

Dr. Prashika KurlikarSr. Associate

Dr. Prashika KurlikarSr. Associate

Harsha KumavatData Analyst

Harsha KumavatData AnalystProfessional Experience:

Harsha has expertise data visualization tools like Tableau, Power BI, Seaborn, and Plotly and programming languages like Python. She is proficient at MySQL and Excel and managing large database. She has worked as an intern for The Sparks Foundation, TwoWaits, Accenture, PwC and Standard Bank.

Educational Background:

She holds BSc in Computer Science from Nagindas Khandwala College and Master

Surabhi ShikhaManager

Surabhi ShikhaManager

Amruta AdhyapakSenior Associate

Amruta AdhyapakSenior Associate

Dr. Usha GopinathExecutive Director

Dr. Usha GopinathExecutive Director

Syeda FarkhandaAnalyst

Syeda FarkhandaAnalyst

Sreyoshi BhattacharyaAssociate

Sreyoshi BhattacharyaAssociate

Shiboni SundarInsights Associate

Shiboni SundarInsights Associate

Kajol SitaniAnalyst

Kajol SitaniAnalyst

Divya WagleAssociate

Divya WagleAssociate

Sweden DsilvaSweden Dsilva

Sweden DsilvaSweden DsilvaProfessional Experience:

Sweden Dsilva has developed creative designs for marketing packages

Aakriti SinghAssociate

Aakriti SinghAssociate

Hardik RaiDigital Strategy and Planning Specialist

Hardik RaiDigital Strategy and Planning SpecialistProfessional Experience:

Hardik is a self-proclaimed marketing geek. Prior to joining Samhita, Hardik has honed his skills in two prominent Ed-tech companies, further enhancing his capabilities in the field of marketing. He likes Social Media so much that he made it his profession. Hardik

Ayushi BhatnagarAyushi Bhatnagar

Ayushi BhatnagarAyushi BhatnagarProfessional Experience:

Ayushi is a knowledgeable professional with over 3 years of experience in the humanitarian and development sectors. She has technical proficiency in a wide range of areas, including communications, learning and development, training, and capacity building services. She has previously worked for a leading Humanitarian Non-profit Organization and a prominent CSO/Think Tank that advocates Sustainability and Climate Change-related initiatives.

Educational Background:

She graduated with Honours in Geography from Kamala Nehru College, Delhi University and is a University Gold Medalist with a Master

Vinay MenonSenior Manager

Vinay MenonSenior ManagerProfessional Experience:

Vinay started his career with Samhita in 2016 in the Research and Knowledge team, before moving on to handle strategic partnerships with key donors, before moving on to work with Piramal Foundation

Archita SharmaAssociate

Archita SharmaAssociateProfessional Experience:

Aarchita has worked as a Young Professional at the Rajasthan Grameen Aajeevika Vikas Parishad (RGAVP), Ministry of Rural Development, Government of Rajasthan. She then joined as an Academic Associate at the Kautilya School of Public Policy in Hyderabad.

Educational Background:

Aarchita holds a BA in Social Sciences from the Tata Institute of Social Sciences and a MA in Development Studies from the Indian Institute of Technology Guwahati.

Personal Interests and Hobbies:

Some of her hobbies include

Varnika JainAssistant Manager

Varnika JainAssistant Manager

Nehal ShahExecutive Director

Nehal ShahExecutive Director

Shiv UppalSpecialist

Shiv UppalSpecialist

Akshatha KarangutkarAssociate Director

Akshatha KarangutkarAssociate Director

Ritu HalderExecutive Director

Ritu HalderExecutive Director

Madhu BahlExecutive Director

Madhu BahlExecutive DirectorProfessional Experience:

Madhu Bahl has totally more than 30 + years of experience in the education space which includes teaching, designing, training, content creation and building profitable models and interventions that are both scalable and sustainable. She has worked independently as a design and training consultant with well-known funding agencies and social organizations. She also has 15 years of corporate experience at senior management level where she was responsible for profitability along with a deep focus on product development and business delivery. Her corporate responsibilities include experience in working with both the private and the government sector. She has built and worked extensively with large teams, both across physical geography and social demography.

Priya NaikCEO & Founder

Priya NaikCEO & FounderAbout Samhita:

Afshan is a marketing and communications professional with over 18 years of experience in the field. She has previSamhita Social Ventures is a social sector consulting firm that collaborates with companies, government and social organizations to co-create and implement impactful initiatives. Samhita is supported by Indian and global foundations such as USAID, the Bill & Melinda Gates Foundation, UNDP, Michael & Susan Dell Foundation and Omidyar Network India. Previously, Priya co-founded The Spark Group, an education incubator that delivered affordable education to low-income communities in India.

Professional Experience:

She has worked with the International Finance Corporation, the Poverty Action Lab at the Massachusetts Institute of Technology (MIT) and at Arthur Andersen.

Educational Background:

Priya has a Master

Afshan ShaikhAssociate Director

Afshan ShaikhAssociate DirectorProfessional Experience:

Afshan is a marketing and communications professional with over 18 years of experience in the field. She has previously worked with the Swades Foundation and Child Rights and You (CRY) in the social development sector. She has been a part of multiple award-winning marketing and awareness campaigns, specializing in brand transformation, creative direction, and marketing strategy. Prior to moving to the social sector, she worked extensively with advertising and media agencies, as well as corporate houses.

Educational Background:

Afshan has a Master

Organisation Overview (Samhita.org)

Role Overview

content1}

Organisation Overview (Samhita.org)

Samhita is a social impact consulting firm, with a vision to build a

content1}

Associate Director

Afshan is a marketing and communications professional with over 18 years of experience in the field. She has previously worked with Swades Foundation and Child Rights and You (CRY) in the social development sector. She has been a part of multiple award winning marketing and awareness campaigns, specializing in brand transformation, creative direction, and marketing strategy. Prior to moving to the social sector, she has worked extensively with advertising and media agencies, as well as corporate houses.

Afshan has a Master

Mandate: Providing sanitation facilities for women engaged at informal workplaces and a 1:1 match establishing the company as a thought leader.

A global FMCG company was keen on furthering its promise of building exceptional workplaces through social responsibility initiatives.

The Apparel company wanted to empower women that work in their factory with life skills that would enable them to be more empowered both on the job as well as in the future (most women prefer to find alternate employment after 3-4 years).

content1}

OECD- DAC Impact Evaluation

The Organisation for Economic Cooperation and Development has developed the normative framework to determine the worth and the merit of the intervention. The framework has six evaluation criterias- relevance, coherence, effectiveness, efficiency, impact and sustainability. The key concepts for each criteria are defined below-

Social Return on Investment Evaluation (SROI)

SROI methodology was introduced in early 2000. It was developed consultatively by economists, CAs and development practitioners as a means of measuring social value. It was piloted in the UK by NEF (New Economics Foundation), Social Value and DFID. An SROI analysis is an attempt to calculate evaluative Social Return on Investment (SROI) for a programme. SROI is a framework for measuring and accounting for a broader concept of value. It measures how change is being created by measuring social, environmental and economic outcomes and uses monetary values to represent them. This supports the clients to understand the utilisation of funds more objectively.

Community Needs Assessment (CNA)

A CNA study is a collaborative process that engages community stakeholders in determining the nature and extent of both needs and resources in a community, and the feasibility to implement initiatives. It typically identifies and responds to a specific social problem or problems in a community.

Organisation Overview (Samhita.org)

Role Overview

content1}

Organisation Overview (Samhita.org)

Samhita is a social impact consulting firm, with a vision to build a

content1}

content1}

Organisation Overview

Samhita is a social impact consulting firm, with a vision to build a

content1}

Organisation Overview

At Samhita, we work to address the most wicked socio-economic problems in India and leverage our strengths, experience, and knowledge to fulfil our vision. We work with multiple stakeholders to curate strategic partnerships that have the potential to create impact at scale. Through the power of collaboration, innovation, and evidence, we aim to create a sustainable and equitable future for all i.e. a better normal for all.

Samhita is a Mission driven Organisation with a young, bright, passionate, committed and exceptionally inspiring team. We believe that great companies are built by great teams. This philosophy is at the heart of our vision for the organisation we want to scale over the next decade. A company with people at its core, where people are the biggest differentiators. If you are looking for an organization that truly cares about people while bringing the best of class innovation into CSR – Samhita is the place for you. We solve problems through collective action.

content1}

Are you passionate about turning around an organisation which is working with people having Neurodevelopmental Disabilities (NDD)?

content1}

Project: Urban Health Initiative

content1}

content1}